EBC Markets Briefing | More short-selling curbs send Chinese stocks higher

The FTSE China A50 and Hang Seng Index rebounded sharply on Thursday, but they were still lagging far behind other major stock markets which have set record highs so far this year.

China's securities regulator announced more curbs on short-selling and pledged tighter scrutiny of computer-driven programme trading in its latest effort to bolster a flagging stock market.

Securities re-lending would be suspended while margin requirements would be raised for short-sellers. The CSRC also urged stock exchanges to publish detailed rules to regulate programme trading

Analysts and money managers surveyed by Bloomberg are gearing up for an upbeat second half for the markets as global funds return and corporate earnings improve.

Those surveyed cite attractive valuations and potentially stronger growth. The valuation gap between Chinese stocks and the MSCI ACWI Index is near the widest since 2020, according to data compiled by Bloomberg,

Still there are plenty of reasons to be cautious. While exports have been surprisingly strong, manufacturing activity fell for a second month in June, keeping alive calls for further stimulus.

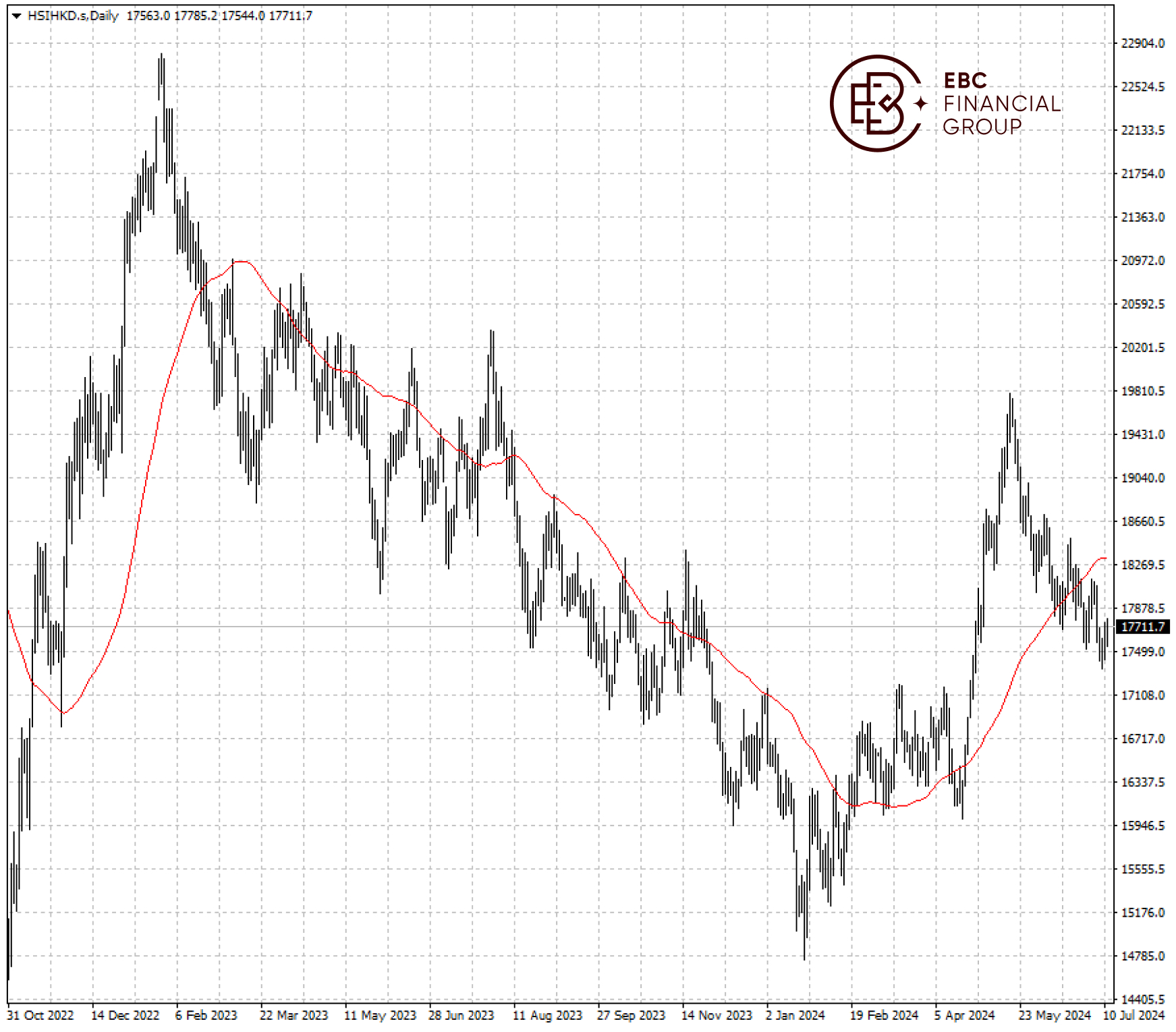

The Hang Seng Index has been in freefall after its rally was rejected by the key psychological 20,000 level in May. We expect further gains towards 50 SMA but Fed’s rate cut outlook will be the key to the longer term trend.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.