Fed could signal the end of the hike cycle

Fed could signal the end of the hike cycle

The Fed’s rate decision is the most anticipated event of the day and possibly the coming weeks. As usual, the markets have a strong consensus (95%) on what the central bank will do in the short term, but they are more uncertain about its future moves. The tone of the statement and the assessment of the latest economic data are the primary sources of potential market volatility.

Rate futures indicate a 95% probability of keeping the key rate unchanged in the current 5.00-5.25% range, leaving only 5% for a chance of a policy tightening. However, the same FedWatch tool shows a 63% likelihood of a new 25-point rate hike at the end of July. Interestingly, the expected rates shift downward significantly further ahead, with only 35% betting that there will be no rate cut before the end of the year.

Since the beginning of the year, the markets have been consistently expecting a policy reversal - a sentiment that the Fed has been trying to counter by reassuring that it will not cut rates anytime soon. This divergence of view promises to be the most heated topic at Powell’s press conference later today and in his subsequent speeches.

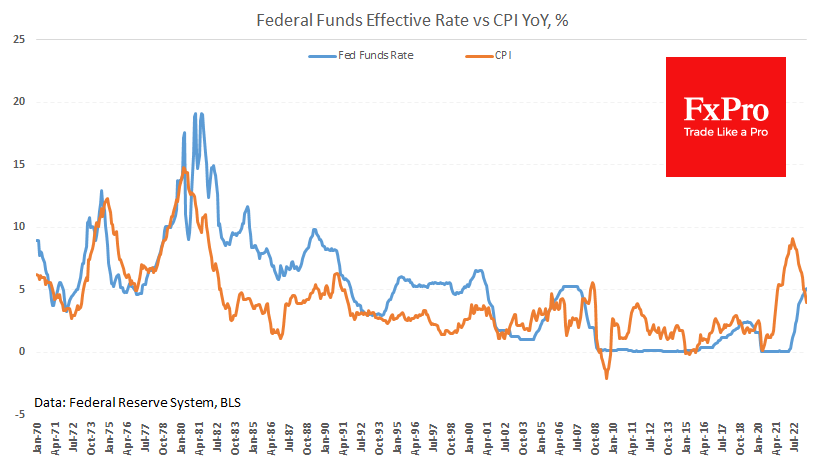

The annual rate of overall inflation has declined for 11 consecutive months and is already below the key rate in May and June. The base effect (a 1.2% price increase for June 2022) suggests an even bigger drop in inflation, which would favour the Fed’s stance. A further rate hike seems unnecessary and risky for the banking system, which faced severe stress in March. It could also trigger a sharp policy reversal, worsening the financial sector’s problems and causing a steep economic slowdown.

On the other hand, a rate cut is not likely either. Higher monthly core CPI growth, on top of a tight labour market and relatively solid business reports, are reasons to maintain restrictive monetary conditions but not enough to tighten them.

If the Fed shares this view, it will signal a readiness to pause rate hikes while trying to change market expectations in favour of keeping current rates for the following quarters.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)