- Utama

- Komuniti

- Pedagang Berpengalaman

- LOST $14 k for 0.01 USDCHF LOT SIZE .Please help !

Advertisement

Edit Your Comment

LOST $14 k for 0.01 USDCHF LOT SIZE .Please help !

forex_trader_178891

Ahli sejak Feb 26, 2014

97 hantaran

Jan 15, 2015 at 22:36

(disunting Jan 15, 2015 at 22:47)

Ahli sejak Feb 26, 2014

97 hantaran

Hello ,

I have account with ic market .

about 15 hours ago I had one small open trade 0.01 buy USDCHF .

My account was wipeout completely with -$14552.54 on 0.01 buy USDCHF position .

here is history trade : USUCHF BUY 0.01 -- lost - $14,552.54

open price 1.00211 closed 0.06460

can some one explain to me :

- is it possible to lose more than $1000 when you open 0.01 lot size ?

- if I open 0.01 lot size I would lose $10 every 100 pips ( 1% ) .

if I lost $14 k for 0.01 lot size , how many pips I lost ? 140,000 pips ?? ( 140 thousand pips )

is it from open price 1.00211 closed 0.06460 is 140 k pips ?

I am confusing .

- if look at the history (open price 1.00211 closed 0.06460 )

how much money I should lose accord to those open and closed price of the pair .

…..

I hope IC market will refund my money . This is big scam need to be investigated .

Thank you .

I have account with ic market .

about 15 hours ago I had one small open trade 0.01 buy USDCHF .

My account was wipeout completely with -$14552.54 on 0.01 buy USDCHF position .

here is history trade : USUCHF BUY 0.01 -- lost - $14,552.54

open price 1.00211 closed 0.06460

can some one explain to me :

- is it possible to lose more than $1000 when you open 0.01 lot size ?

- if I open 0.01 lot size I would lose $10 every 100 pips ( 1% ) .

if I lost $14 k for 0.01 lot size , how many pips I lost ? 140,000 pips ?? ( 140 thousand pips )

is it from open price 1.00211 closed 0.06460 is 140 k pips ?

I am confusing .

- if look at the history (open price 1.00211 closed 0.06460 )

how much money I should lose accord to those open and closed price of the pair .

…..

I hope IC market will refund my money . This is big scam need to be investigated .

Thank you .

Ahli sejak Nov 12, 2010

160 hantaran

Jan 16, 2015 at 00:21

Ahli sejak Nov 12, 2010

160 hantaran

You have an image of the trade? Or can you set up a system on here to show the trade? Very interesting indeed if this is true. You can contact your broker but unfortunately you might have lost it all. That is the risk with Forex, you can lose everything very easily. I don't know how you closed at 0.06460 as I don't see the price ever dropping that far on my charts. One time I had a similar situation where there was a major dip but it was actually my brokers fault where for some reason their price took a major drop and closed my position for a big loss, but the pair never actually took that dip. I got my money refunded since it was an issue with their software or something. Hopefully you get some better luck with this. Fight Fight Fight

See my profile or message me for my latest EA

forex_trader_178891

Ahli sejak Feb 26, 2014

97 hantaran

Jan 16, 2015 at 01:23

(disunting Jan 16, 2015 at 01:26)

Ahli sejak Feb 26, 2014

97 hantaran

bestdarngood posted:

You have an image of the trade? Or can you set up a system on here to show the trade? Very interesting indeed if this is true. You can contact your broker but unfortunately you might have lost it all. That is the risk with Forex, you can lose everything very easily. I don't know how you closed at 0.06460 as I don't see the price ever dropping that far on my charts. One time I had a similar situation where there was a major dip but it was actually my brokers fault where for some reason their price took a major drop and closed my position for a big loss, but the pair never actually took that dip. I got my money refunded since it was an issue with their software or something. Hopefully you get some better luck with this. Fight Fight Fight

I will let every body know how ICmarket handle this .

This is scary broker if they don't take care this right away .

Ahli sejak Dec 16, 2011

268 hantaran

Jan 16, 2015 at 01:47

Ahli sejak Dec 16, 2011

268 hantaran

please keep us posted . im very interesting at whats happened there

forex_trader_178891

Ahli sejak Feb 26, 2014

97 hantaran

Jan 16, 2015 at 02:26

Ahli sejak Feb 26, 2014

97 hantaran

It is crazy .

can you imagine You have $100 k account with ic market .You just open 0.05 lot size ( just 5% of your equity ) .

one morning you get up and your account gone ???

This must be scam to take money from people for free .

The whole world is watching how IC market handle this .

can you imagine You have $100 k account with ic market .You just open 0.05 lot size ( just 5% of your equity ) .

one morning you get up and your account gone ???

This must be scam to take money from people for free .

The whole world is watching how IC market handle this .

Ahli sejak Mar 31, 2014

53 hantaran

Jan 16, 2015 at 02:49

Ahli sejak Mar 31, 2014

53 hantaran

Ahli sejak Mar 31, 2014

53 hantaran

Jan 16, 2015 at 03:43

Ahli sejak Mar 31, 2014

53 hantaran

but there is surely a problem here since the lowest of USDCHF I see on all my MT4's is only around 0.8. So you must have lost 1.4k at the most.

forex_trader_178891

Ahli sejak Feb 26, 2014

97 hantaran

Jan 16, 2015 at 03:54

Ahli sejak Feb 26, 2014

97 hantaran

chiecghethunam posted:

but there is surely a problem here since the lowest of USDCHF I see on all my MT4's is only around 0.8. So you must have lost 1.4k at the most.

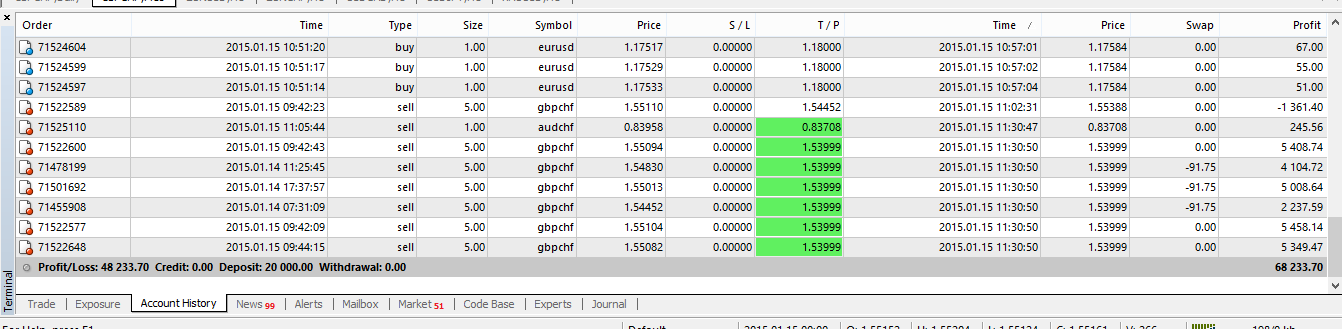

Here is crazy chart from icmarket .

Ahli sejak Dec 04, 2010

1447 hantaran

Jan 16, 2015 at 04:02

Ahli sejak Dec 04, 2010

1447 hantaran

I was just looking at my charts also as I have accounts with Global Prime and IC Markets. I can't believe the IC Markets price on the chart of 0.06571, surely they won't be expecting clients to cop those losses (contact them and see what the will revise the price to) compare it to the lowest price Global Prime reached in the chart. I will be watching to see how you are treated also VN, keep us upto date.

Ahli sejak Nov 12, 2010

160 hantaran

Jan 16, 2015 at 05:52

Ahli sejak Nov 12, 2010

160 hantaran

Oanda is apparently refunding all losses occurred when trades were not able to go through according to this article. Perhaps other brokers will do the same...

http://www.zerohedge.com/news/2015-01-15/2-fx-brokers-suffer-significant-losses-after-snb-surprise-breach-regulatory-capital-

You are not alone with issues today, forex is just legalized gambling where you could lose it all very easily. All money put in should be considered lost any time you put it in a trade because there are just too many unknowns sometimes. Nothing is guaranteed.

http://www.zerohedge.com/news/2015-01-15/2-fx-brokers-suffer-significant-losses-after-snb-surprise-breach-regulatory-capital-

You are not alone with issues today, forex is just legalized gambling where you could lose it all very easily. All money put in should be considered lost any time you put it in a trade because there are just too many unknowns sometimes. Nothing is guaranteed.

See my profile or message me for my latest EA

Ahli sejak Apr 03, 2014

28 hantaran

Jan 16, 2015 at 07:13

Ahli sejak Apr 03, 2014

28 hantaran

Vn - I got this email from them this morning.

Dear Client,

This email is concerning the CHF position(s) on your trading account and the prices streamed across the CHF pairs that have affected you today.

Today at 11:30 platform time (GMT+2) the Swiss National Bank removed the floor at 1.20 on the EURCHF currency pair which caused extreme volatility in all CHF pairs and the market in general. Over this period we saw spreads widen significantly which in turn caused the activation of price filters to stop pricing. Once pricing stopped on our main Integral price feed our backup price feed from Currenex was allowed to price. It was at this time that some liquidity providers were able to stream erroneous prices to IC Markets and execute client trades at prices they shouldn’t have.

Today IC Markets will be amending the prices on trades done across the CHF pairs with our liquidity providers. Once we have had these trades amended we will begin the process of adjusting clients accounts. This may include but not be limited to the actions below:

• Reinstatement of positions where appropriate and possible

• Amendment of open/close prices on trades

• Assessment of client portfolios closed due to insufficient margin

• Adjusting client cash balances to reflect the actions above

IC Markets staff will be working as fast as possible to complete the above and restore trading accounts to their correct state. We appreciate your patience as we complete this.

Kind regards,

IC Markets Trade Desk

Dear Client,

This email is concerning the CHF position(s) on your trading account and the prices streamed across the CHF pairs that have affected you today.

Today at 11:30 platform time (GMT+2) the Swiss National Bank removed the floor at 1.20 on the EURCHF currency pair which caused extreme volatility in all CHF pairs and the market in general. Over this period we saw spreads widen significantly which in turn caused the activation of price filters to stop pricing. Once pricing stopped on our main Integral price feed our backup price feed from Currenex was allowed to price. It was at this time that some liquidity providers were able to stream erroneous prices to IC Markets and execute client trades at prices they shouldn’t have.

Today IC Markets will be amending the prices on trades done across the CHF pairs with our liquidity providers. Once we have had these trades amended we will begin the process of adjusting clients accounts. This may include but not be limited to the actions below:

• Reinstatement of positions where appropriate and possible

• Amendment of open/close prices on trades

• Assessment of client portfolios closed due to insufficient margin

• Adjusting client cash balances to reflect the actions above

IC Markets staff will be working as fast as possible to complete the above and restore trading accounts to their correct state. We appreciate your patience as we complete this.

Kind regards,

IC Markets Trade Desk

forex_trader_198169

Ahli sejak Jul 06, 2014

1 hantaran

Jan 16, 2015 at 07:16

Ahli sejak Jul 06, 2014

1 hantaran

Are you sure you didn't buy .1 lots? Either way your numbers don't add up right.

Last night's move crushed a lot of people.

Last night's move crushed a lot of people.

Ahli sejak Feb 10, 2013

5 hantaran

Jan 16, 2015 at 07:16

Ahli sejak Feb 10, 2013

5 hantaran

If open price 1.00211 and close 0.0646 , then number of pips = 9375.1 pips - then shouldn't the loss be just $937.51 ?

\

\

The Magic of Believing

Ahli sejak Jan 30, 2012

20 hantaran

Jan 16, 2015 at 07:30

Ahli sejak Jan 30, 2012

20 hantaran

I wanna try to share what I know. Please CMIIW.

In my chart, Pepperstone, low bid price in Jan 15 was 0.71412 (see my attachment). You can see it in Data Window in left side or in status bar in lower right side. Your buy position was closed at 0.06460 of bid price. Please find another chart comparison.

Yes, it is possible.

In USDCHF, and in other 4 or 5 digit currency prices, 1 pip is equal to the movement of price of 0.0001.

So, when you buy at 1.00211 and close it at 0.06460, it means you lose 1.00211 - 0.06460 = 0.93751 (9,375.1 pips).

If you trade 1 lot of USDCHF, it's 1 pip value is not $10, but $10 divided by your entry price, ie 1.00211, or equal to $9.98 (rounded).

So, when you lose 9,375.1 pips, it was equal to 9,375.1 pips x $9.98 x 0.01 lot = $935.54.

Your lose almost reach $1,000 right?

This is the real lose that you face if the price 'really' hit 0.06460 level.

Hope this can help you 😄

vinabao posted:

here is history trade : USUCHF BUY 0.01 -- lost - $14,552.54

open price 1.00211 closed 0.06460

In my chart, Pepperstone, low bid price in Jan 15 was 0.71412 (see my attachment). You can see it in Data Window in left side or in status bar in lower right side. Your buy position was closed at 0.06460 of bid price. Please find another chart comparison.

vinabao posted:

- is it possible to lose more than $1000 when you open 0.01 lot size ?

Yes, it is possible.

vinabao posted:

if I lost $14 k for 0.01 lot size , how many pips I lost ? 140,000 pips ?? ( 140 thousand pips )

is it from open price 1.00211 closed 0.06460 is 140 k pips ?

In USDCHF, and in other 4 or 5 digit currency prices, 1 pip is equal to the movement of price of 0.0001.

So, when you buy at 1.00211 and close it at 0.06460, it means you lose 1.00211 - 0.06460 = 0.93751 (9,375.1 pips).

vinabao posted:

- if I open 0.01 lot size I would lose $10 every 100 pips ( 1% ) .

how much money I should lose accord to those open and closed price of the pair .

My account was wipeout completely with -$14552.54 on 0.01 buy USDCHF position .

If you trade 1 lot of USDCHF, it's 1 pip value is not $10, but $10 divided by your entry price, ie 1.00211, or equal to $9.98 (rounded).

So, when you lose 9,375.1 pips, it was equal to 9,375.1 pips x $9.98 x 0.01 lot = $935.54.

Your lose almost reach $1,000 right?

This is the real lose that you face if the price 'really' hit 0.06460 level.

Hope this can help you 😄

Ahli sejak Jan 30, 2012

20 hantaran

Jan 16, 2015 at 07:31

Ahli sejak Jan 30, 2012

20 hantaran

chiecghethunam posted:

damn, after reading this thread, I feel bad for winning that much yesterday 😂

I think you don't have to feel bad, because nothing wrong with your trades.

At Jan 15, GBPCHF reach a low at 1.10996 level in my chart, Pepperstone (see my attachment). You closed your sell order in 1.53999 level. Nothing wrong, right?

If you like, you can share some of your winning to support @vinabao to solve this case. It would be very helpful 😄

Ahli sejak Jan 23, 2012

52 hantaran

Jan 16, 2015 at 07:32

Ahli sejak Jan 23, 2012

52 hantaran

Calm down.. You could have mailed Icm.. In fact a mail was send by them.

Dear Client,

This email is concerning the CHF position(s) on your trading account and the prices streamed across the CHF pairs that have affected you today.

Today at 11:30 platform time (GMT+2) the Swiss National Bank removed the floor at 1.20 on the EURCHF currency pair which caused extreme volatility in all CHF pairs and the market in general. Over this period we saw spreads widen significantly which in turn caused the activation of price filters to stop pricing. Once pricing stopped on our main Integral price feed our backup price feed from Currenex was allowed to price. It was at this time that some liquidity providers were able to stream erroneous prices to IC Markets and execute client trades at prices they shouldn’t have.

Today IC Markets will be amending the prices on trades done across the CHF pairs with our liquidity providers. Once we have had these trades amended we will begin the process of adjusting clients accounts. This may include but not be limited to the actions below:

• Reinstatement of positions where appropriate and possible

• Amendment of open/close prices on trades

• Assessment of client portfolios closed due to insufficient margin

• Adjusting client cash balances to reflect the actions above

IC Markets staff will be working as fast as possible to complete the above and restore trading accounts to their correct state. We appreciate your patience as we complete this.

Kind regards,

IC Markets Trade Desk

Dear Client,

This email is concerning the CHF position(s) on your trading account and the prices streamed across the CHF pairs that have affected you today.

Today at 11:30 platform time (GMT+2) the Swiss National Bank removed the floor at 1.20 on the EURCHF currency pair which caused extreme volatility in all CHF pairs and the market in general. Over this period we saw spreads widen significantly which in turn caused the activation of price filters to stop pricing. Once pricing stopped on our main Integral price feed our backup price feed from Currenex was allowed to price. It was at this time that some liquidity providers were able to stream erroneous prices to IC Markets and execute client trades at prices they shouldn’t have.

Today IC Markets will be amending the prices on trades done across the CHF pairs with our liquidity providers. Once we have had these trades amended we will begin the process of adjusting clients accounts. This may include but not be limited to the actions below:

• Reinstatement of positions where appropriate and possible

• Amendment of open/close prices on trades

• Assessment of client portfolios closed due to insufficient margin

• Adjusting client cash balances to reflect the actions above

IC Markets staff will be working as fast as possible to complete the above and restore trading accounts to their correct state. We appreciate your patience as we complete this.

Kind regards,

IC Markets Trade Desk

Ahli sejak Aug 03, 2012

291 hantaran

Jan 16, 2015 at 08:10

Ahli sejak Aug 03, 2012

291 hantaran

vinabao posted:

Hello ,

I have account with ic market .

about 15 hours ago I had one small open trade 0.01 buy USDCHF .

My account was wipeout completely with -$14552.54 on 0.01 buy USDCHF position .

here is history trade : USUCHF BUY 0.01 -- lost - $14,552.54

open price 1.00211 closed 0.06460

can some one explain to me :

- is it possible to lose more than $1000 when you open 0.01 lot size ?

- if I open 0.01 lot size I would lose $10 every 100 pips ( 1% ) .

if I lost $14 k for 0.01 lot size , how many pips I lost ? 140,000 pips ?? ( 140 thousand pips )

is it from open price 1.00211 closed 0.06460 is 140 k pips ?

I am confusing .

- if look at the history (open price 1.00211 closed 0.06460 )

how much money I should lose accord to those open and closed price of the pair .

…..

I hope IC market will refund my money . This is big scam need to be investigated .

Thank you .

i think you loss 93751*0.01=937.51 USD

so you compare chart with other chart because i am not trade with this fair and screenshot your chart to public ,hope help you for case

Ahli sejak Aug 03, 2012

291 hantaran

Jan 16, 2015 at 08:28

Ahli sejak Aug 03, 2012

291 hantaran

since jan 15 2015 USDCHF never hit to 0.06460

Ahli sejak Jan 14, 2010

2279 hantaran

Jan 16, 2015 at 19:40

(disunting Jan 16, 2015 at 19:41)

Ahli sejak Jan 14, 2010

2279 hantaran

Sad to hear but I think they will recalculate and you will get money back to your account. The only question is what kind of hit your broker took. Are clients accounts segregated.

You know, FXCM is most probably going tits up. The company lost $225 million and shares dropped 90%.

By the way, did you have stop loss

This was one nasty Black Swan...The news were not even scheduled.

You know, FXCM is most probably going tits up. The company lost $225 million and shares dropped 90%.

By the way, did you have stop loss

This was one nasty Black Swan...The news were not even scheduled.

Ahli sejak Aug 21, 2013

14 hantaran

Jan 17, 2015 at 03:14

Ahli sejak Aug 21, 2013

14 hantaran

*Penggunaan komersil dan spam tidak akan diterima, dan boleh mengakibatkan penamatan akaun.

Petua: Menyiarkan url gambar/youtube akan menyisipkannya secara automatik dalam siaran hantaran anda!

Tip: Taipkan tanda @ untuk melengkapkan nama pengguna yang menyertai perbincangan ini secara automatik.