Bears get the upper hand in crypto

Market picture

Crypto market capitalisation fell a further 1.6% overnight to 1,137 trillion. A brief dip in the morning to 1,113 took the market to its lowest level in almost two months. Bitcoin is down 1.7%, Ethereum is down 1.2%, with the top altcoins losing between 0.8% (Cardano) and 7% (Bitcoin Cash).

Bitcoin slipped to $28.3K in light trading early Thursday morning before stabilising at $28.6K. The fall below $28.8K confirmed the local dominance of the bears. The following key support points are now at the next round level of $28K and then at the $27.2K area, where the 200-day moving average and uptrend support from last November are centred.

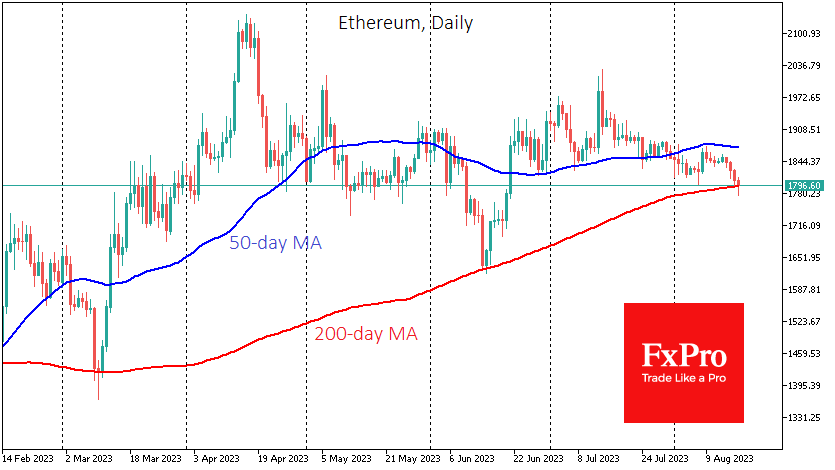

Ethereum pulled back below $1800 and tested its 200-day moving average. It bounced steadily from this level in March and June. Given the bearish sentiment in global markets and rising government bond yields, the chances of a drop to the previous lows of $1630 are increasing.

News background

The new SEI crypto token surpassed $1.6 billion in trading volume overnight. The token beat major crypto assets such as XRP, BNB and Dogecoin (DOGE) in turnover. The SEI launched its Sei Network blockchain project on Tuesday. The developers are positioning it as a network for high-frequency trading applications with high transaction processing speeds.

Tron co-founder Justin Sun described himself as a “Bitcoin supporter” and said he owns more than 100,000 BTC.

According to an agency report, the Federal Bureau of Investigation seized $1.7 million in various digital assets between March and May 2023.

Coinbase Exchange received a CFTC’s Futures Commission Merchant licence allowing crypto-based futures trading access to select US customers.

Observers noticed the movement of 1,005 BTC from the sleeping 13-year-old wallet, and some cryptocurrency community members even thought Satoshi Nakamoto had moved the coins.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)