Too early to announce the beginning of the altcoin Season

Market picture

The bitcoin exchange rate is hovering around $43,000, up a modest 0.8% in 24 hours. This momentum is mirrored by the broader crypto market, where capitalisation has risen to $1.69 trillion. Technically, bitcoin continues to trade around its 50-day moving average.

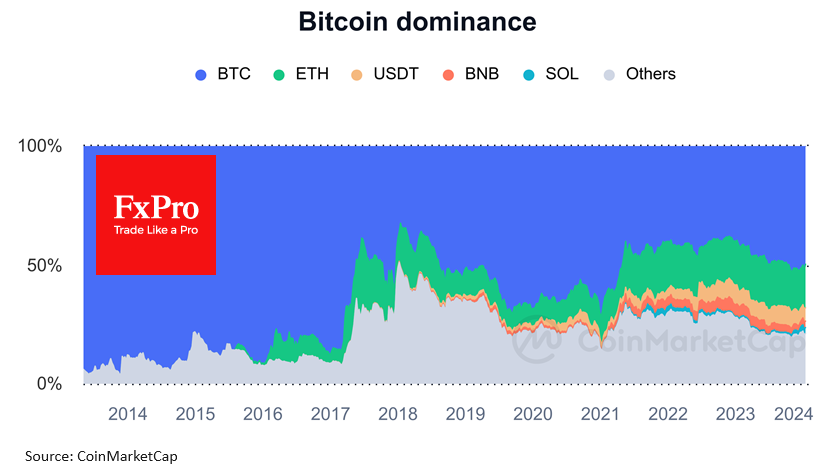

Over the 30 days, the capitalisation of all cryptocurrencies rose almost three times as much (5.6%) as bitcoin. Some signals point to the start of the altcoin season, but we expect Bitcoin to be the market driver for most of 2024, with bets halving and capital inflows thanks to ETFs.

According to CoinShares, crypto fund investments rose by $1.185 billion last week, marking 15 out of the last 16 weeks of positive inflows. Bitcoin investments increased by $1.142 billion, Ethereum by $26 million, XRP by $2.2 million, and Cardano by $1.4 million.

Despite the strong inflow of funds, the figure did not break the record set when the futures-based Bitcoin ETF was launched in October 2021 ($1.5bn).

News background

SkyBridge Capital founder Anthony Scaramucci expects the BTC surplus to clear in the next six to eight trading days.

Binance called 2023 a "favourable" year for cryptos. A 109% increase in the total market capitalisation of the crypto market in 2023 was a "favourable reversal" for the crypto industry.

US video game retailer GameStop announced the closure of its own NFT platform due to crypto regulatory uncertainty.

Of the 24,000 cryptocurrency projects listed on aggregator CoinGecko since 2014, 14,039 have ceased to exist. Most of the now 'dead' projects were launched during the market rally in 2020-2021.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)