Crypto did not give up trying to find the bottom

Crypto did not give up trying to find the bottom

Market Picture

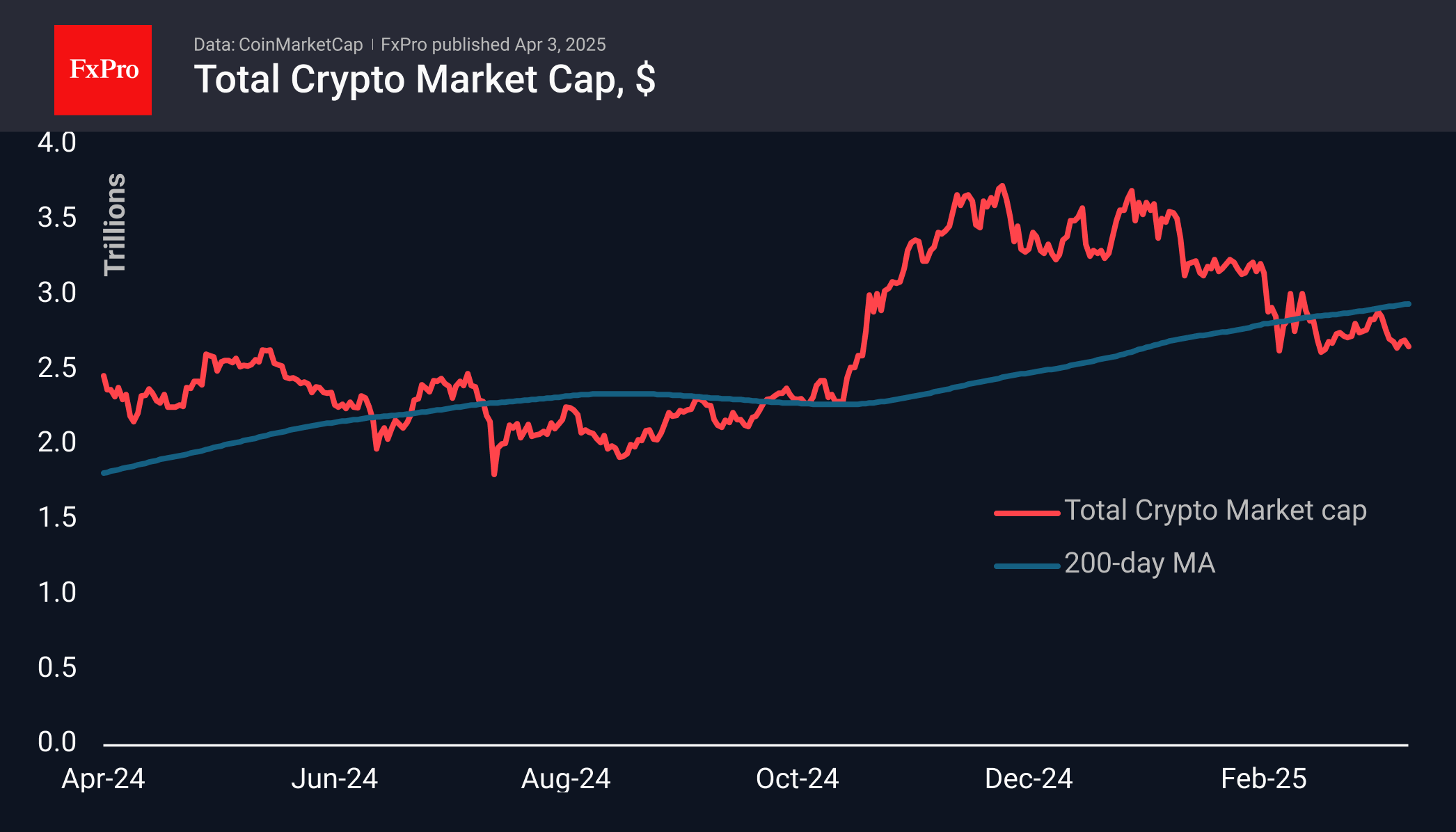

The crypto market cap fell below $2.65 trillion twice during the week. The market was below the 2.60 level in November. The ability to consolidate above it was an important signal for the start of the rally. The market will likely defend this, which promises a prolonged battle near these levels. However, the balance is now on the side of the bears as the capitalisation index is moving away from its 200-day average. This is an important signal for large funds to reduce their investments in the sector.

The Cryptocurrency Sentiment Index spent the entire week in fear territory, ending in extreme fear at 25—the lowest level in three and a half weeks. However, these readings are not low enough to suggest oversold conditions, which should discourage sellers.

Bitcoin jumped to $88K in reaction to the tariff announcement, only to soon fall back below $82K. In the short term, it looked like another wave of selling to the upside. We have been seeing this trend since the second half of February. Technically, this is a continuation of the struggle with the major moving averages. The market is failing to consolidate above the 200-day MA, and the 50-day MA stopped rising intraday on Wednesday. As much as crypto enthusiasts would like it to be otherwise, the bears are in control of the market for now.

News Background

Nansen estimates that the crypto market has a 70% chance of forming a local bottom in the next two months amid global uncertainty over trade tariffs.

GameStop raised $1.5 billion by issuing convertible notes. The proceeds will be used to buy Bitcoin and for corporate purposes. The company's management approved the strategy on 25 March.

According to CryptoQuant, in the first quarter of the year, companies around the world added nearly 91,800 BTC (more than $7.7 billion) to their reserves. Meanwhile, selling by long-term investors and capital outflows from bitcoin ETFs prevented the asset from growing.

JPMorgan noted that March was the worst month for miners. The 14 largest US-listed bitcoin miners lost 25% of their market capitalisation (around $6 billion) last month.

Circle, which issues the USDC stablecoin, has filed its initial public offering (IPO) with the US Securities and Exchange Commission (SEC). The Class A shares will be issued on the NYSE under the ticker CRCL.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)