Fear does not leave the crypto market

Market Picture

The crypto market capitalisation remained at $2.04 trillion, the same as the previous day, although it fell to $2.01 trillion during the day before rebounding on Tuesday morning. The Cryptocurrency Sentiment Index returned to the fear zone after briefly rising to neutral levels on Saturday and Sunday.

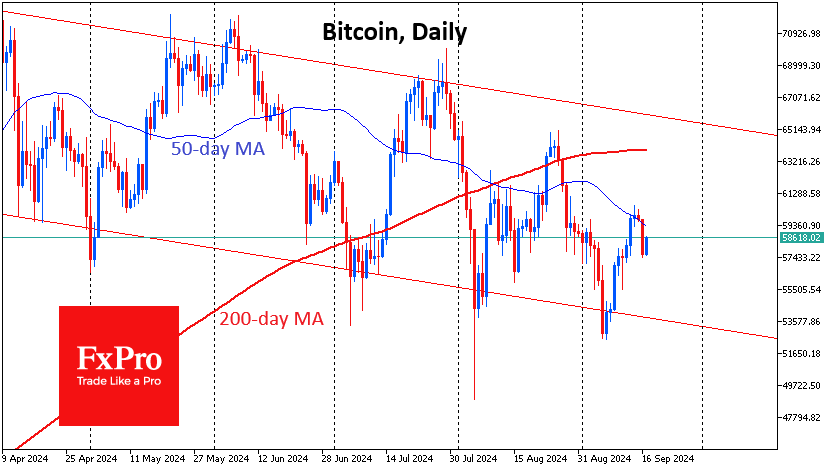

Bitcoin is trading at $58.6K, having gained 1.7% since the start of the day. However, it remains below its 50-day moving average, which is pointing lower. This resistance level has seen increased selling activity, signalling a cautious sentiment ahead of the Fed's rate decision.

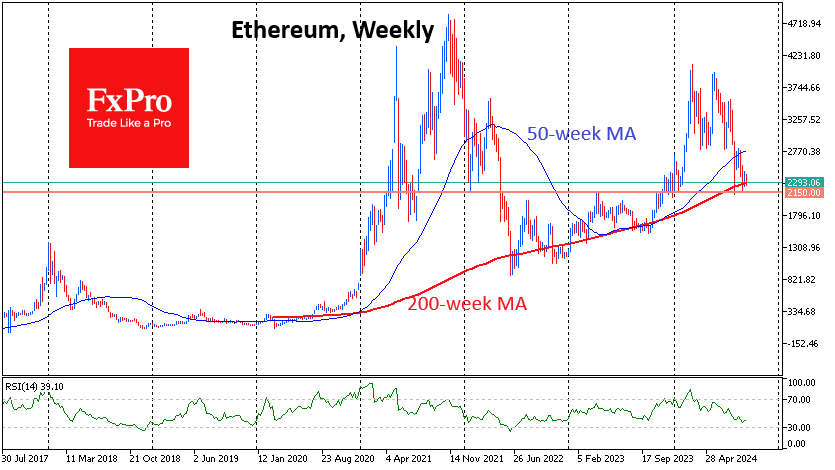

Ethereum is trading around $2300, testing support at the 200-week moving average for the third consecutive week. Since 2020, Ethereum has repeatedly found support from long-term buyers when falling towards this line or shortly after breaking it. However, without visible buyer support this time around, long-term investors may start to capitulate and doubt the prospects of the second-largest cryptocurrency. At the same time, the RSI is approaching the oversold territory, suggesting more chances of a bounce than a continuation of the decline in the absence of buyer capitulation. As such, the coin's momentum will be telling in the coming weeks.

News Background

According to CoinShares, investments in crypto funds rose by $436 million last week after two weeks of outflows. Investments in Bitcoin increased by $436 million, Solana increased by $4 million, and Ethereum decreased by $19 million. Investments in multi-asset crypto funds increased by $23 million. The surge in inflows at the end of the week was driven by a significant shift in market expectations for a potential 50bps Fed rate cut following comments from former New York Fed President Bill Dudley. Ethereum continues to struggle, which CoinShares believes is due to concerns over the network's profitability following the Decun update.

WeRate calculated that Bitcoin's rally could begin in the next 22 days based on previous historical cycles. The rally began around 170 days after the halving, with the peak occurring 480 days later. Crypto investor Lark Davis recalled Bitcoin's impressive Q4 gains during the halving years. BTC also closed with growth in Q1, Q2 and Q3 of the year after the event.

The Ethereum developers have proposed to split the major Pectra update into two parts. They plan to activate the first phase in early 2025.

USDT stablecoin issuance on the TON blockchain exceeded $1 billion. The Telegram-connected ecosystem climbed to fifth place in terms of issuance of the largest stablecoin from Tether in five months.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)