XAUUSD

Movements in forex isn't random but well define mathematical Numbers!. There are some special numbers and those are kept hidden behind the chart. Whenever you see reversals of price, then you should know 'There is a special number behind it". Once you know those numbers, then your trading success will be 90%, rest 10% will depends on Fundamental analysis.

I don't expect gold to go any higher based on the Federal reserve statement and news related to Powell and the rate. even this spike in the price is fragile. look forward for the Russia-Ukraine deal and that grey area where all the tariff wars and peace deals trump is making is for. you know; to go wrestle with china.

Gold-Algo here

looking at gold Daily, the price is stuck under a resistance that has been tested multiple of times and is still strong. however, the continuation of the higher lows and the push to the top with tighter and tighter legs seems the price insists on breaking that resistance.

on the 4H chart. the price has entered the block order and reacted to the 50% lever of the OB candle. right after is minimal reaction and move down, but with the strong push to the top and the bullish sentiment, the price might linger in the OB.

now in the 15M chart, if the price breaks the red line down and stay, can be confident and positive in a move down to 3330.

NOW, gold is very much affected and its actions are very much related to the news, China-Taiwan conflict, Russia-Ukraine war, Trump vs cook/FederalReserve news and... all these news, data, quotes, public speaks and tweets and... pushes gold up. so have it in mind that trading bearish is super risky.

GoldAlgo posted:

Gold-Algo here

looking at gold Daily, the price is stuck under a resistance that has been tested multiple of times and is still strong. however, the continuation of the higher lows and the push to the top with tighter and tighter legs seems the price insists on breaking that resistance.

on the 4H chart. the price has entered the block order and reacted to the 50% lever of the OB candle. right after is minimal reaction and move down, but with the strong push to the top and the bullish sentiment, the price might linger in the OB.

now in the 15M chart, if the price breaks the red line down and stay, can be confident and positive in a move down to 3330.

NOW, gold is very much affected and its actions are very much related to the news, China-Taiwan conflict, Russia-Ukraine war, Trump vs cook/FederalReserve news and... all these news, data, quotes, public speaks and tweets and... pushes gold up. so have it in mind that trading bearish is super risky.

Truly, challenging and exciting days are ahead.

Gold Algo here,

UBS is sticking with its gold forecast of $3,700 an ounce, while ANZ says in the short run it all comes down to the U.S. jobs report.

Both UBS’s 12-month outlook and ANZ’s short-term view hinge on the Fed cutting rates.

UBS also points out that gold should keep getting a boost from lower real rates and ongoing geopolitical tensions.UBS: “We’re still aiming for $3,700 an ounce by the end of June 2026.”(They’re also predicting the Fed will cut rates at four meetings in a row.)

ANZ, looking at the near term, says the focus is on the NFP jobs numbers:The rally in precious metals is being fueled by hopes of a September rate cut from the Fed.

“This week’s U.S. jobs report will be key to seeing if the rally has legs or not.”

#GOLD

CalendarCalculatorsNewsspreadsSentimentForex Heat MapCorrelationHomePortfolioNewsMarketSystemsCommunityReviewsBrokersProp FirmsEducationContestsDark mode Home Community Experienced Traders Gold next week Gold next week Subscribed GoldAlgoAug 29 at 13:40122 Views7 Replies GoldAlgoMember Since Aug 21, 2025 15 postsAug 29 at 13:40

Gold-Algo here

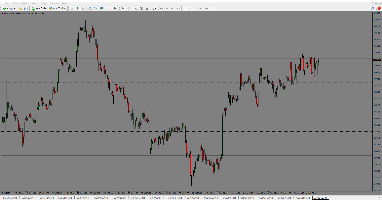

(1)

looking at gold in its daily chart, the price is stuck under a resistance that has been tested for multiple of times and still is strong however the continuation of higher lows and the push to the top with tighter and tighter legs seems the price insists on breaking that resistance.

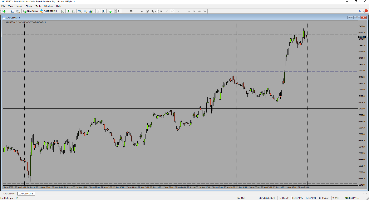

(2)

on the 4H chart, the price has entered the block ordered and reacted to the 50% level of the OB candle(s). right after is a minimal reaction and move down, but with the strong push to the top, the bullish sentiment of the market and etc..., the price will linger in the OB.

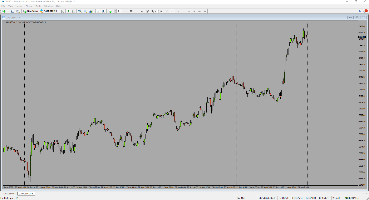

(3)

now in the 15M chart, if the price breaks the red line, we can be more confident and positive in a strong bear move to 3330.

NOW,

gold is very much affected and its actions are very much related to the news, China-Taiwan conflict, Russia-Ukraine war, Trump vs cook/FederalReserve news and... all these news, data, quotes, public speaks and tweets and... pushes gold up. so have it in mind that trading bearish is super risky.

Gold-AlgoQuote GoldAlgoMember Since Aug 21, 2025 15 postsAug 29 at 17:46

Gold-Algo here with the update,

price failed to break the red line and bounced on the opposite direction as it touched it and the price spiked upward and now again, is testing the daily resistance.

Gold-AlgoQuote forex_trader_4138832Member Since May 16, 2025 2 postsSep 01 at 21:14 (edited Sep 01 at 21:28)I think gold is in a bear trap phase now and liquidity is above recent height. institutions are carefully distributing, keeping price elevated to pressure retail shorts. Price can day/weekend gap down but will remain elevated until retail flip sentiment or capitulate on shorts. but SM can also distribute more, letting price drop, to bait more retail shorts before a final squeeze. QuoteReport GoldAlgoMember Since Aug 21, 2025 15 postsSep 02 at 10:04vovaborysko posted:I think gold is in a bear trap phase now and liquidity is above recent height. institutions are carefully distributing, keeping price elevated to pressure retail shorts. Price can day/weekend gap down but will remain elevated until retail flip sentiment or capitulate on shorts. but SM can also distribute more, letting price drop, to bait more retail shorts before a final squeeze.

for now, i keep my eyes on the NFP jobs numbers this week. The metals rally is running on the idea that the Fed will finally cut in September. And this week’s jobs data will kinda decide if that rally keeps going or fizzles out.Gold-AlgoQuote GoldAlgoMember Since Aug 21, 2025 15 postsSep 06 at 09:26Gold Algo here,

the NFP numbers came and it was bad for USD. Exactly what trump wanted and needed. now more pressure on Federal Reserve and Powell to cut the rate. With this NFP, the rally up in Gold will continue strongly. Gold-AlgoQuote forex_trader_4138832Member Since May 16, 2025 2 postsSep 06 at 14:08GoldAlgo posted:Gold Algo here,

the NFP numbers came and it was bad for USD. Exactly what trump wanted and needed. now more pressure on Federal Reserve and Powell to cut the rate. With this NFP, the rally up in Gold will continue strongly.

It seems you assume that price goes synchronized with fundamentals, which isn't the way forex is functioning. When fundamentals matter a lot and they define some core value, the market is almost never traded at its "true value" because its primarily speculative and sentimental driven. Big guys need tons of liquidity to enter/exit their positions, and their main counterparty is retail volume as its easy to predict and manipulate. And its not some conspiracy theory, although it may sound like it, its just the way markets are being historically, its their natural stance. Its something Professionals use in our everyday trading: live sentiment data, retail positioning, and liquidity pools get targeted all the time days by days, years by years. QuoteReport GoldAlgoMember Since Aug 21, 2025 15 posts23 hours agovovaborysko posted:GoldAlgo posted:Gold Algo here,

the NFP numbers came and it was bad for USD. Exactly what trump wanted and needed. now more pressure on Federal Reserve and Powell to cut the rate. With this NFP, the rally up in Gold will continue strongly.

It seems you assume that price goes synchronized with fundamentals, which isn't the way forex is functioning. When fundamentals matter a lot and they define some core value, the market is almost never traded at its "true value" because its primarily speculative and sentimental driven. Big guys need tons of liquidity to enter/exit their positions, and their main counterparty is retail volume as its easy to predict and manipulate. And its not some conspiracy theory, although it may sound like it, its just the way markets are being historically, its their natural stance. Its something Professionals use in our everyday trading: live sentiment data, retail positioning, and liquidity pools get targeted all the time days by days, years by years.

Gold Algo here,

I don't believe price is synced with fundamentals, but it is highly affected by it. the false or the true price in any market is set by the news and data and...Let's look at GOLD (which is not forex, brokers just let us trade it along with the PAIRS), why is it 3600? two wars, one in Europe, one in the Middle East, tariff conflicts, USA inflation, China buying Gold and...Since Gold is a safe asset, during times of conflict, the demand goes up, by people, institutes and even governments.About your other point, retailers vs Banks and institutes? They make 95% of the market and retailers are only 5%.I agree with some points you made, however fundamentals are heavy weights in this market, more important than technical if you ask me.Gold-AlgoQuote GoldAlgoMember Since Aug 21, 2025 15 posts22 hours agoGold Algo here,

Price shattered the 3500 with the NFP, currently sitting at 3600. Road to 4000 is clear. The only roadblock may be the US cpi and inflation data at the end of this week. Gold-AlgoQuote GoldAlgoMember Since Aug 21, 2025 15 postsa moment agoGold Algo here,

Geopolitical risks, monetary policy, government spending, and technical conditions have driven gold to continue its strong, record-breaking uptrend.

⭕️ This sharp rise in gold is mainly due to large-scale buying; yet the main factors behind gold’s rally include along side with the large scale buying are:

Expectations of Federal Reserve rate cuts, acting as a bullish catalystPolitical instability, which increases gold’s appeal as a safe-haven assetMajor buyers sustaining both physical demand and investment demandTrump’s attempts to control the Fed and push interest rates lower than they otherwise would beDisruptions in global trade order, raising economic risksDisruptions in global order related to military interventions (e.g., J.D. Vance’s comments about military action in Venezuela)Excessive government spending, putting pressure on the macroeconomic outlookTechnical analysis aligning with the bullish trend, pointing to continued parabolic movement

📌 The current trend suggests gold remains on a strong upward path, with investors closely watching major economic and political factors.

#Gold #Xauusd