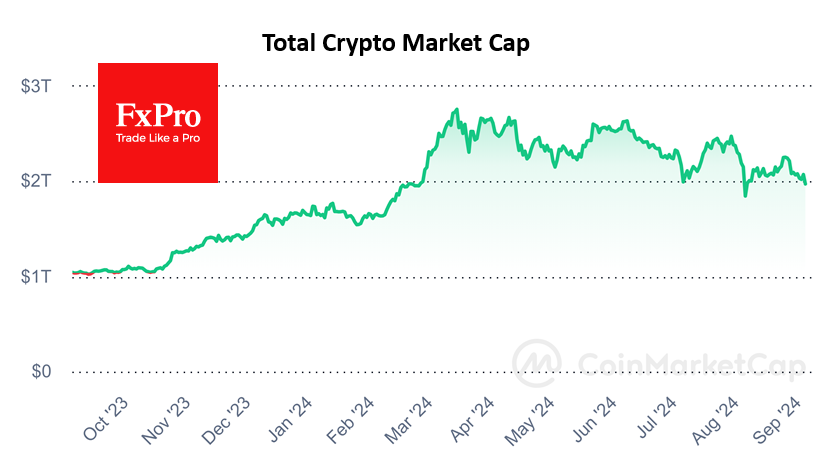

The crypto cap sinks below $2 trillion.

Market picture

Pressure on the crypto market returned on Tuesday and intensified on Wednesday morning, with capitalisation falling 4.8% to $1.98 trillion. This is below the psychological support line that attracted buyers for most of August and is the lowest level since 8 August. The nature of the decline early in the day suggests another wave of stop orders during a period of reduced liquidity, so it is too early to say that the $2 trillion support has been breached.

On Tuesday, bitcoin sellers took the initiative first on the approach to $60,000 and then at $59,000, supported by the growing sell-off in traditional markets. Bitcoin fell to $55.5K at the peak of the decline, before stabilising at $56.4K. Current levels acted as support during the May and July declines, but the trend of lower local lows sets up a reversal at $54K at the earliest.

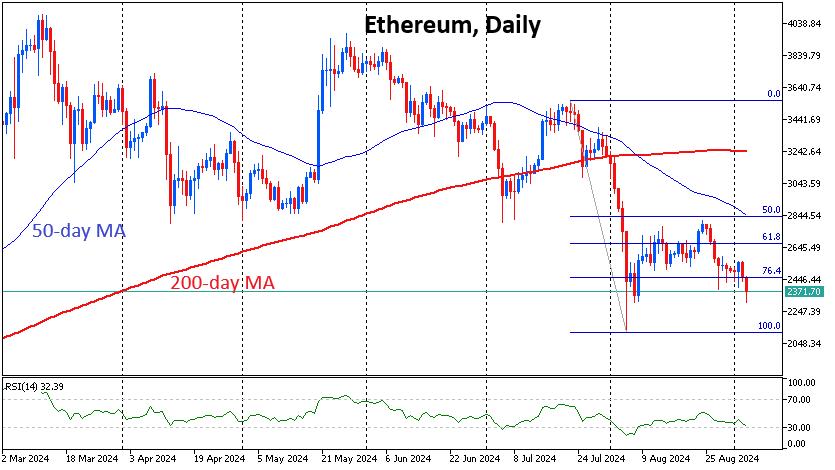

Like other altcoins, Ethereum's local high was on August 24th, two days before bitcoin reversed and interrupted a corrective rebound. Technically, a retest of the 5 August lows around $2100 is now more likely.

News background

Former BitMEX CEO Arthur Hayes attributes Bitcoin's fall to a lack of liquidity. He estimates that this situation will continue as long as the US Treasury's four-week T-bill rate is lower than the Reverse Repo Rate (RRP). Currently, the spread is minus 0.92%.

QCP Capital, citing seasonality, says it makes strategic sense to accumulate bitcoin in September and then take profits in October or near the end of the year. September has historically been negative for all asset classes, including BTC. October has been the opposite—in eight of the last nine years, the top cryptocurrency has gained an average of 22.9%.

The developers of BNB Smart Chain (BSC) reported on the growth of the ecosystem on the fourth anniversary of the launch of the core network. The number of daily active users of BSC reached 1.2 million and of opBNB 2.7 million.

The decentralised forecasting platform Polymarket has been integrated into the Bloomberg Terminal, according to its founder Shane Coplan.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)