Has USDCAD reached a peak point?

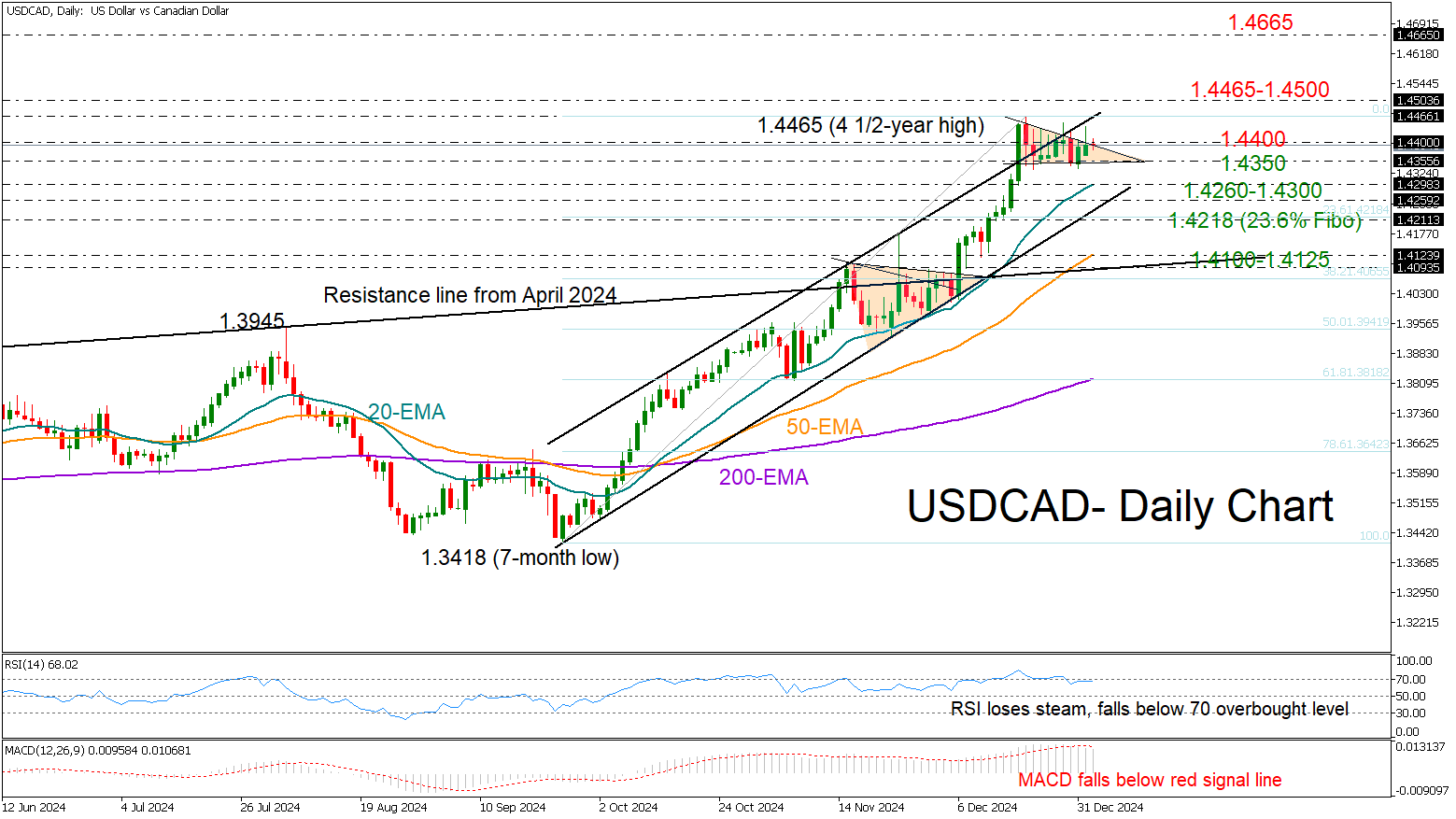

USDCAD is holding steady within the tight three-week-old range of 1.4350-1.4400 despite a brief rise to 1.4465 in the first trading day of 2025.

Technical indicators point to weakening buying sentiment, with the MACD decelerating below its red signal line and the RSI retreating from overbought territory. Despite this, the price seems to be forming a descending triangle at the top of its three-month-old uptrend, a pattern typically signaling continued bullish movement. Supporting this view, the exponential moving averages (EMAs) show a positive slope.

For a clearer bullish signal, the pair needs a close above 1.4400 and perhaps a sustainable move above the critical resistance zone of 1.4465-1.4500 before reaching the 2020 high of 1.4667. This is near the 2016 top of 1.4689, a break of which could open the door for the 1.4800 barrier last seen in 2003.

Alternatively, a slide below the 1.4350 floor could instantly pause near the 20-day EMA at 1.4300 or around the support trendline at 1.4260. If the 23.6% Fibonacci retracement of the September-December uptrend at 1.4218 fails too, the price could slide toward the 50-day EMA at 1.4125.

All in all, USDCAD is in a wait and see mode. A clear move above 1.4400 could trigger the next bull run, whilst a drop below 1.4350 may activate selling orders.