Crypto Recharged Over the Weekend

Market Picture

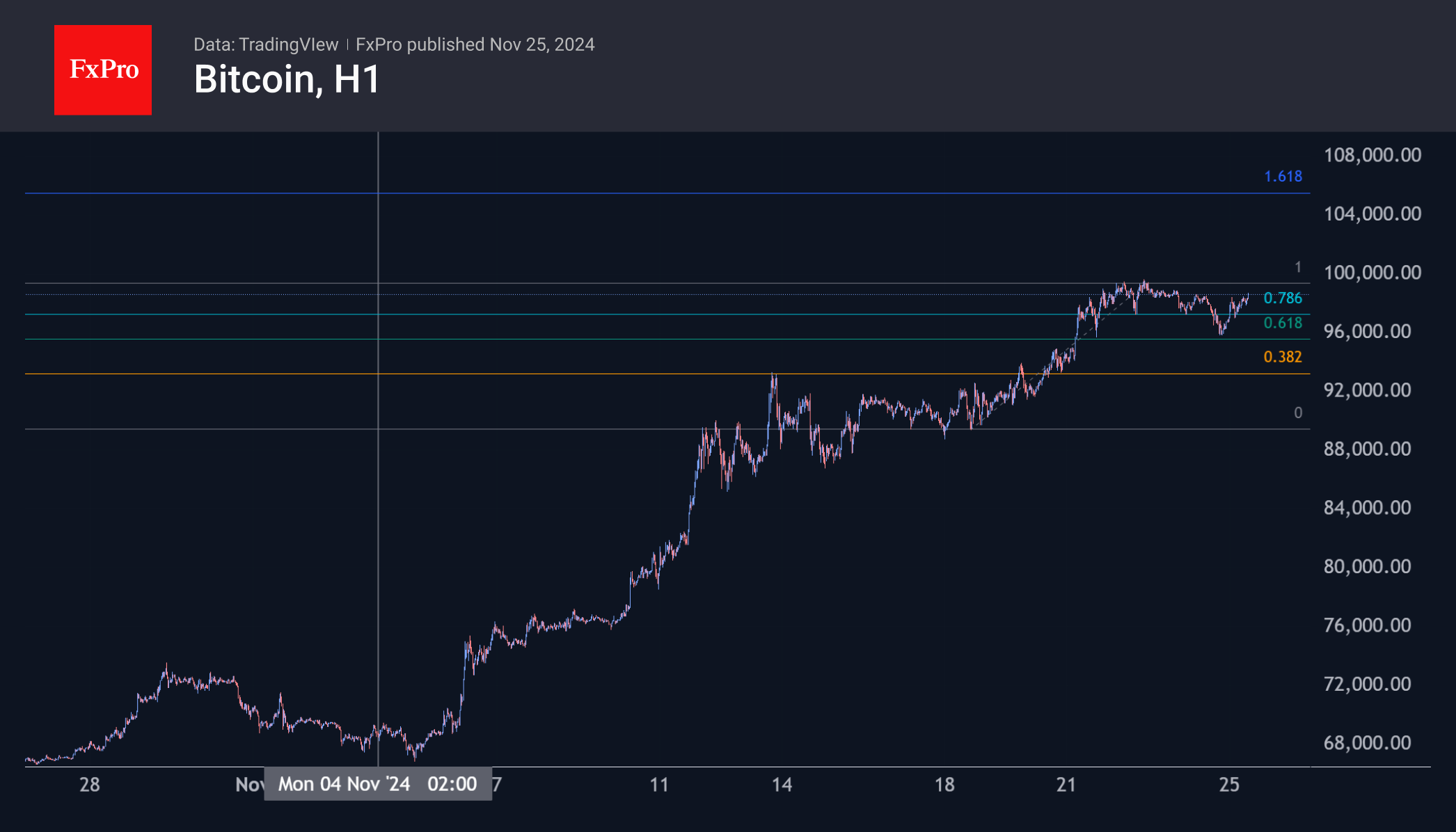

The crypto market has recharged over the weekend. Positive traction resumed on Monday after the crypto market's total capitalisation shrank by 150 billion from Saturday's high near $3.39 trillion to Sunday's low. We saw more profit-taking by retail traders, and buying resumed during trading hours, setting the stage for inflows from institutional traders due to increased risk appetite in global markets.

Bitcoin approached the $100K level on Friday but failed to break through and, at one point, pulled back below $96K. This looks like an intra-week correction. On Monday morning, we saw buying dominate again, taking the price back to $98.2K. The persistence of the recent pattern suggests that Bitcoin will reach the $106K level by the end of the week.

Ethereum is trading near $3400, close to the November highs. A move above $3450 could spark more active growth, with a potential target at $4000-4100, the area of the year's highs.

News Background

According to SoSoValue, net inflows into US spot bitcoin ETFs totalled a record $3.38 billion last week, bringing total inflows since bitcoin ETFs approval in January to $30.84 billion.

Solana updated the all-time high previously set in 2021 on the back of four filings with the SEC to launch spot Solana ETFs. The Chicago Board Options Exchange (CBOE) published Forms 19b-4 for these funds.

VanEck reiterated its September Bitcoin forecast. The target price for the first cryptocurrency in the current cycle is $180,000. Several key indicators suggest that the next phase of the bull market has just begun.

According to The Block, Ethereum's daily transferred on-chain value reached $7.13 billion, the highest since the beginning of the year. This indicates a recovery in network activity amid the cryptocurrency market rally.

Trump is expanding the number of cryptocurrency supporters in a future administration. He has nominated hedge fund manager Scott Bessent as Treasury Secretary. According to CNN, Trump is considering appointing former Bakkt CEO Kelly Leffler as Secretary of Agriculture.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)