Tariff relief steadies nerves on Wall Street, dollar edges up

Trump flip-flops on tariffs again

Risk appetite continued to recover mildly on Tuesday as the White House flagged more tariff concessions following Friday’s decision to exclude a range of electronic products from the reciprocal levies. In his almost daily updates from the Oval Office, US President Trump said imports of vehicles and auto parts could soon be exempt from the 25% tariffs on the sector, as he addresses concerns from the industry about higher costs.

However, any tariff break is likely to be temporary to give car manufacturers “a little bit of time” to bring production onshore. Moreover, Trump gave no details on the timeline and what would be covered from the list of exclusions.

Uncertainty remains high

It’s clear that despite the constant back-and-forth, Trump is not wavering on his ultimate goals of reviving domestic production and boosting US exports. But negotiating trade pacts with individual countries and allowing companies time to reroute supply chains and build more in the United States is a long-term mission, something that only Trump seems to envision at this stage.

For investors, this just means more uncertainty and disruption in the meantime even if everyone were to jump on board with his vision of America. With an announcement likely in the coming days on sectorial tariffs on semiconductors and after that on pharmaceuticals, uncertainty remains elevated even with Trump showing willingness to listen to industry leaders and throwing an olive branch here and there to his global counterparts.

Not much of a relief rally

Hence, the positive effect on the markets from each tariff reprieve seems to be diminishing and shares on Wall Street could only manage gains of less than 1% on Monday. In Asia, the Hang Seng and Nikkei 225 indices, which were sold heavily after Trump’s reciprocal tariffs announcement, also rose only modestly today.

European shares appear to be doing a little better, but with US futures having another lacklustre session, the relief rally is on shaky ground at the moment.

The Q1 earnings season hasn’t offered much of a lift either. The focus later today will be on the next wave of bank earnings from Bank of America and Citigroup before attention turns to Netflix’s results on Thursday.

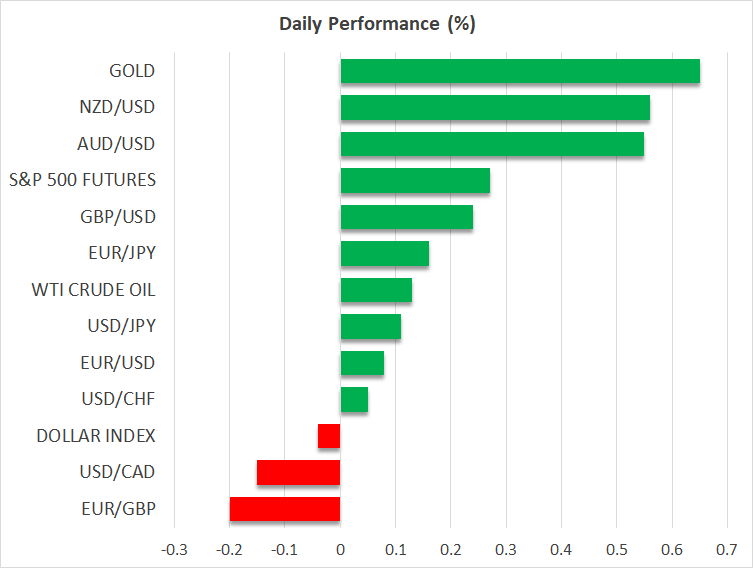

Dollar attempts to halt losing streak

The US dollar, meanwhile, was somewhat steadier on Tuesday, although it’s still at risk of extending its losing streak to a sixth session. The easing in the selloff in US Treasuries may be having some calming effect, but on the whole, the greenback’s status as the world’s reserve currency has been seriously undermined by Trump’s chaotic policies.

Treasury yields fell on Monday after Fed Governor Christopher Waller suggested that he would back rate cuts should the US economy be headed for a recession even if inflation was above the Fed’s 2% target.

Gold, on the other hand, is climbing again on the back of the fragile risk sentiment after coming under pressure yesterday. The precious metal is trading around $3,225.

Kiwi shines, loonie eyes CPI data

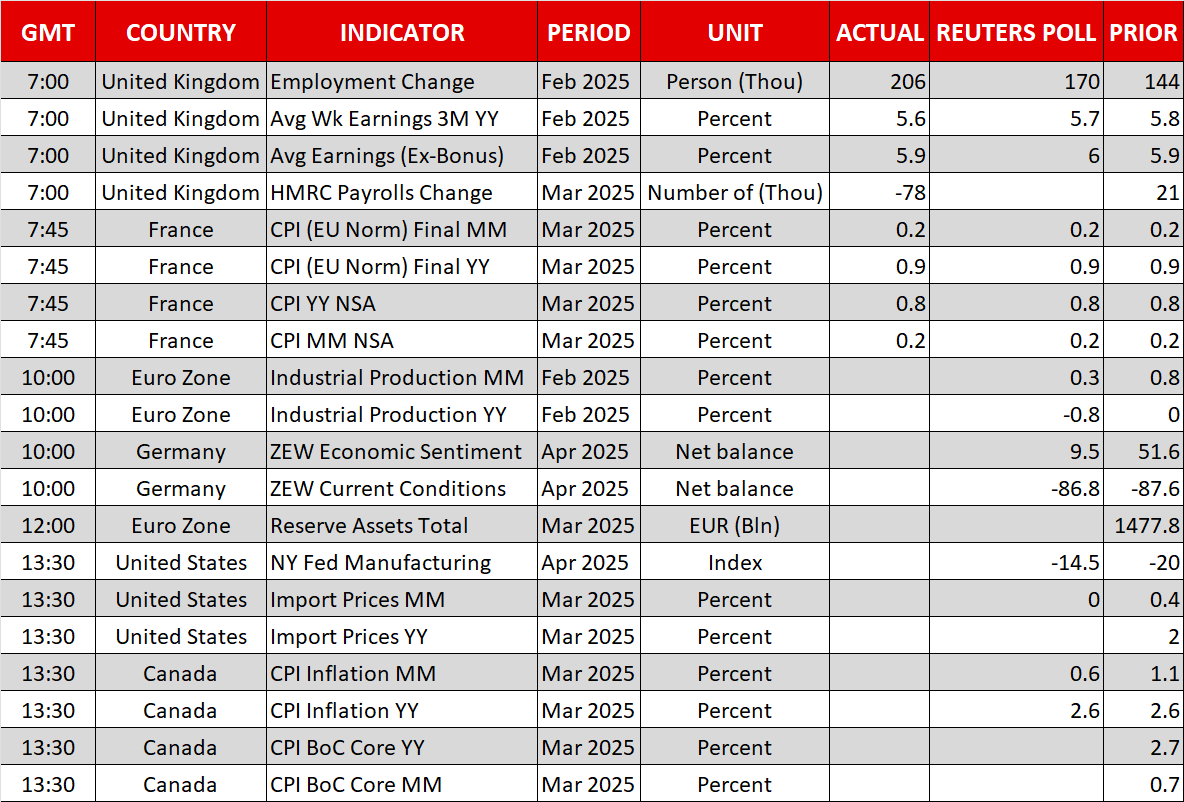

Interestingly, there’s been a shift among the winners and losers within the FX sphere. The euro’s rally has turned into caution ahead of Thursday’s ECB decision, while the pound has been playing catchup, helped by solid UK data.

The biggest surprise, however, has been the New Zealand dollar’s surge over the past week. Expectations of narrowing interest rate differentials between the RBA and RBNZ is hurting the aussie/kiwi pair and this is likely buoying the New Zealand dollar against other currencies too.

The minutes of the RBA’s April meeting published earlier today confirmed that the May meeting is a live one. The Bank of Canada is also in the spotlight as it may leave rates unchanged tomorrow, but ahead of that, Canadian CPI data will be watched today, with the loonie trading slightly firmer in the European session.

.jpg)