The Bank of Japan cannot defend the yen and is unlikely to want to

The Bank of Japan cannot defend the yen and is unlikely to want to

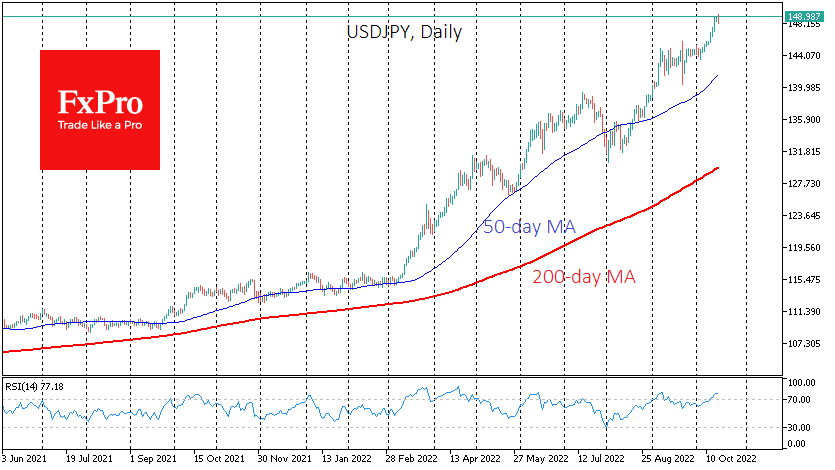

The exchange rate of the Japanese yen to the dollar is renewing its 32-year lows since the beginning of the week, and there is no end to the move. The USDJPY has touched and exceeded 149 and has gained about 3% since the beginning of the month. The pair has gained an astounding 45% since the beginning of this new cycle in 2021, and there is no solid fundamental reason for the JPY to latch on to this decline.

A few moments ago, we saw another intervention from Japan's Ministry of Finance to stop the yen's accelerating fall. The USDJPY was trading close to 149.30, and that sent the pair falling back to 148.12 within a minute.

The latest attempt of the authorities to stop the yen's unilateral decline can only make the markets smile for now. On Tuesday, Finance Minister Suzuki warned that Japan is ready to take appropriate and drastic measures against speculators.

But the speculators are more than a cohort of traders looking for a quick profit. In this case, the market is betting that Japan will not be able to sit on two chairs simultaneously. Even with a trillion dollars in U.S. treasuries as a safety cushion, it is impossible to keep long-term bond rates near zero in the face of extreme rate hikes and seriously assert its intention to defend the yen.

Sooner rather than later, Japan must choose one action, defend the yen, or defend bond yields by abandoning its current controversial policy.

So far, we see tangible signs that policymakers are only trying to slow the weakening of the yen but are unwilling to reverse the process. That means the markets are likely to continue the trend of buying USDJPY on any declines. This is reminiscent of Soros' (and not just his) bet that the Bank of England would not be able to stay within the European monetary mechanism, as it was contrary to economic fundamentals.

Chances are high that the Ministry of Finance and the Bank of Japan want to bring about an orderly weakening of the yen. It is quite possible that before March 2023, USDJPY will test the 1990 highs near 160, more than doubling from the global lows of 2012, when international interest rates were at their peak. That is, when the other major central banks squeezed their rates, roughly as Japan had done for years before.

It seems unlikely that the Bank of Japan would copy the policies of other central banks by drastically raising rates. After all, in that case, the government's expenditures on servicing the government debt would balloon to more than 280% of GDP, while economic growth would remain lifeless. Belt-tightening in such an environment would be far beyond what we saw with Greece a decade ago.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)