GBP/USD is under pressure after labour data

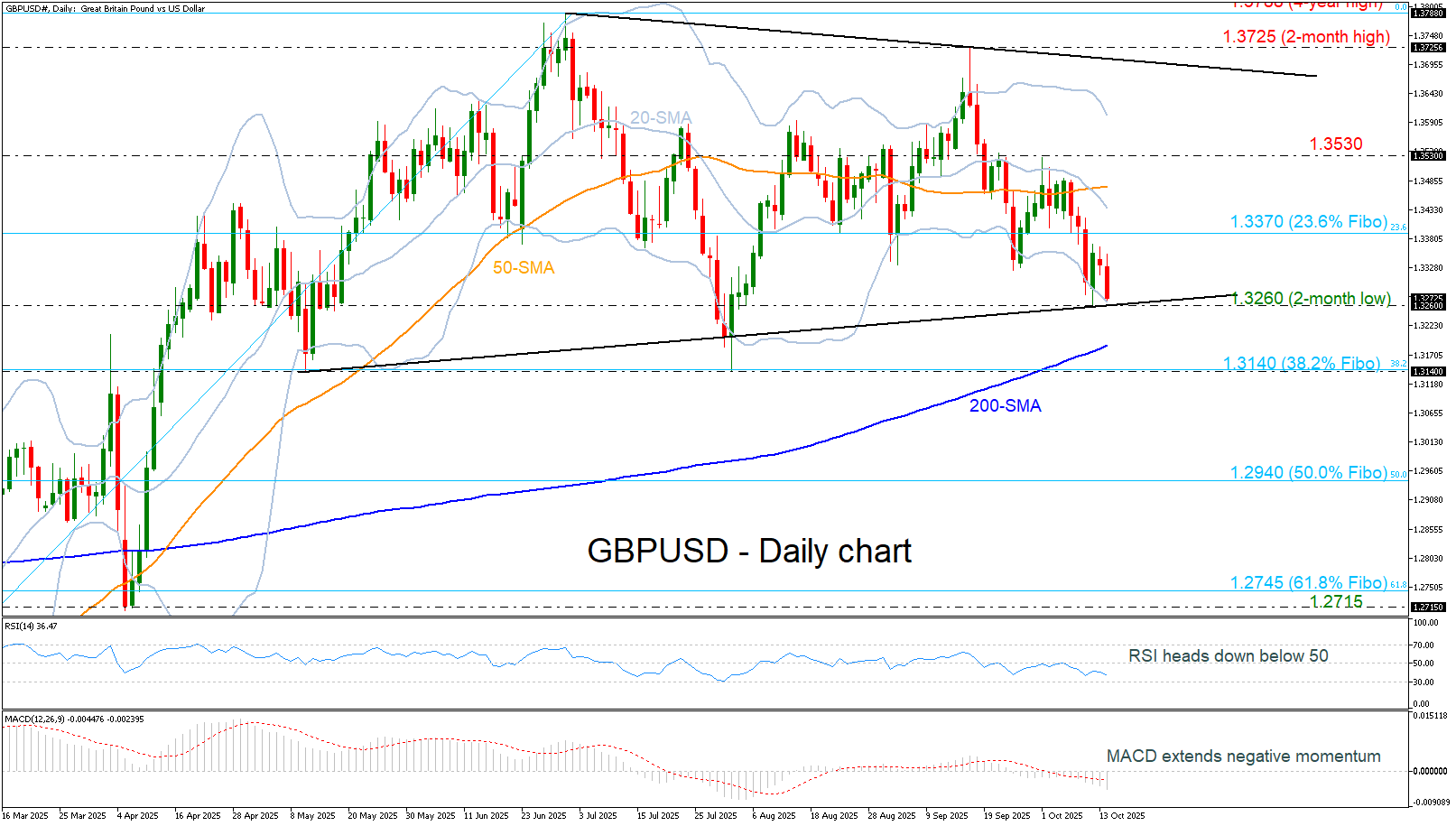

GBP/USD is diving toward the two-month low of 1.3260 following the release of disappointing UK labor market figures. The unemployment rate unexpectedly rose to 4.8% in the three months to August, up from 4.7% in the previous quarter, while employment levels declined, adding pressure to the British pound.

The pair is nearing a medium-term ascending trendline, which may act as a support level. A potential rebound from this area could shift attention toward the 23.6% Fibonacci retracement level at 1.3370, followed by resistance at the mid-level of the Bollinger Band and the 50-day simple moving average (SMA) in the 1.3435–1.3475 zone.

However, a decisive break below the trendline would expose the 200-day SMA at 1.3190 and the 38.2% Fibonacci retracement of the uptrend from 1.2100 to 1.3788, located at 1.3140. Such a move would likely neutralize the medium-term bullish outlook.

From a momentum perspective, the RSI is trending below the neutral 50 level, indicating weakening buying interest, while the MACD continues to extend its negative trajectory below both its signal and zero lines.

All in all, GBP/USD is at a critical juncture, with technical indicators pointing to increased downside risks. A sustained move below 1.3260 could open the way for a neutral phase.

.jpg)