Fragile market balance as US government shutdown persists

New LDP party leader elected, yen under pressure

The LDP party leadership contest in Japan produced the strongest headline of the weekend, as Sanae Takaichi was declared the winner and is now vying for the prime minister position. Since the LDP-Komeito coalition does not hold a majority in the bicameral Diet, Takaichi will have to gain a confidence vote to officially take office. This is not as clear-cut as it sounds, as the opposition parties could throw a spanner in the works, potentially proposing a new PM. This vote is expected within the next 10 days, and Takaichi is expected to steer clear of confrontation until then.

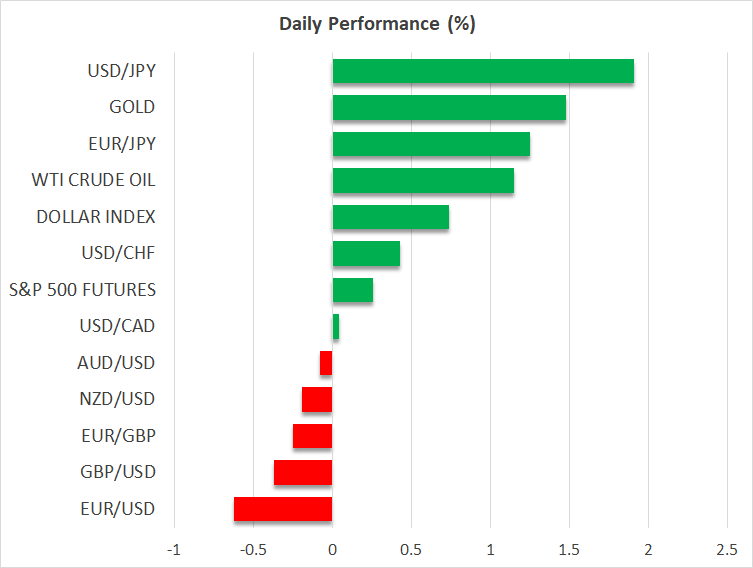

That said, the market reaction has been sizeable, with Japanese stocks rallying on expectations of an aggressive fiscal strategy, most likely supported by new bond issuance, and dollar/yen rising to a new two-month high. A break above 150.15 could open the door to a more protracted rally towards 151.93.

Since Takaichi has been highly critical of the BoJ’s ongoing hiking cycle, markets have to reassess their BoJ hike expectations. Notably, Governor Ueda will be on the wires tomorrow, and it would be interesting to see if he comments on the unfolding political developments.

US government shutdown continues, data releases missing

Developments in Japan have temporarily overshadowed the lack of progress regarding the US shutdown. With the US House in recess this week, the onus falls on the Senate to accept the House-approved funding bill or make adjustments and send it back to the lower chamber. With both sides unyielding at this stage, and the Democrats insisting on health issuance subsides, there is a strong chance of the Federal government remaining in shutdown this week as well.

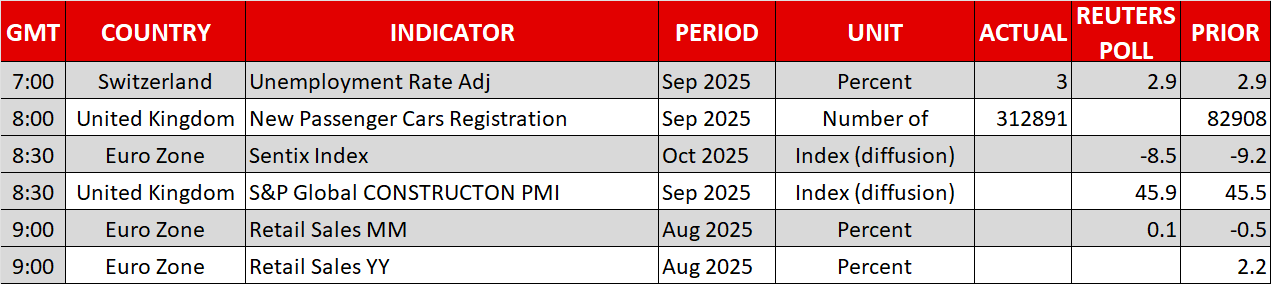

Investors reacted calmly to the absence of last Friday’s jobs data and will have to make do with private releases. However, the clock and their patience are running out as October 15 nears, when the US CPI report is scheduled for release. If the US shutdown continues into next week and data releases are still suspended, serious doubts about the expected Fed rate cut will move to the foreground.

Following another difficult week for the US dollar, the greenback started the week on the right foot, posting small gains across the board, with the exception of dollar/yen that is 2% up at the time of writing, and euro/dollar dropping to 1.1650 following the resignation of French PM Lecomu. However, gold and bitcoin are currently stealing the limelight.

Gold and bitcoin remain in demand; oil jumps despite OPEC+ production hike

The uncertainty arising from the US shutdown appears to be boosting both gold and cryptocurrencies. Gold posted another all-time high of $3,954 earlier today, jumping almost $100 from last Friday’s opening price, bringing the key $4,000 target much closer.

Similarly, bitcoin reached $125.6k during yesterday's session, lifting altcoins higher, supported by positive ETF inflows and reports that US President Trump is pondering the idea of $1000-$2000 stimulus checks for Americans. Such headlines could significantly contribute to bitcoin reaching the $200k target set by certain pro-crypto investment houses.

Meanwhile, US equity indices closed last week with modest gains, but the outlook remains quite challenging. Although AI headlines act as a tailwind, reports about elevated valuations and the dominance of tech stocks are keeping bullish momentum under control. A quick resolution of the US government shutdown, along with positive developments on the geopolitical front, could unlock another upside move in US stocks, although tariff-related developments could even out any such goodwill.

Finally, Sunday’s OPEC+ meeting produced a 137k bpd increase, despite disagreements between Saudi Arabia and Russia. Following reports of discussions about a much stronger production hike, oil prices staged a relief rally, jumping above the key $61.62 level, which has been haunting the bears since early June.

.jpg)