EBC Markets Briefing | Oil struggles as OPEC+ turns on the tap

Oil was close to its three-year low on Friday on uncertainties around tariffs between the US, Canada, and China, and plans by OPEC+ to raise output.

Trump exempted goods from Canada and Mexico under a North American trade pact for a month from the 25% tariffs. A source familiar with the discussions said that Trump could eliminate the tariff on Canadian energy imports.

Meanwhile, Washington will exert a campaign of maximum pressure of sanctions on Iran to collapse its oil exports and put pressure on its currency, Treasury Secretary Scott Bessent said.

US crude stockpiles rose more than expected last week amid seasonal refinery maintenance, while gasoline and distillate inventories fell due to a hike in exports, the EIA said.

The OPEC+ decided on Monday to increase output for the first time since 2022. Russia said it will seek a peace deal that guarantees its long-term security and will not cede land it has occupied.

China is pushing its oil refiners to reduce fuel output, raising new questions about demand in the largest importing nation, so the world’s drillers need buyers for the extra barrels added to the market.

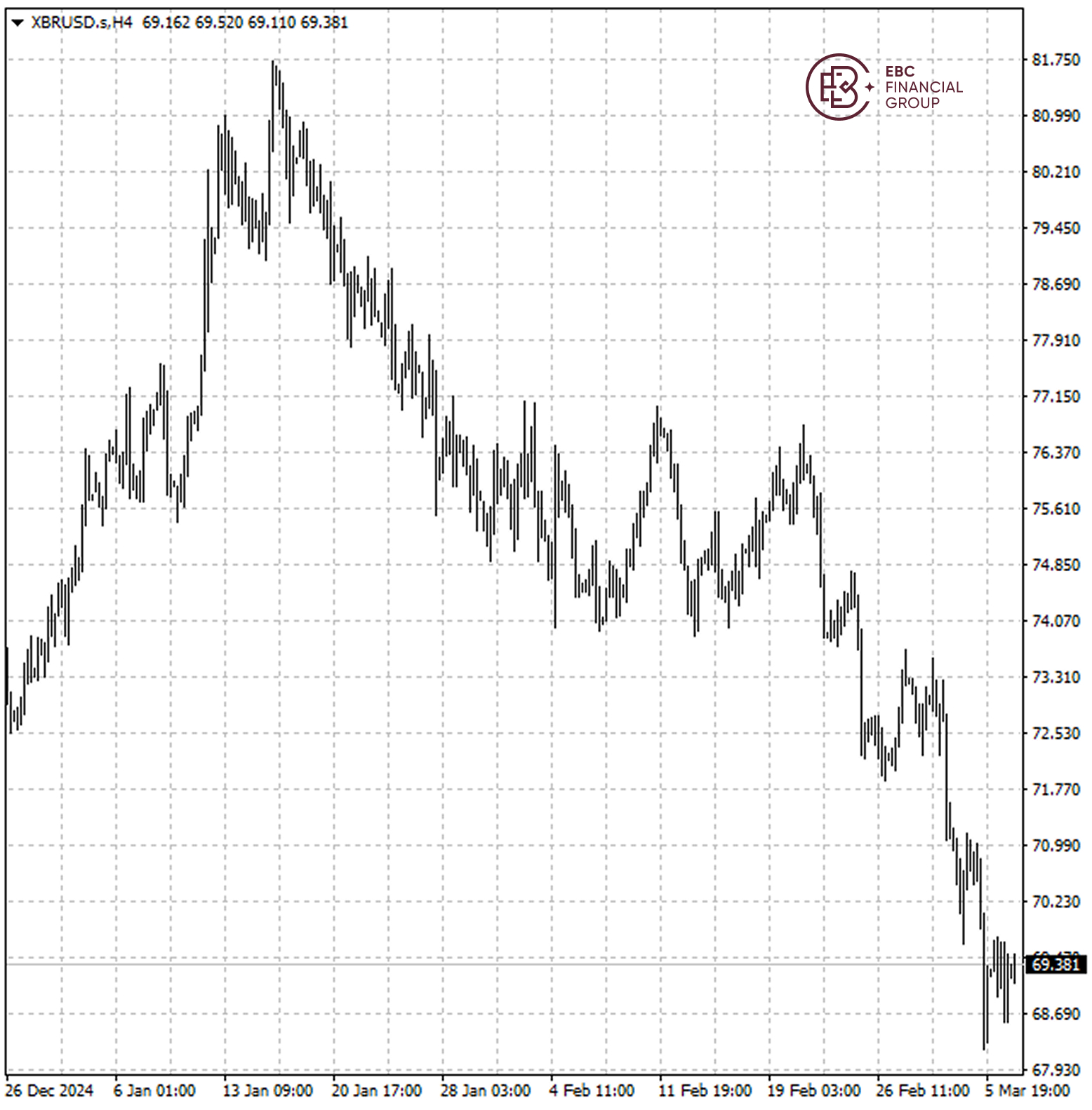

Brent crude seemingly faces a bumpy road to recovery. It may need to break above the resistance around $71 to weaken the bearish bias, otherwise a push below $68 is likely.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.