Dollar’s resilience could be tested after Monday’s surge

Risk appetite receives an enormous boost

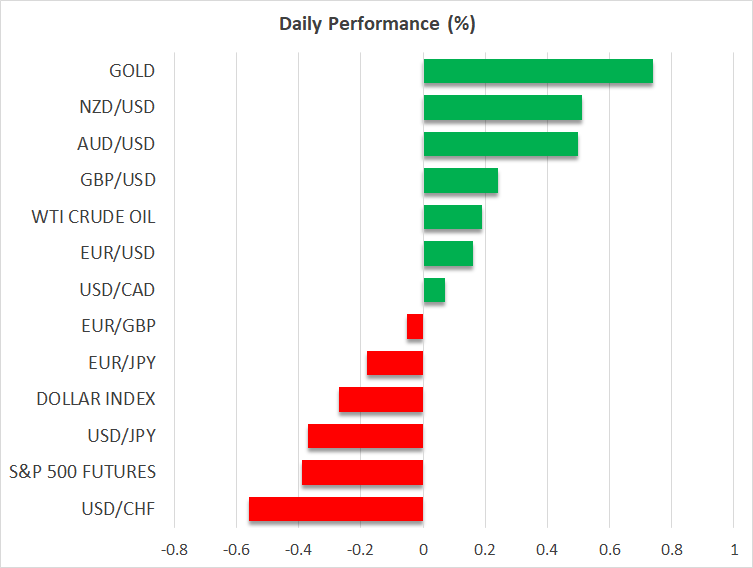

Risk appetite is slightly receding today after getting a significant boost yesterday following the US-China trade deal. As more details of the agreement emerge - for example, the de minimis tariff will remain sizeable at 54% - and with US President Trump commenting that the agreement does not cover tariffs on cars, steel, aluminum or pharmaceuticals, the desire to address the ballooning trade differences, even for 90 days, resulted in significant market moves.

US stocks rallied, with the Nasdaq 100 index leading the charge with a 4% rise. Interestingly, US equity indices are now trading above the April 2 level, when Trump announced the reciprocal tariffs. Sector-wise, consumer discretionary and technology stocks recorded the strongest performance on Monday, with the bond-like utilities sector closing in negative territory.

The US dollar was also boosted, outperforming most major currencies. Crucially, euro/dollar dropped by 1.4%, which is the strongest one-day decline since November 6, 2024, while dollar/yen jumped to 148.64, recording the strongest daily rally since March 2020. However, aussie/dollar did not join the selloff and recorded a small drop, which is already reversing today.

Critically, there is a plethora of questions about the incentive behind this swift agreement, particularly from the US side, and what needs to happen in the next 90 days for the current lower tariffs regime to be maintained. These questions will gradually start to impact market sentiment, with US stocks already giving back a tiny portion of Monday’s gains.

US yields rise as well

Meanwhile, US Treasury yields also jumped higher on Monday. One would have expected that the temporary suspension of these punitive tariffs would lead to a relaxation of yields via the inflation channel. However, it looks like bond investors are either not convinced of the viability of the current US-China agreement and/or believe that the strengthening US economy will generate demand-driven inflation. Either way, higher yields are increasing the interest costs of the US administration, thus displeasing fiscal hawks.

Fed still in waiting mode, doves worry about stagflation

The market’s immediate reaction was to price out 15bps of rate cuts by year-end, with just 56bps of easing now expected in 2025. A few investment banks have swiftly pushed out their rate cut expectations, but it is evident that the US economy is not yet out of the woods, despite the US-China agreement. Incoming Fedspeak will be closely watched, with the doves already downplaying the importance of the trade announcement. The Chicago Fed’s Goolsbee and Board member Kugler - both known doves - warned on Monday that the US economy might still face stagflation.

Decent UK data, focus shifts to US CPI

With the decent UK jobs data failing to impress pound traders, the focus is gradually shifting to today’s US CPI report. Following the US-China deal, which could prove a turning point for the US economy, data releases referring to the period before May 12 have probably lost some of their market-moving potential. Having said that, a softer CPI report today could further support Monday’s risk-on reaction.

Both the headline and core inflation figures are forecast to remain stable at 2.4% and 2.8% YoY, respectively. However, there are chances of a surprise on either side; specifically, the April 2 reciprocal tariffs might have shocked consumers, thus affecting their spending appetite, while, at the same time, various business and consumer surveys saw their inflation subcomponents or expectations rising to new highs.

Gold edges higher, oil stabilizes north of $62

Gold and oil experienced opposing moves on Monday, with the former recording one of its weakest daily sessions, both in percentage and absolute terms, and the latter rallying north of the $62 level. Both are slightly up today, with investors also focusing on the likely Ukraine-Russia talks potentially taking place in Turkey later this week.

.jpg)