Tensions remain high in equities

Data reconfirm the strength of the US economy

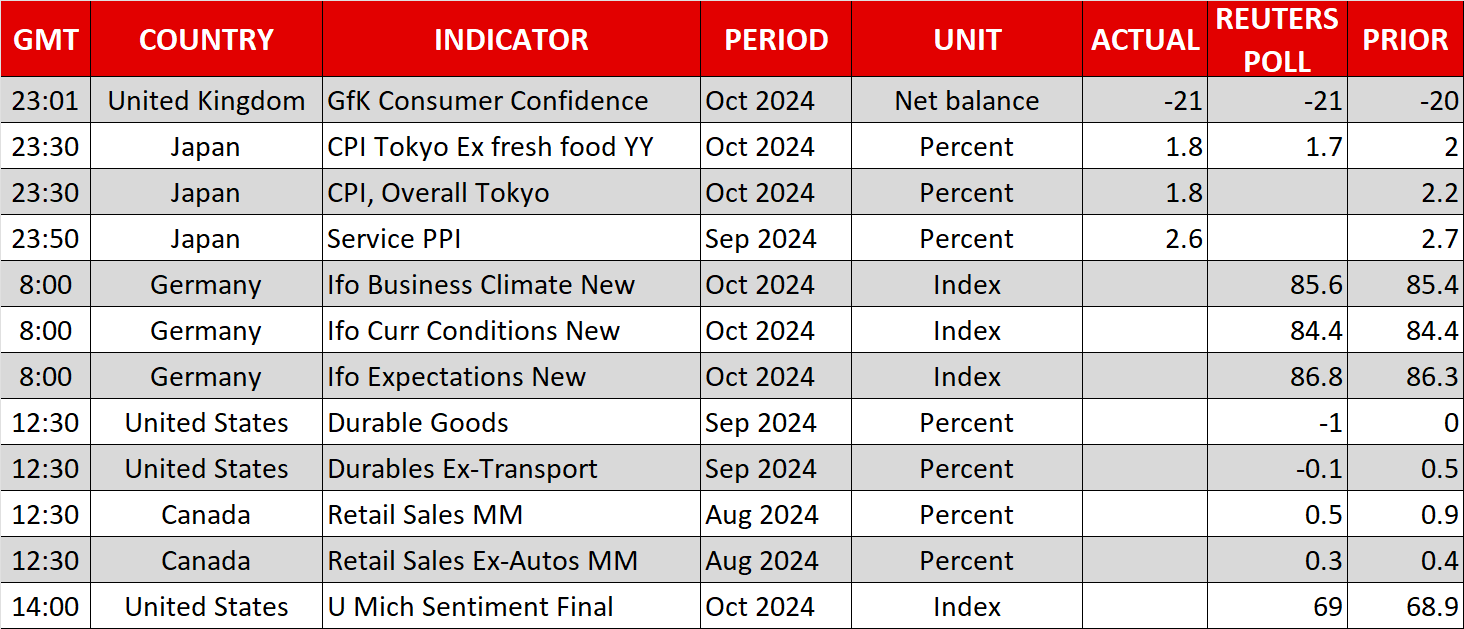

Yesterday’s PMI surveys release was a stark reminder that the US presidential election is not the sole market-moving factor. The next Fed meeting will be held two days after the election date and, assuming an eventless election process occurs, Chairman Powell et al will evaluate the progress made since the September aggressive rate cut.

The message from yesterday’s preliminary PMI surveys, the jobless claims figures and the new home sales data was that the US economy is still growing at a respectable rate, far above the growth achieved by most developed countries. The Fed hawks are not 100% on board for another rate cut, but the market will have to wait for November 7 for further comments on monetary policy, as Fedspeak will gradually diminish due to the usual blackout period that occurs before FOMC meetings, commencing shortly. The market, though, remains confident that a 25bps rate cut will be announced in a fortnight.

Today’s durable goods report could prove the main event of the session, ahead of next week’s very busy calendar. The combination of the October jobs report and the first release of the third quarter GDP has the potential to further increase divisions in the Fed ranks and dent the US dollar’s recent strength.

Data releases confuse equity investors

In the meantime, US equity indices are caught up in the middle. Investors are trying to navigate through this pre-election period, as the rhetoric is gradually becoming more aggressive, US economic data is producing further surprises, and third quarter earnings are picking up speed.

US indices remain in the red this week, with the Dow Jones index suffering from yesterday’s weak earnings result from IBM. The Nasdaq 100 index is doing slightly better but that might change dramatically if next week’s barrage of earnings from Alphabet, Microsoft, Meta and Amazon fail to appease investors.

Japanese elections on October 27

Following a weak set of inflation figures from Tokyo, which are usually a very strong predictor of national CPI, the market is preparing for Sunday’s general election in Japan. The LDP party is expected to earn the highest number of votes, but the latest polls increase the possibility of the LDP failing to achieve the necessary majority in the lower house, even with the help of its junior partner. In that case, the leading party would have to look elsewhere for the necessary support to form a new coalition, making generous compromises.

In the meantime, the yen remains under pressure, having quickly lost almost 60% of its July-September outperformance against the dollar. The BoJ is meeting next week, but the market has turned its focus to the December gathering. Political uncertainty along with weaker data prints could potentially force Governor Ueda et al to postpone any December decisions and thus remove the strongest tailwind for the yen.

.jpg)