Gold marches to consecutive all-time highs

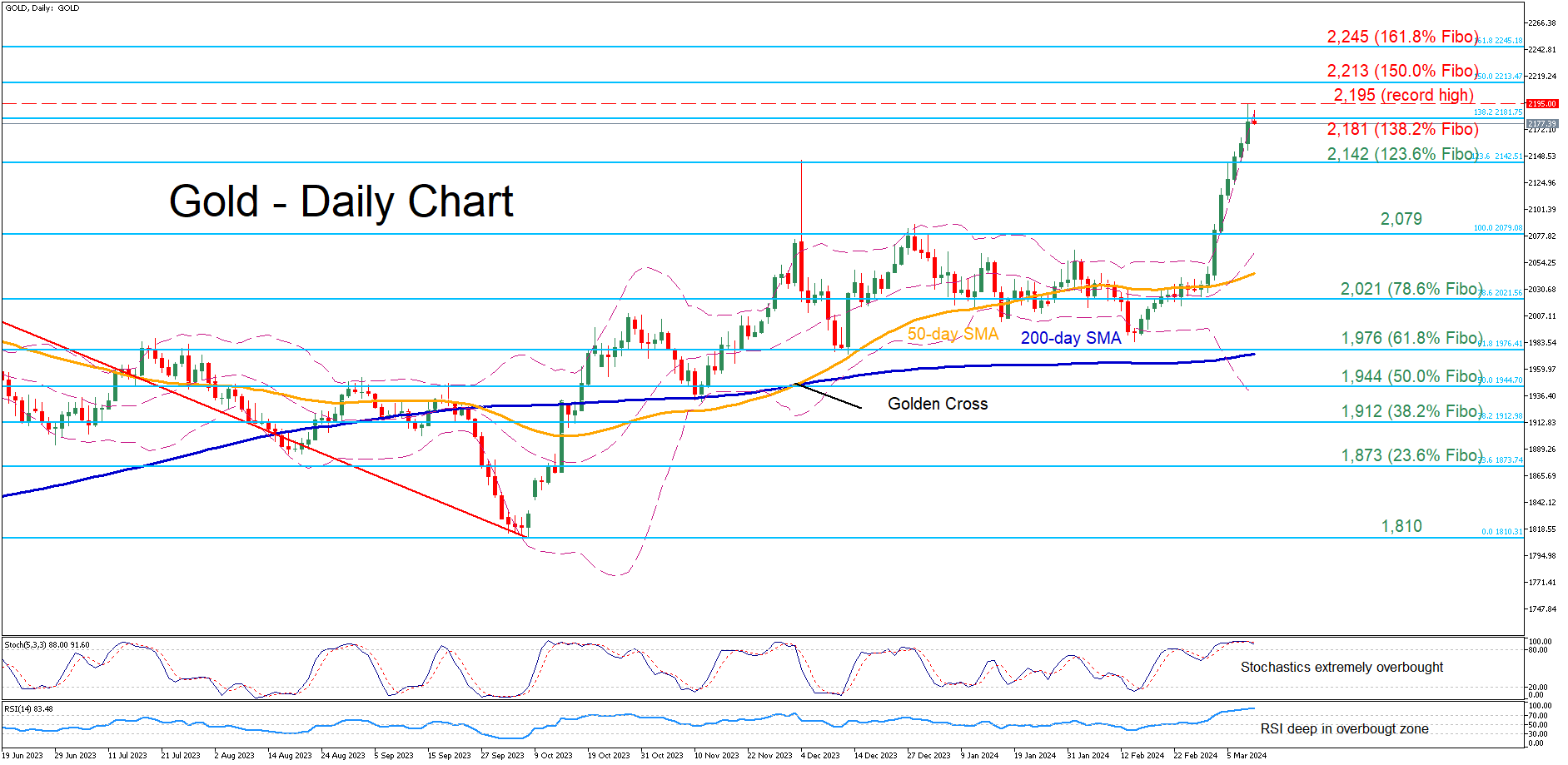

Gold has been in a steep uptrend following its profound break above the 50-day simple moving average (SMA), posting a barrage of fresh all-time highs in the past few sessions. However, traders should not rule out a pullback as the momentum indicators have been in their overbought zones for more than a week.

Should bullish pressures persist, bullion could initially claim 2,181, which is the 138.2% Fibonacci extension of the 2,079-1,810 downleg. Jumping above that region, the price may revisit its all-time high of 2,195. A violation of that zone could pave the way for the 150.0% Fibo of 2,213.

Alternatively, if gold experiences a mild correction, the 123.6% Fibo of 2,142 could act as the first line of defence. Further declines could then come to a halt at the previous resistance of 2,079, which held strong both in April and December 2023. Even lower, the 78.6% Fibo of 2,021 might provide downside protection.

In brief, gold has exploded in the short-term, surging to consecutive all-time highs amid heightened volatility. Nevertheless, there are emerging signs that the advance could be overdone as the short-term oscillators are deep in their overbought territories.

.jpg)