Old altcoins are back in vogue

Market picture

Bitcoin rose 2.2% over the past week, finishing near $17K. On Monday morning, a new upward momentum lifted the price to $17.2K, a new high in almost four weeks. Over the week, Ethereum has added 8% to $1310. Other top-ten altcoins gained between 3.4% (XRP) and 17.9% (Cardano). Total crypto market capitalisation, according to CoinMarketCap, rose 5.3% to $850bn for the week.

The crypto market reacted positively to favourable news for the US stock market and negative news for the dollar, climbing to a new level. Such smooth growth is reminiscent of building a solid foundation for future recovery.

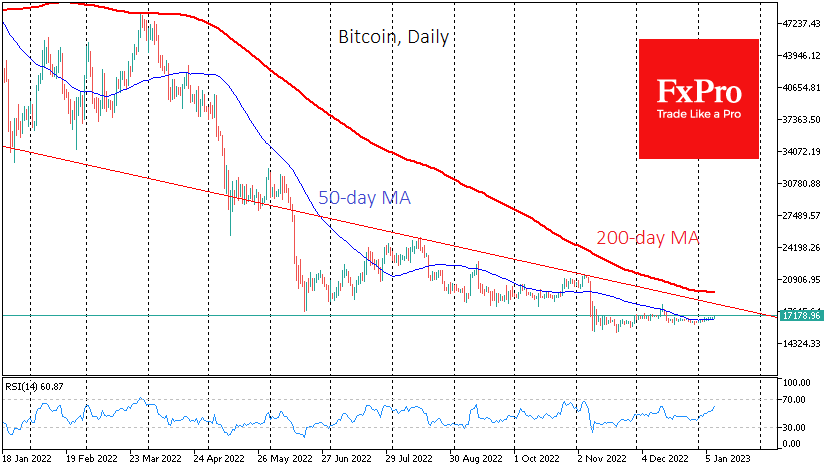

On Monday, Bitcoin draws its sixth daily growth candle, increasingly confidently trading above its 50-day average. The largest and oldest altcoins are also attracting market attention.

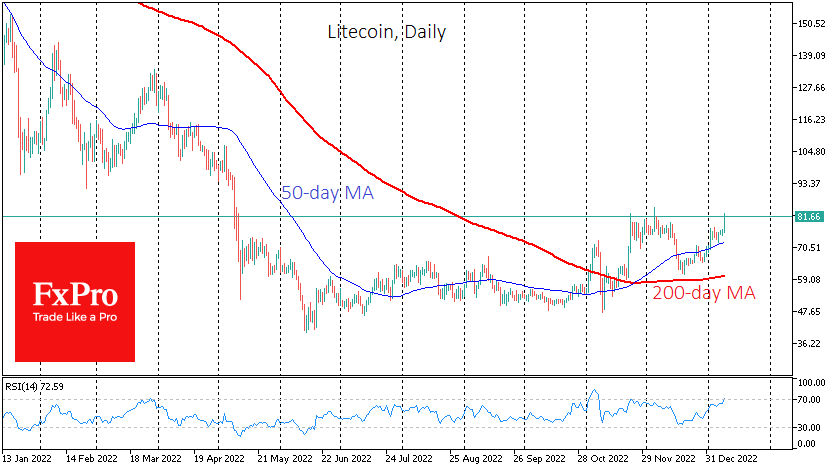

In addition to Ethereum, which is approaching December highs, Litecoin deserves attention. On Monday morning, its price jumped 7.5% to $82, which is in the region of November and December highs and near the highest levels since last May.

The interest in long-only altcoins is an essential indication of the work of long-term buyers. In Meanwhile, investors are busy assessing the most ambitious and advanced projects' vulnerability.

News background

The cryptocurrency community has heard rumours about the potential insolvency of the Huobi exchange amidst the outflow of funds, rumours of layoffs in the team and reductions in employee payments. Huobi has confirmed layoffs of around 20% of its staff. The NT exchange token has collapsed by 28% in the past month.

Justin Sun, a founder of Tron and advisor to Huobi, denied rumours of problems with the exchange, stressing that users' assets are safe. Meanwhile, CryptoQuant said that Huobi was "in a vulnerable position", while analytics service Arkham explicitly urged subscribers to withdraw funds from the site.

Digital Currency Group (DCG), troubled cryptocurrency broker Genesis's parent firm, announced the closure of its digital asset management subsidiary HQ Digital. Bloomberg reported that the SEC and other US regulators had investigated DCG.

Cryptocurrencies have no intrinsic value and should be regulated like gambling, ECB executive committee member Fabio Panetta said.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)