The crypto market has moved to growth after a pause

The crypto market has moved to growth after a pause

Market Picture

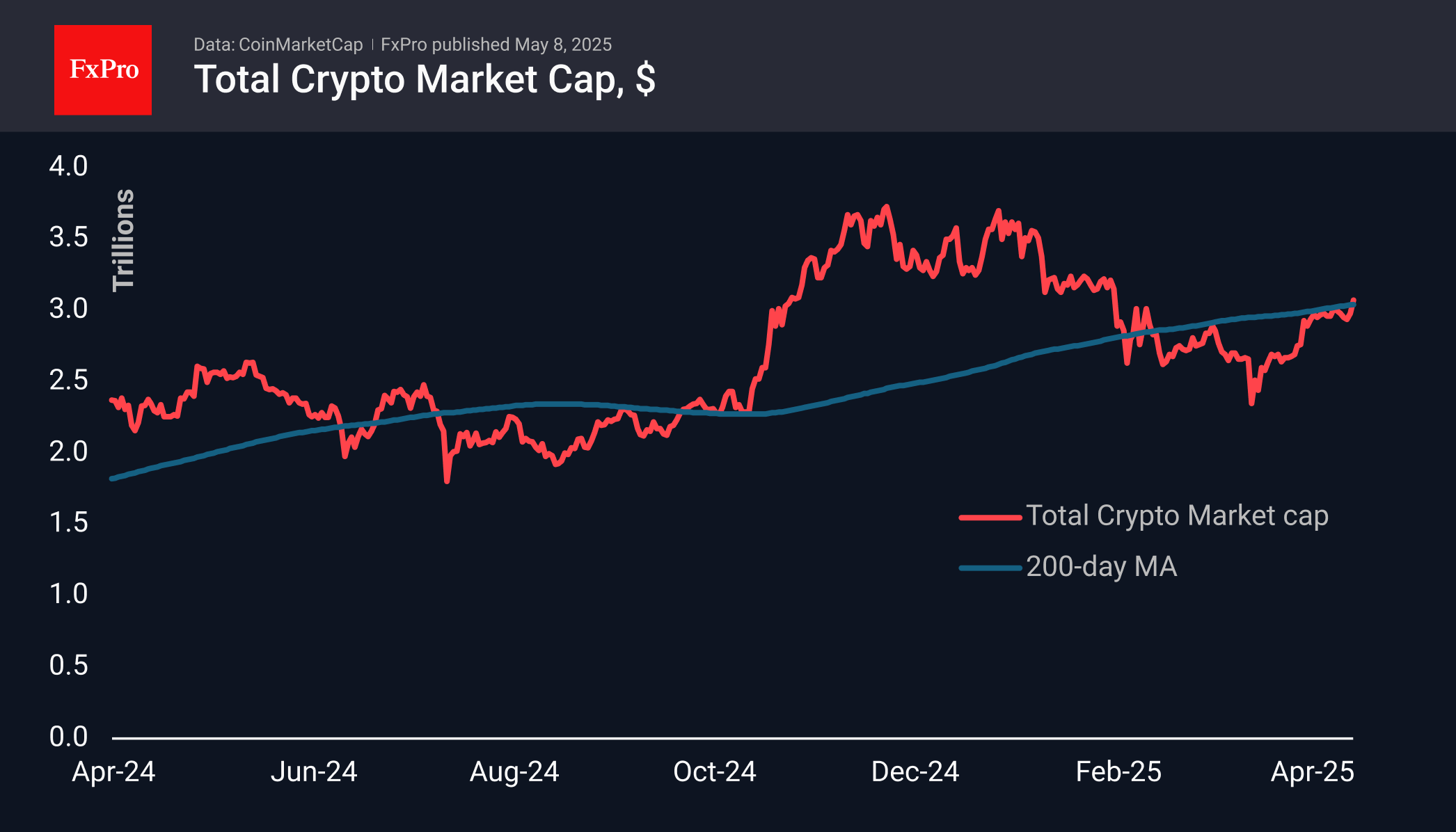

Market capitalisation has increased by 2.8% in the last 24 hours to $3.07 trillion, reacting positively to the US-China trade talks scheduled for the weekend. The recent move above this round level was preceded by a two-week consolidation just below it. Technically, the market is also showing appreciation with a rise above the 200-day moving average. The next upside target is the $3.20 trillion area, where the market stayed for most of February.

Bitcoin has reached the $99K mark, last seen in early February. Technically, a Fibonacci extension has begun with a potential upside of 161.8% from the rally from 9 April to 2 May to above $112K. Reaching the April lows fits into a broader scenario of a correction from the global rally from last September to January this year, with a target in the $162K area and upside potential of over 60%.

News Background

The current dynamics of BTC net realised gains do not indicate the formation of a macro top but signal the entry into the ‘zone of caution’, CryptoQuant reports. Investors continue to take profits after quotes recover, which is consistent with late-stage bull market behaviour.

New Hampshire has become the first US state to pass a bitcoin reserve law. The governor signed the law after approval from the state House and Senate. The document allows the Treasury to use up to 5% of the funds to invest in BTC and precious metals.

On 7 May, the Ethereum network activated a major upgrade to Pectra, including 11 key enhancements to improve usability and efficiency.

Standard Chartered forecasts the value of the Binance-linked token BNB to rise to $2775 by 2028, which implies a more than 4-fold increase in value.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)