Crypto’s dive

Crypto’s dive

Market Picture

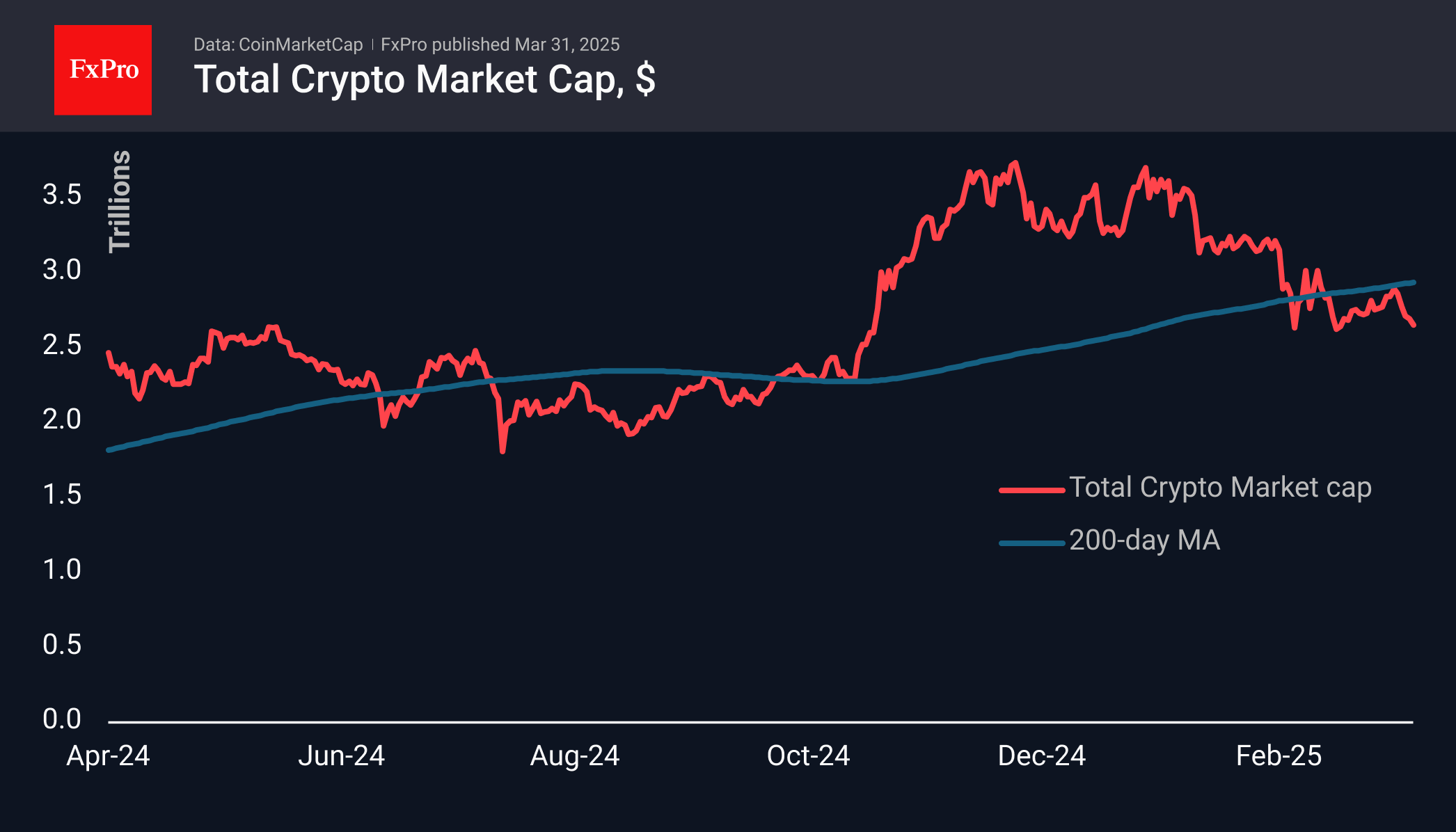

Crypto market capitalisation has fallen 1.3% in the last 24 hours and around 6.5% over the weekend, pulling back towards the lows of three weeks ago. The sell-off intensified after a failed attempt to climb above the 200-day average. It may turn out that the market's recovery from 11 to 26 March was a rebound after a decline. A $2.56 trillion plunge below the March 11 lows could confirm this bearish scenario.

Bitcoin has pulled back below 82,000, having lost over 6% since Friday, when a sell-off in stock markets dampened enthusiastic sentiment. On Monday, the pressure in the markets remains, forcing us to consider BTC's return below 80000 as the main scenario for the near term. Deepening below would open the way to 68000-72000, triggering a broader institutional sell-off.

XRP is moving down despite reports of Ripple and SEC proceedings ending. The coin's price has pulled back to $2.05, testing the support area near where the reversal has been taking place since early December. A failure of this support is very likely due to the negative sentiment in the larger markets. But in this case, there is a risk of the start of a large capitulation, capable of taking up to 70% of the current price.

News Background

According to SoSoValue data, net inflows into spot bitcoin-ETFs almost quadrupled last week to $196.5 million to cumulative inflows since the approval of bitcoin-ETFs to $36.24bn. Net outflows from the ETH-ETF amounted to $8.6 million, decreasing the total inflow since this ETF’s launch to $2.41 billion.

CryptoQuant believes crypto funds are ‘at a critical turning point.’ Institutions are shaking up their portfolios and de-risking due to macroeconomic uncertainty, which is having a major impact on Bitcoin.

The US SEC has dropped lawsuits against cryptocurrency companies Kraken, ConsenSys and Cumberland. The cases have been dismissed due to ‘bias,’ making it impossible to re-file them.

Tron founder Justin Sun appeared on the cover of Forbes, becoming the second Chinese person after Jack Ma to be featured on the magazine's cover. The news was met with wariness in the community, as in the past, the appearance of crypto industry representatives in Forbes was accompanied by a market decline.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)