USD/JPY retreats after 3-month peak around 151.00

USD/JPY experienced a new three-month high of 150.87 on Tuesday’s session after the release of the US CPI data. The rebound off the 140.20 support is still in progress, endorsing the bullish tendency in the short-term timeframe.

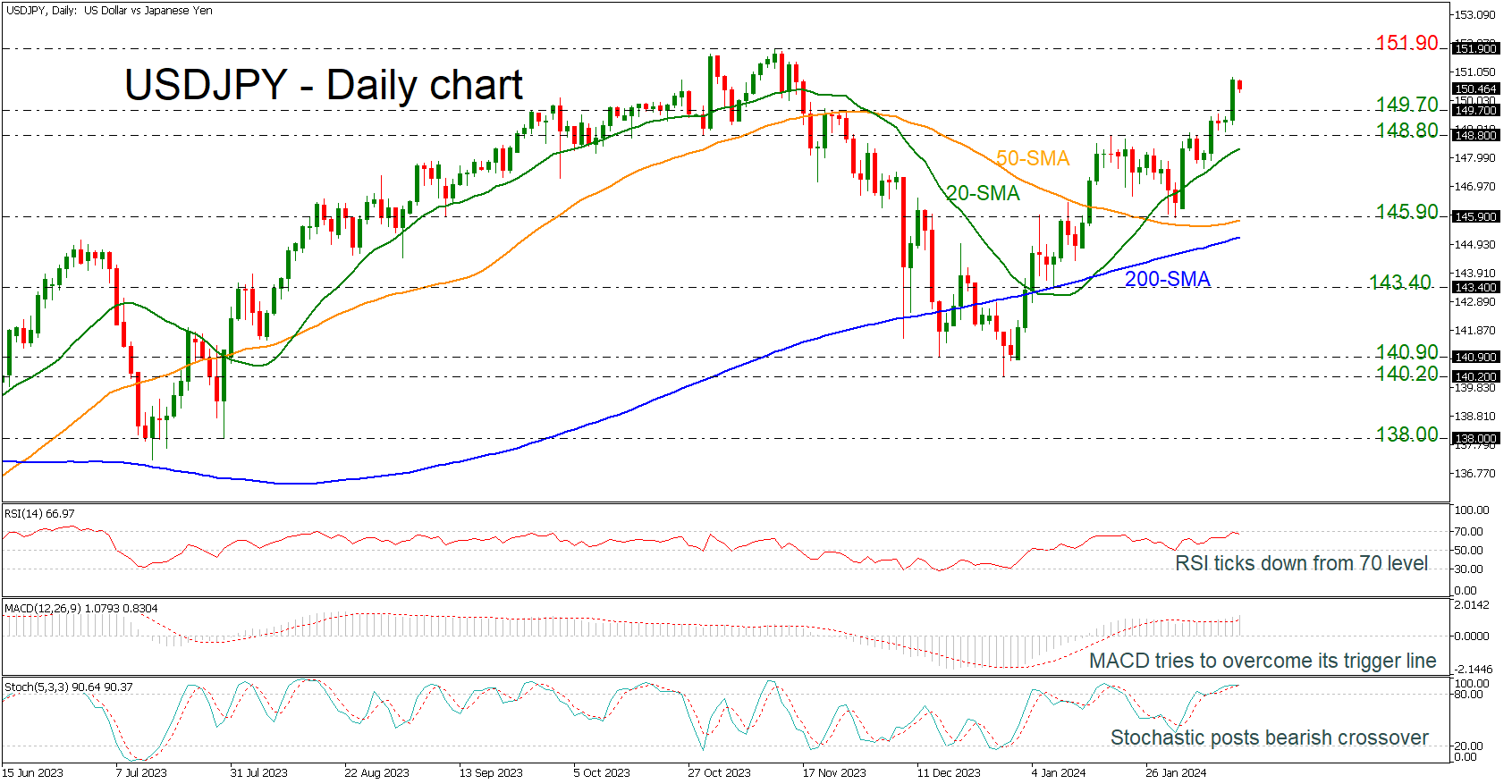

The technical oscillators are showing some mixed signals. The RSI is ticking lower near the 70 level, while the stochastic oscillator is posting a bearish crossover within its %K and %D lines in the overbought area. Both indicate an overstretched market. However, the MACD oscillator is still strengthening the bullish mode, standing above its trigger and zero lines.

If the market rallies further, then it may pause its uptrend at the 151.90 resistance level, taken from the peak on November 13. Surpassing this zone, the price could move towards the next psychological marks such as 152.00 and 153.00 as the next barricade is coming from the highs in 1990 at 160.00.

On the flip side, a downside correction may find support at the 148.80-149.70 restrictive region ahead of the 20- and the 50- day simple moving averages (SMAs) at 148.30 and 145.90 respectively. Beneath these levels, the 200-day SMA at 145.17 may act as a turning point for traders.

All in all, USDJ/PY has been in an upward movement over the past almost two months and only a dive below the 200-day SMA may change this outlook.

.jpg)