The FOMC will take another route

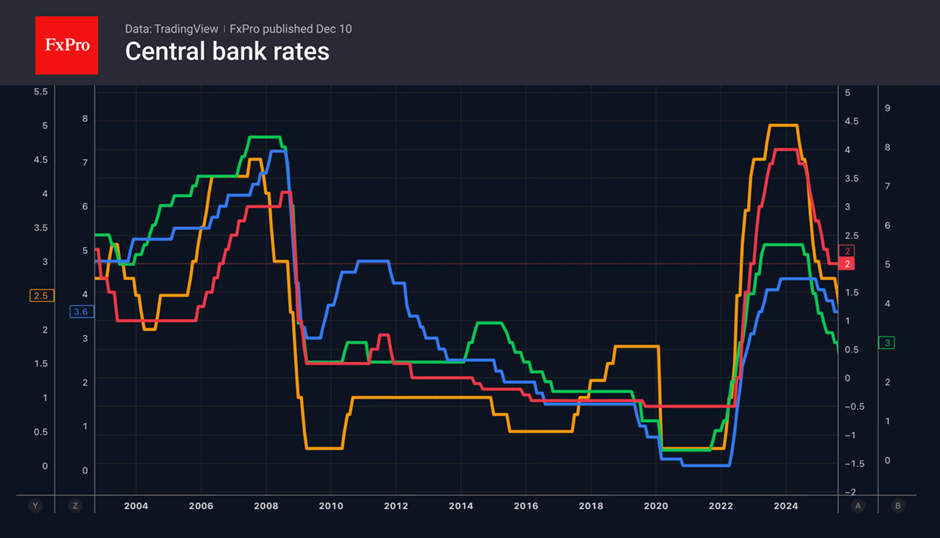

In the Foreign Exchange market, an increasing number of key central banks are ending their easing measures. The Reserve Banks of Australia and New Zealand have made it clear that they have finished their rate-cut cycles. Similar signals are expected from the Bank of Canada. The ECB feels comfortable with the current level of rates. As a result, markets are beginning to price in that the next step will be a tightening. This is leading to a strengthening of the world's major currencies against the dollar. But the latter is not giving up without a fight.

The Fed is likely to cut rates for the third consecutive time in 2025, but as in the previous two cases, the USD index risks rising. The baseline scenario is a hawkish shift, where the rate cut will be accompanied by less dovish rhetoric on the outlook and hints of a pause in policy easing. Judging by the quotes, the probability of one rate cut in 2026 is rising in the futures market, while the chances of three cuts are falling. This allows the US dollar to remain stable amid the changing policy landscape.

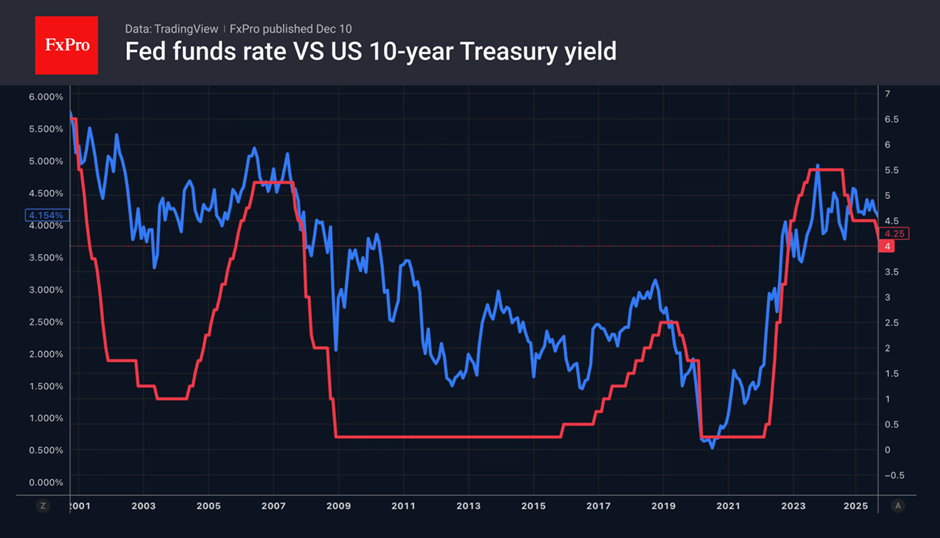

In addition, the debt market is not buying into Donald Trump's idea of flooding the FOMC with doves. Jerome Powell's resignation and the potential dismissal of Lisa Cook will allow the White House to increase the number of its people on the Committee. This could lead to aggressive rate cuts and a weaker US dollar. Unfortunately, Treasury yields are higher than in September, when the Fed resumed easing. Traders do not believe that the rate will fall below 3.25%.

The White House itself is indirectly to blame for this. Treasury Secretary Scott Bessent noted that the Fed is not a one-person show. The chairman has only one vote there, just like everyone else. The leading candidate for the position, Kevin Hassett, has stated that he does not intend to bow to political pressure. If the US president told him to lower rates and inflation accelerated to 4%, he would not do so.

Most likely, the US administration is being disingenuous. The White House aims to create the appearance of Fed independence to avoid undermining investor confidence in the USD as the primary reserve currency. However, we believe that the policies of Donald Trump and the central bank may be more aligned than ever before, which mitigates the decline in yields and increases the risks of a weakening greenback.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)