Soft CPI Hammers Dollar to Monthly Low

- Soft U.S. CPI reading hammered the dollar index to near $104 level while U.S. equity markets surged to all-time highs.

- Both gold and oil prices jumped on the back of a soft dollar’s strength.

- Japanese Yen appreciates against its peers despite mixed GDP data.

Market Summary

Yesterday’s U.S. inflation gauge, CPI, rattled financial markets as the dollar index (DXY) plunged nearly 1% and equity markets jumped following a reading below market consensus. The April CPI came in at 0.3%, lower than the previous month, alongside flat Retail Sales data at 0%. This downbeat economic data has fueled hopes for a sooner rate cut from the Fed.

In the commodity market, gold prices are climbing toward their next crucial resistance level at $2,400 on the back of the softening dollar, while oil prices rebounded, encouraged by upbeat weekly crude stockpile data. In the forex realm, the Australian dollar is leading the charge against the lacklustre U.S. dollar, reaching its highest level in 2024. The Japanese Yen has also appreciated against the dollar, reaching 154, marking a drop of more than 1% over the past two sessions.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.5%) VS -25 bps (8.5%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which measures the greenback against a basket of six major currencies, extended its losses aggressively following the latest U.S. inflation and retail sales data, sparking expectations of potential Federal Reserve rate cuts. The U.S. Consumer Price Index (CPI) report largely met forecasts, with the annual rate for headline inflation falling to 3.4% from 3.5%, and the core rate declining to 3.6% from 3.8%. Notably, the core inflation rate has dropped to its lowest level in three years, while headline prices appear to have stabilised.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 16, suggesting the index might enter oversold territory.

Resistance level: 104.70, 105.80

Support level: 103.95 103.15

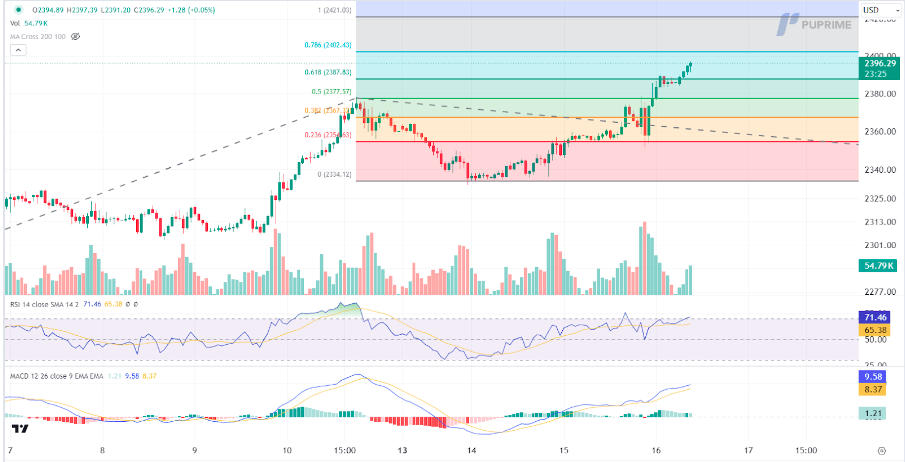

XAU/USD, H4

Gold prices extended gains, buoyed by the U.S. Dollar's depreciation following the downbeat inflation report. As U.S. Treasury yields continued to dip, the demand for dollar-denominated gold increased. Concerns over the global economic outlook, stoked by poor inflation and weak retail sales reports, have shifted sentiment towards safe-haven assets like gold, which is valued for its hedging ability against financial stress and price pressures.

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 2400.00, 2420.00

Support level: 2390.00, 2380.00

GBP/USD,H4

The GBP/USD pair has surged sharply, reaching its highest level in a month, driven by a lacklustre U.S. dollar. The dollar weakened following a soft U.S. CPI reading and sluggish Retail Sales growth, bolstering traders' bets on an imminent Fed rate cut. The dollar index has now declined to a critical liquidity zone near the 104 level, awaiting a catalyst for a potential rebound.

GBP/USD surged on the back of strong bullish momentum. The RSI has gotten into the overbought zone, while the MACD edged higher above the zero line, suggesting that bullish momentum is gaining.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2600

EUR/USD,H4

The EUR/USD pair has broken through its previous resistance and is climbing toward its highest level in two months. The euro's recent strength is driven by upbeat economic data, including improved PMI, economic sentiment, and industrial production figures. Additionally, the pair is benefiting from the softening dollar, which has weakened due to downbeat U.S. inflation data. This combination suggests the EUR/USD is trading with strong bullish momentum.

The pair is trading with strong bullish momentum suggest a bullish bias for the pair. The MACD continue to edge higher from above the zero line while the RSI has broken into the overbought zone suggest the bullish momentum remains strong.

Resistance level:1.0865, 1.0940

Support level: 1.0775, 1.0700

Dow Jones,H4

The U.S. equity market closed at record highs as cooling consumer inflation, following three months of upside surprises, boosted hopes for sooner rate cuts, sending U.S. Treasury yields sharply lower. Falling yields benefit stocks, particularly big tech and chip stocks such as Apple, Google, Meta, and Nvidia, by reducing borrowing costs and increasing the present value of future earnings.

The Dow Jones is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 78, suggesting the index might enter overbought territory.

Resistance level: 39900.00, 40505.00

Support level: 39439.00, 38565.00

USD/JPY, H4The USD/JPY pair declined sharply in the last session, returning to the 154 level for the second time in May. The Yen capitalized on the softening dollar, recording a nearly 1% slide as U.S. inflation showed signs of easing. However, the Japanese Yen's strength was hindered by the disappointing Japanese GDP, which came in at -2.0%.

The pair surpassed its consolidation range at near 155.60 levels and traded with strong downside pressure. The RSI has declined to the oversold zone, while the MACD has broken below the zero line, suggesting that bearish momentum is gaining.

Resistance level: 145.30, 155.70

Support level: 153.30, 151.90

CL OIL, H4

Crude oil prices rebounded sharply, supported by the U.S. Dollar's depreciation after the release of softer-than-expected U.S. consumer inflation data. Additionally, a larger-than-expected drop in U.S. crude inventories fueled bets on tighter global supplies in the coming months. According to the Energy Information Administration (EIA), U.S. crude oil inventories shrank by a more-than-expected 2.5 million barrels in the past week, with gasoline and distillate stockpiles also seeing unexpected draws.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 79.85, 81.35

Support level: 77.90, 75.95