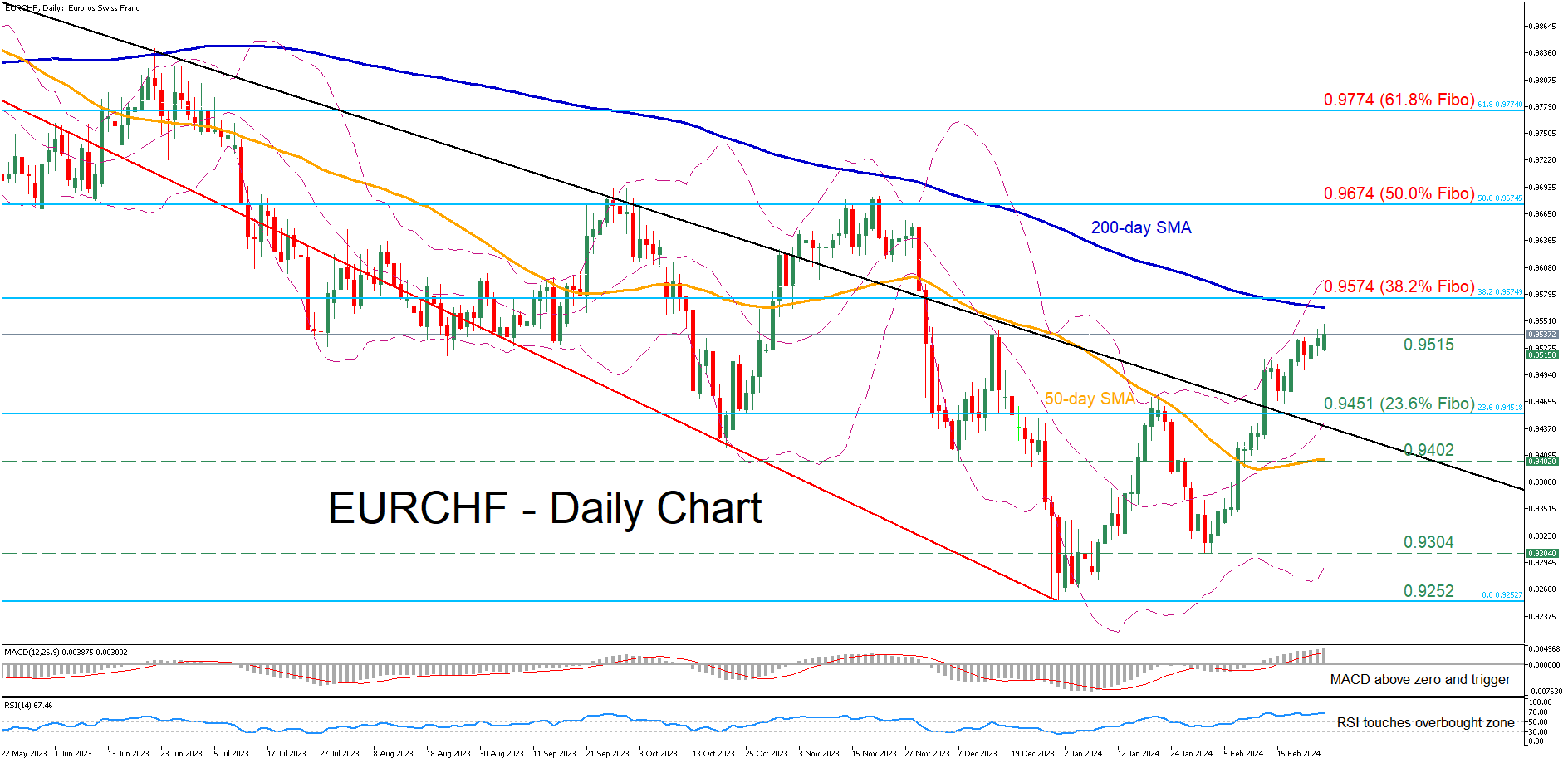

Gold battles with 50-day SMA

Gold has been regaining ground in the past few sessions, following its bounce off the 2024 bottom of 1,984. Although the price has recouped a significant part of its losses, it has currently stalled at the congested region that includes the 50-day simple moving average (SMA) and the ascending trendline that connects the higher lows since December.

Should bullish pressures persist, bullion could challenge the 2,044 hurdle, which acted as resistance both in December and February. Failing to halt there, the price may advance towards the February high of 2,065. An upside violation of that zone could open the door for the crucial 2,079-2,088 range.

Alternatively, if the price reverses back lower, the January support zones of 2,008 and 2,001 could act as the first lines of defence. Further declines might then cease around the 2024 bottom of 1,984. Even lower, the December low of 1,973 could provide downside protection.

In brief, gold has been in a recovery mode in the past two weeks, but the 50-day SMA has been repeatedly curbing its upside. Hence, a break above the latter is needed for the price to extend its rebound towards all-time highs.

.jpg)