USDJPY trapped in a gloomy trajectory

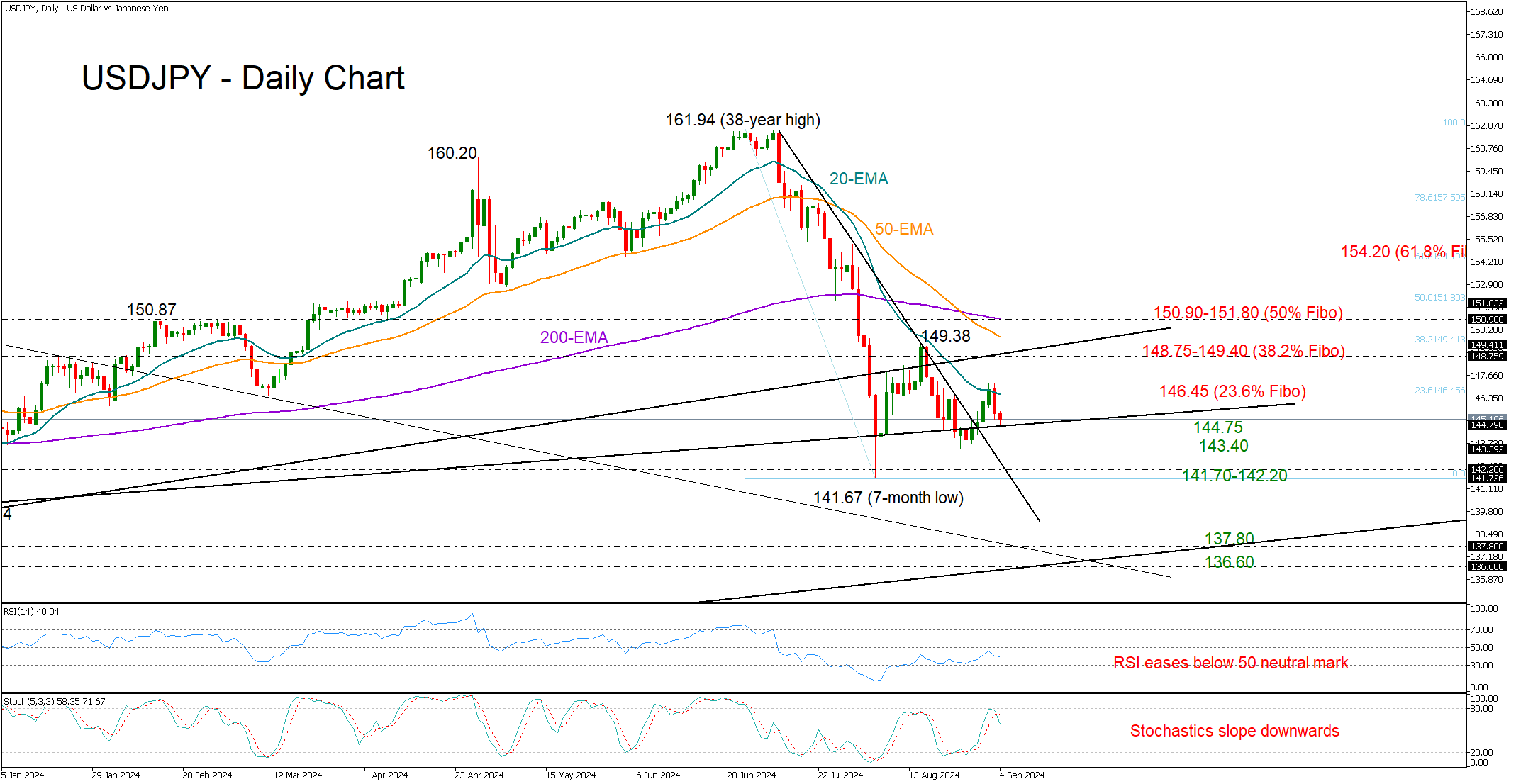

USDJPY was unable to maintain its strength on Tuesday despite briefly surpassing the 147.00 level, as the 20-day exponential moving average (EMA) caused a retreat towards the support trendline from July 2023 at 144.75.

The technical indicators cannot guarantee an immediate bullish rotation as the RSI has changed direction to the downside before reaching its 50 neutral mark and the stochastic oscillator has posted a negative cross near its 80 overbought level.

Trend signals are discouraging as well, with the 50- and 200-day EMAs sloping downwards after registering a death cross and the 20-day EMA declining well below them.

Should it dip below 144.80, the price might temporarily stall near 143.40 before encountering the broken resistance trendline at 142.20 and the August trough of 141.67. Then a clear close below the December 2023 bar of 140.80 could cause a rapid downfall towards the 136.60-137.80 zone, where the descending constraining line from November 2023 and the 161.8% Fibonacci extension of the previous upturn are positioned.

If the bulls make a comeback and manage to push the pair above its 20-day EMA at 146.45, a resistance zone could come into play between 148.75 and 149.40. This area is significant as it includes the broken ascending trendline from 2023 and the 38.2% Fibonacci retracement level of the July-August freefall. Note that the 50-day EMA is converging to that zone too. Hence, the bulls may need to knock down that wall to access the 200-day EMA at 150.90 and the 50% Fibonacci mark of 151.80.

In a nutshell, USDJPY appears bearish in the short-term picture, with new selling forces anticipated below 144.75.

.jpg)