Gold's retreat is not yet a reversal

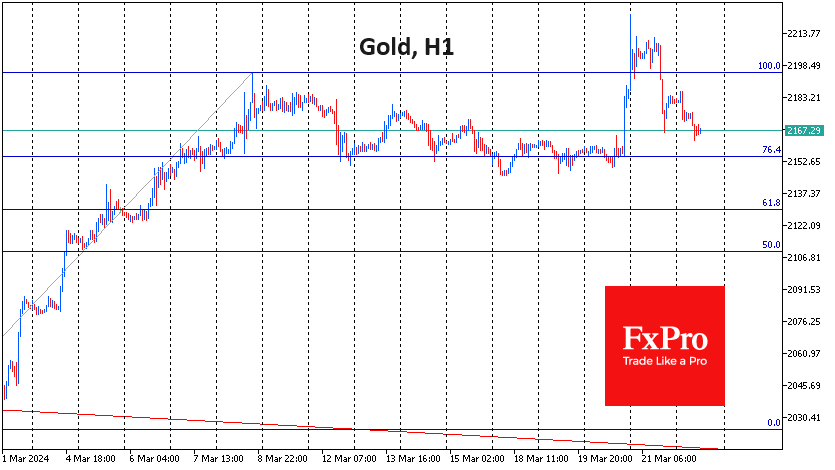

The Fed's comments led to a 3% rise in gold, but the dollar's recovery in the second half of Thursday reduced this gain to just 0.5%. Technically, the outlook is unclear, but fundamentally, things are still on the side of the bulls.

In early trading on Thursday, gold slipped to $2222 on thin liquidity and the triggering of stop orders, which washed short positions out of the market. Throughout the day on Thursday, a stabilisation above $2200 looked attractive for many to take money off the table.

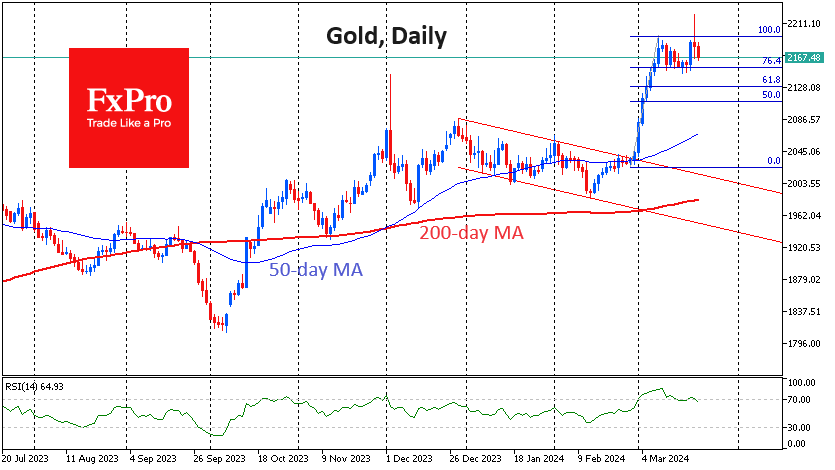

The technical analysis so far gives a mixed picture on the daily timeframes.

On the bullish side, gold's ability to break above previous highs confirmed the Fibonacci extension scenario to 2300 (161.8% of the rally in the last days of February) after a corrective consolidation of 76.4%. The ability to make new highs after a pause is also a bullish signal.

On the bearish side, fatigue after the rise is temporarily evident: the price update of the highs has not been confirmed by the RSI. Moreover, the index left the overbought territory (>70) in the first half of Friday's trading.

Cautious traders may want to wait for a break above the $2155-2190 area, as the chances of further movement in the direction of the break are higher.

In our view, gold's failure on Thursday and the first half of Friday does not look like a reversal, as the push into the dollar in recent hours is the result of speculation that other central banks will be even softer than the Fed. This is a supportive environment for risk assets, including gold. Still, the impressive rally in gold since the second half of February and the recent surge have left the market somewhat overheated and in need of a pause.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)