EBC Markets Briefing | Euro weakens against pound on policy divergence

Sterling edged up against the euro on Wednesday after Bailey said the BOE must approach interest rate cuts carefully based on assessment of the impact of the rise in employer national insurance contributions.

Moscow issued a warning to Biden on Tuesday, lowering the threshold for a nuclear strike just days after the US reportedly allowed Ukraine to fire American missiles deep into Russia.

Barring geopolitical turmoil, several analysts expect the pound to strengthen against the euro as the UK – a consumer-driven economy - is unlikely to be the focal point for the incoming US administration

The German economy is likely to stagnate in the last three months of the year as the labour market continues to soften and possible new trade tariffs loom, the country's central bank said.

Germany is due to hold elections in the coming months after the implosion of its ruling coalition. There is a possibility that a new government could reform debt break to fight recession risks.

The single currency has been among the biggest victims of the dollar's surge. Amundi believes it could fall to the key $1 mark in the next month before rebounding to 1.16 by the end of 2025.

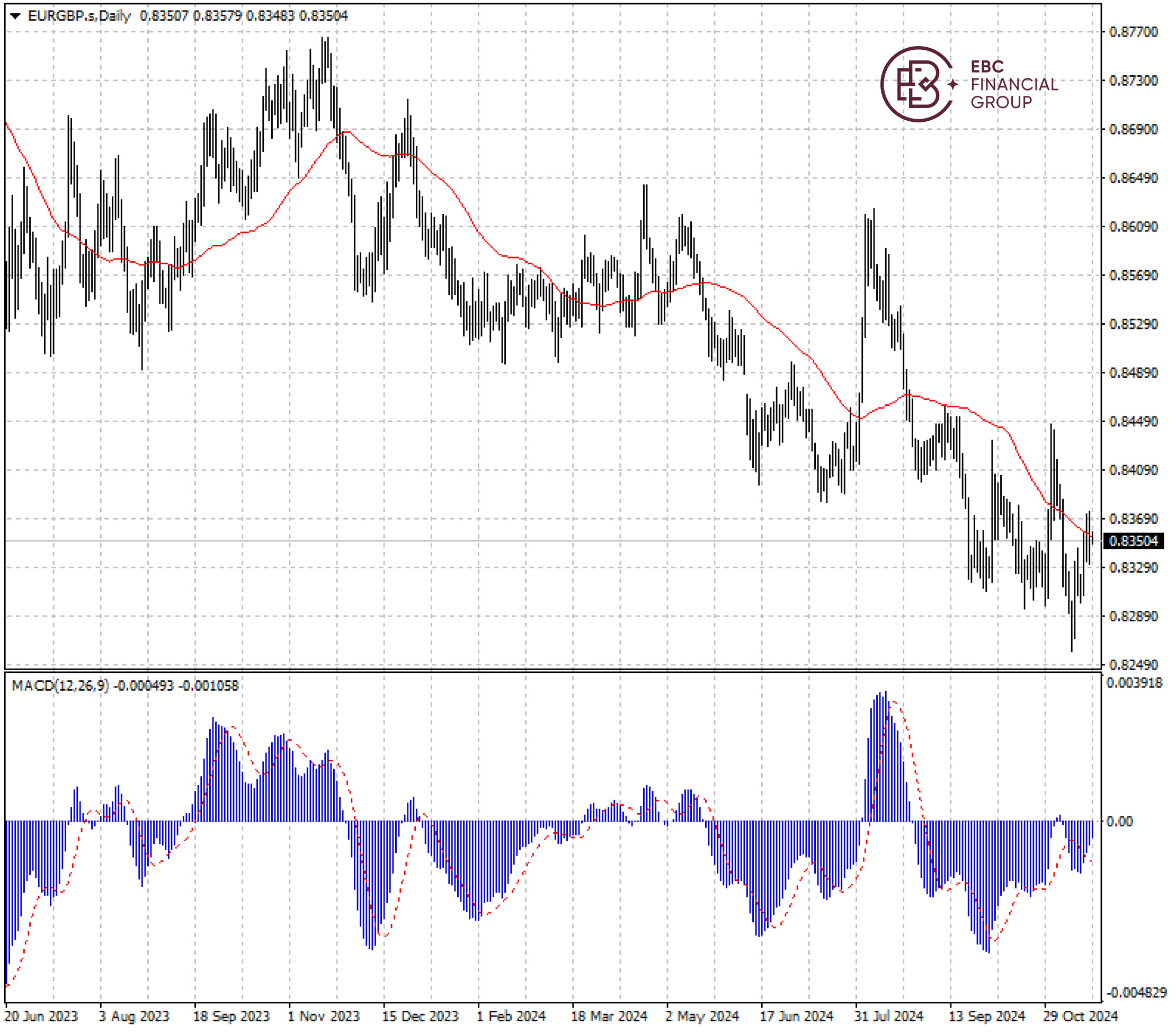

A breach of 50 SMA and MACD divergence point to more potential gains for the euro against the pound. The resistance lies around 0.8400 which is followed by 0.8440.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.