Fed Holds Steady, Markets Await the Next Move

Fed Holds Steady, Markets Await the Next Move

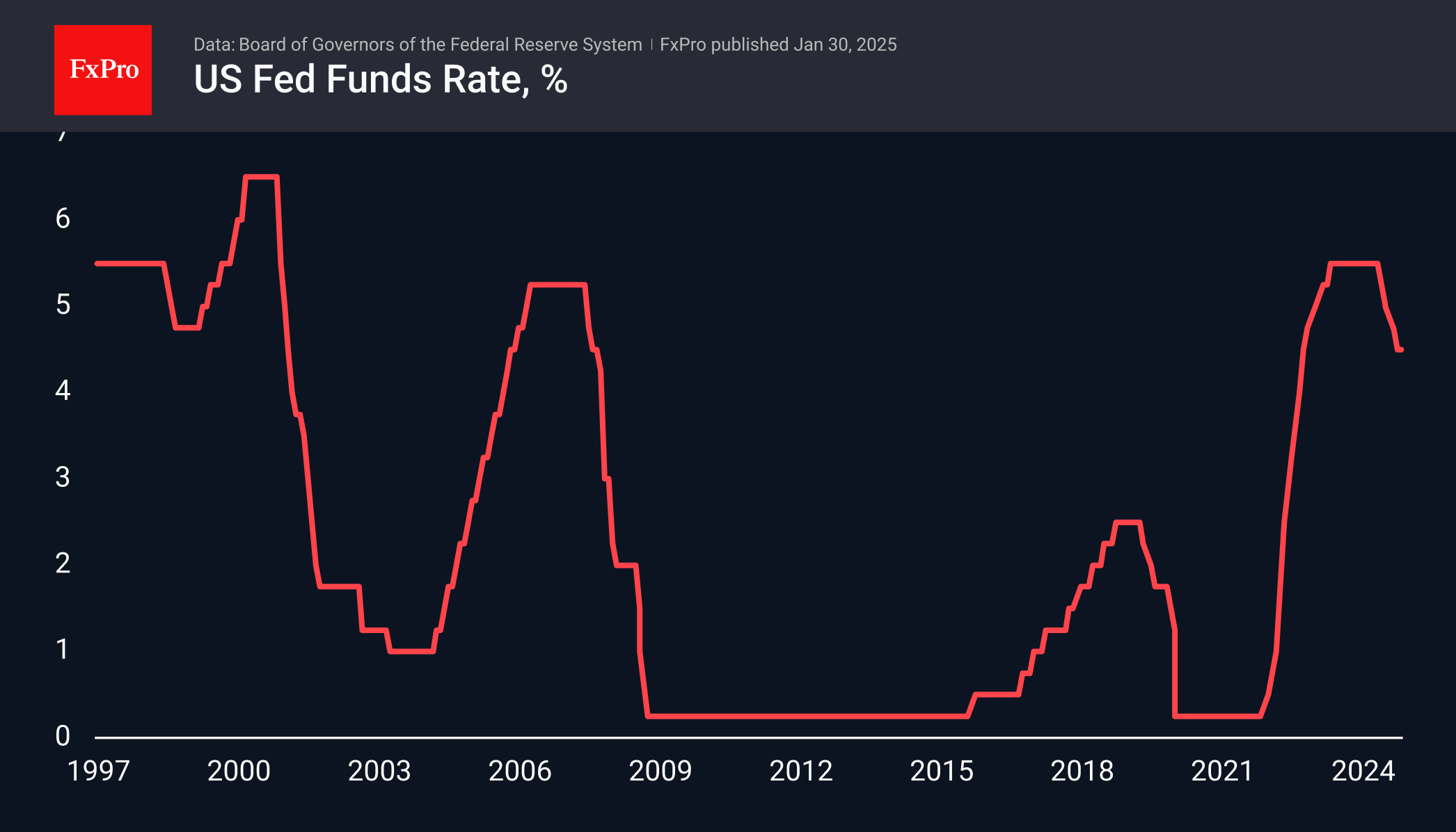

The Federal Reserve left its key rate unchanged in the 4.25%-4.50% range at the end of its January meeting after three consecutive 100 basis point cuts. The markets expected this decision, so their attention was focused on signalling the prospects for further moves.

The Fed continued to tighten its rhetoric, removing any mention of inflation moving towards the 2% target. Later in the press conference, Powell said that we need to see more progress in reducing inflation and the actual impact of rates. Premature action in this situation may not be effective.

The market reaction was subdued. There was only a slight increase in the probability of a rate cut before the end of the year. The probability of two rate cuts before the end of the year rose to 29% against 26% a day earlier. The probability of the rate remaining unchanged fell to 9.6% versus 11.2% a day earlier and 15.5% a week earlier.

The dollar index, as well as key dollar pairs (EURUSD, GBPUSD, USDJPY), have been near their 50-day moving averages for over a week now after the USD weakened. The Fed has moved into a wait-and-see mode for the real effects on the economy from the policies of the Republican party and President Trump. In the short term, the USD market is also waiting for signals from the economy.

So far, this mode has not been changed by either the inflation report or the Fed meeting. Perhaps the release of PCE data on Friday will make a change. Still, it is more likely that traders will see dollar volatility only after the publication of NFP data for January, scheduled for 7 February.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)