USDJPY starts the New Year with a selloff

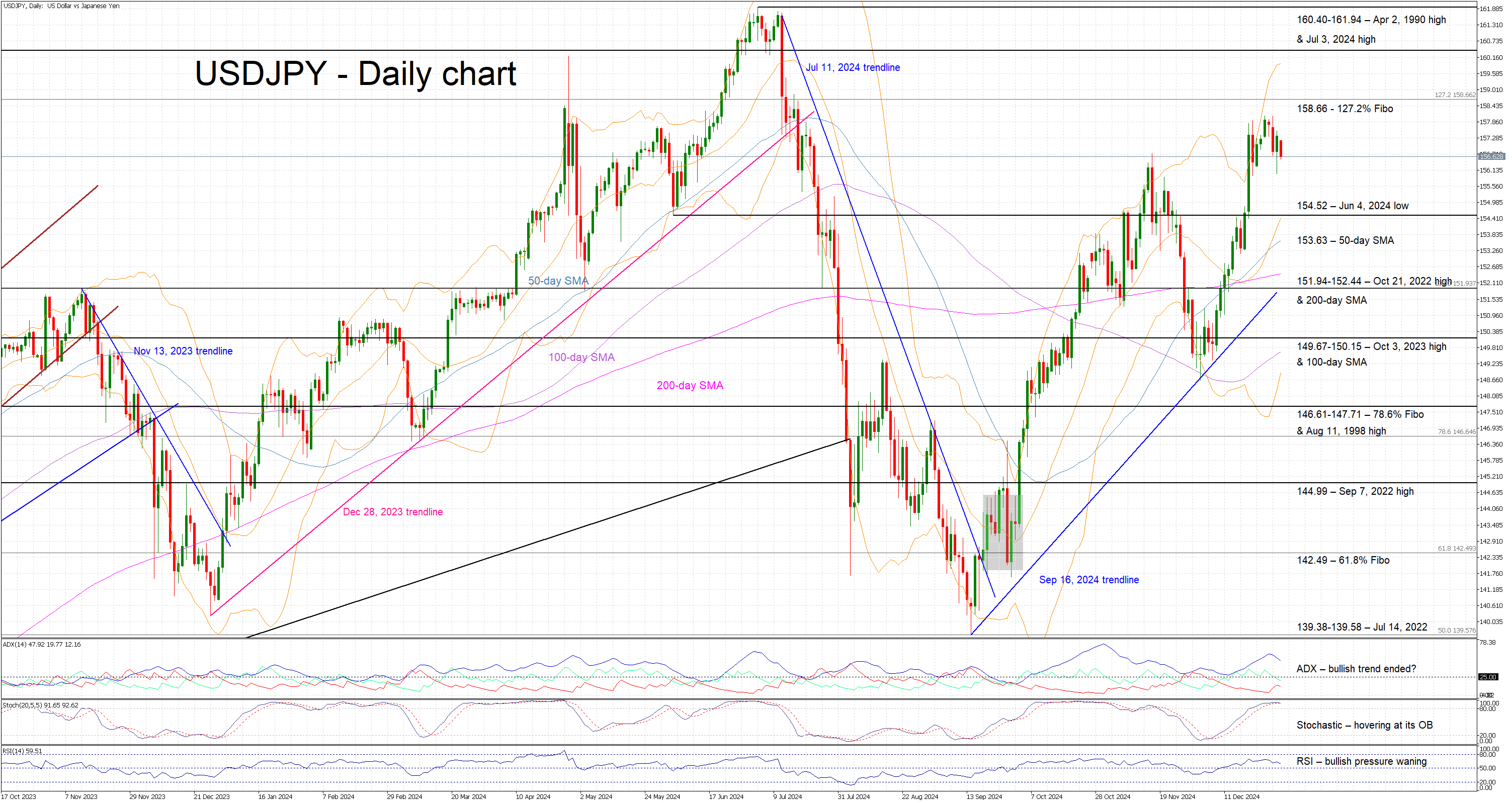

USDJPY is trading slightly lower again today, building a good distance from the key 158 area. The dollar is mixed in the New Year’s first full trading session, with the yen bulls trying to recoup part of their recent significant losses. Japanese government officials remain on red alert, ready to verbally intervene when yen resumes its sizeable underperformance. The bullish trend from the September 16, 2024 trendline is still valid, characterized by a series of higher highs and higher lows.

Meanwhile, the momentum indicators are confirming the current loss of bullish momentum. Specifically, the RSI is edging lower towards its midpoint, indicating a decent decline in bullish pressure on USDJPY. Similarly, the Average Directional Movement Index (ADX) is moving lower and thus signaling an aggressively weaker bullish trend. Interestingly, the stochastic oscillator is hovering inside its overbought territory (OB). Should it manage a bearish breakout, it could be seen as a strong bearish signal.

Should the bears remain confident, they could try to push USDJPY even lower, towards the June 4, 2024 low at 154.52. Provided they overcome the 50-day simple moving average (SMA) at 153.63, the path could then be unhindered until the 151.94-152.44 area. This region is populated by the October 21, 2022 high and 200-day SMA. A break below this area could signal that the bearish move is gaining significant traction.

On the flip side, the bulls are probably preparing for another upleg. They could try to regain market control and then push USDJPY towards the 127.2% Fibonacci extension of the October 21, 2022 - January 16, 2023 downtrend at 158.66. The bulls could then test the reaction function of both the BoJ and the Japanese Finance Ministry, by pushing USDJPY towards the 160.40-161.94 region.

To sum up, USDJPY’s rally appears to have paused, but the prevailing bullish trend remains firmly in place.