Dow Jones: Rebound or Rally? The Fed Holds the Key

Dow Jones: Rebound or Rally? The Fed Holds the Key

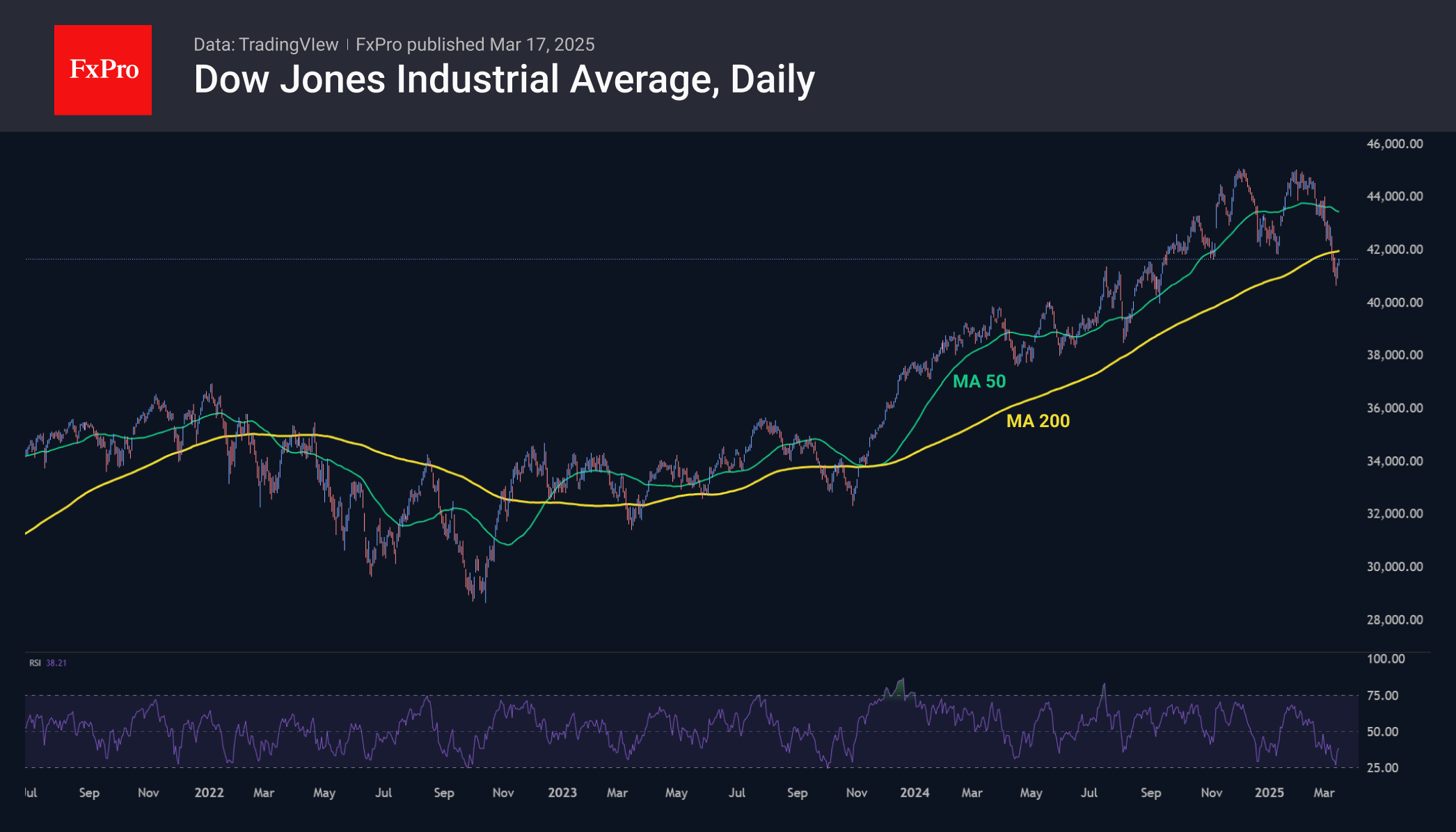

Key US indices staged an impressive rebound on Friday, turning the Dow Jones Industrial Average (DJI) up one step away from formally entering correction territory (-10% from the peak). In doing so, the US economy is headed for recession if the theories coined by the index's founder and first editor of the Wall Street Journal still apply.

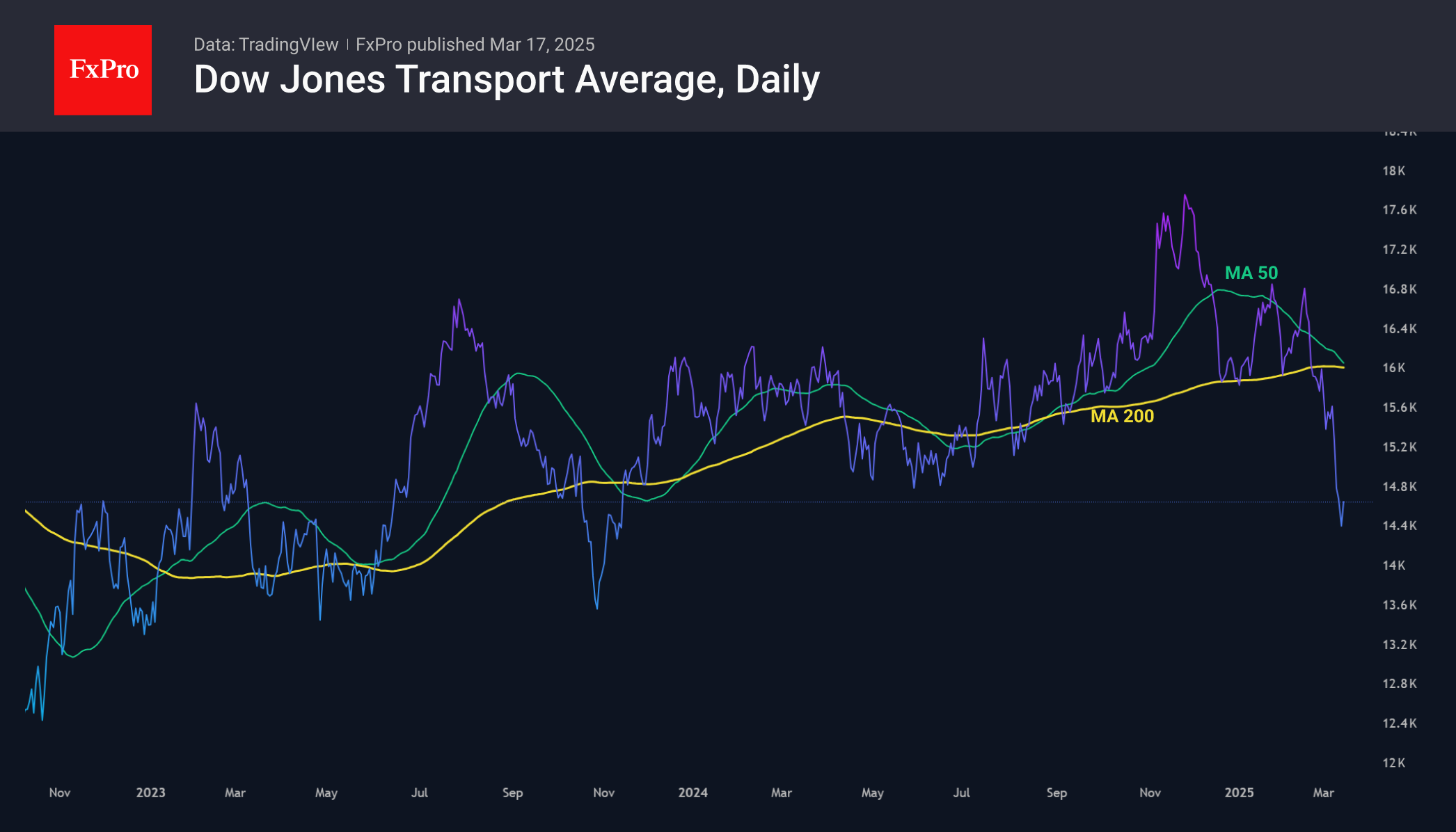

In his theory, Charles Dow pointed out that the trend of the industrial index is correct if confirmed by the dynamics of the transport sector. However, since peaking in late November, the DJTA index has lost nearly 20%, accelerating its decline three weeks ago. The rapid decline has led to the formation of a 'death cross,' a bearish market signal when the 50-day moving average dips below the 200-day moving average.

The accumulated oversold conditions in equities over the past three weeks suggests a high chance of a rebound, but how soon that rebound will lose strength will depend on monetary policy and incoming data.

The DJI was down as low as 25 on the RSI index last week. This is an oversold area from where a reversal to the upside was forming in October 2023 and September 2022. However, this technique could be broken or confirmed by market reaction to the FOMC meeting later in the week.

It is within Powell and Co's power to break the mature beginning of the recovery by softening the tone of comments and promising further rate cuts soon. In this case, the market would be in an attractive position for buyers, who could launch a global rally towards new highs above 45000.

However, downside risks are pretty much equivalent. Since Trump's presidential election victory, Powell has noticeably tightened his tone: tariffs have a pro-inflationary effect and are operating even with expectations. Friday's jump in inflation expectations to 2.5-year highs recorded by the University of Michigan doesn't help matters either.

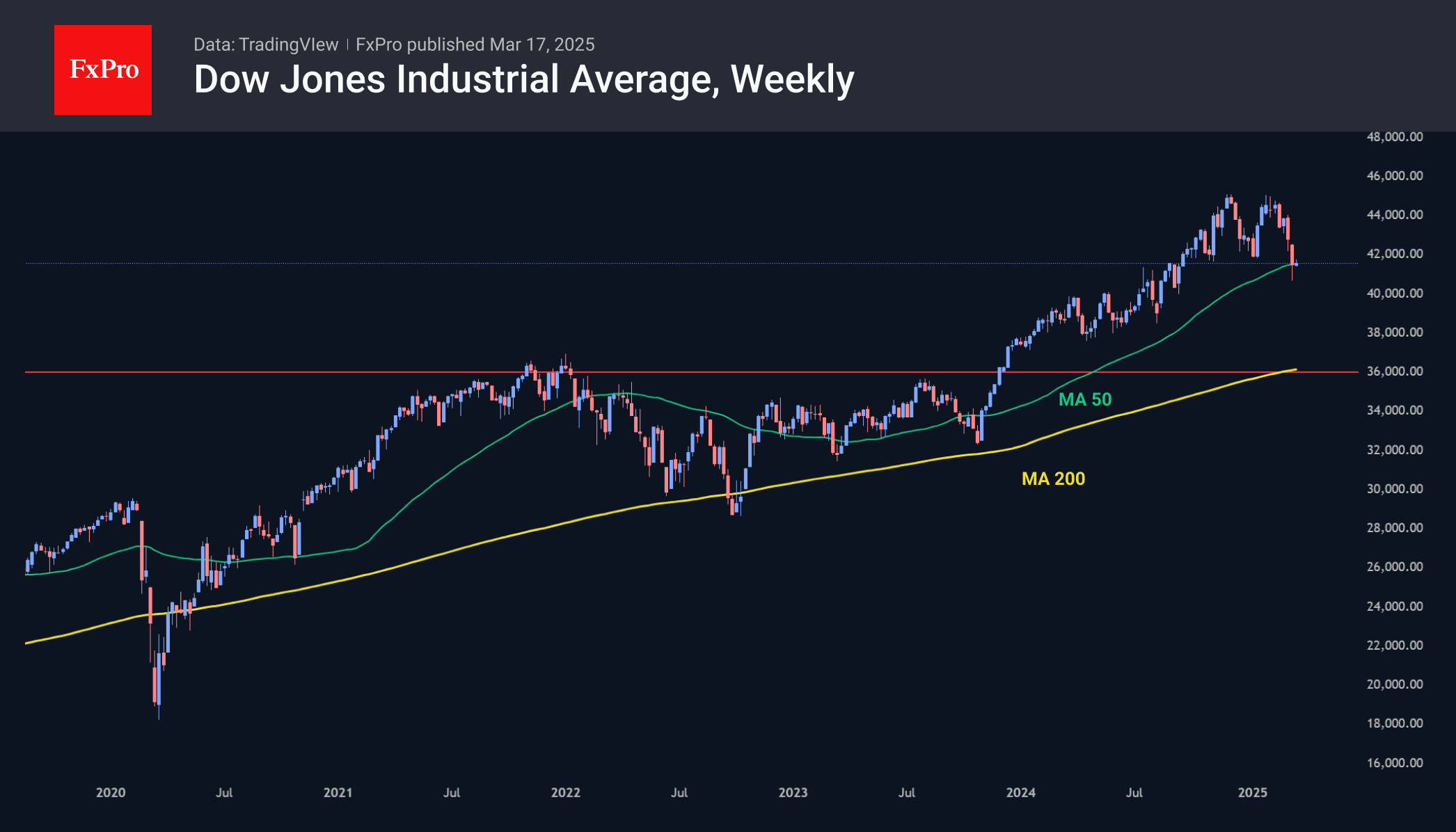

Consolidation and rebound in the indices are quite fragile right now. Without Fed support, the sell-off could quickly take on threatening proportions, triggering a liquidation of long positions and margin calls that could quickly take the index to 36000.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)