Investors cut off risk ahead of NFP. Gold and Silver in focus

Investors cut off risk ahead of NFP. Gold and Silver in focus

The new week in the market had started with another round of tariff wars: Canadian dollar and Mexican Peso have taken a big hit against the greenback on Monday, after which tariffs have been put on hold: S&P 500 had corrected from the bottom, trimming losses. Nasdaq bounced back too, though tech stocks still stay under pressure.

Crypto markets have experienced massive liquidations after flash crashes for Bitcoin, Ether and other cryptocurrencies. In spite of big hopes for a new crypto era, volatility had whipsawed many speculative holders holding aggressive long bets. That’s not an unusual situation in the markets, as excessive bullish sentiment often ends up with a cold shower.

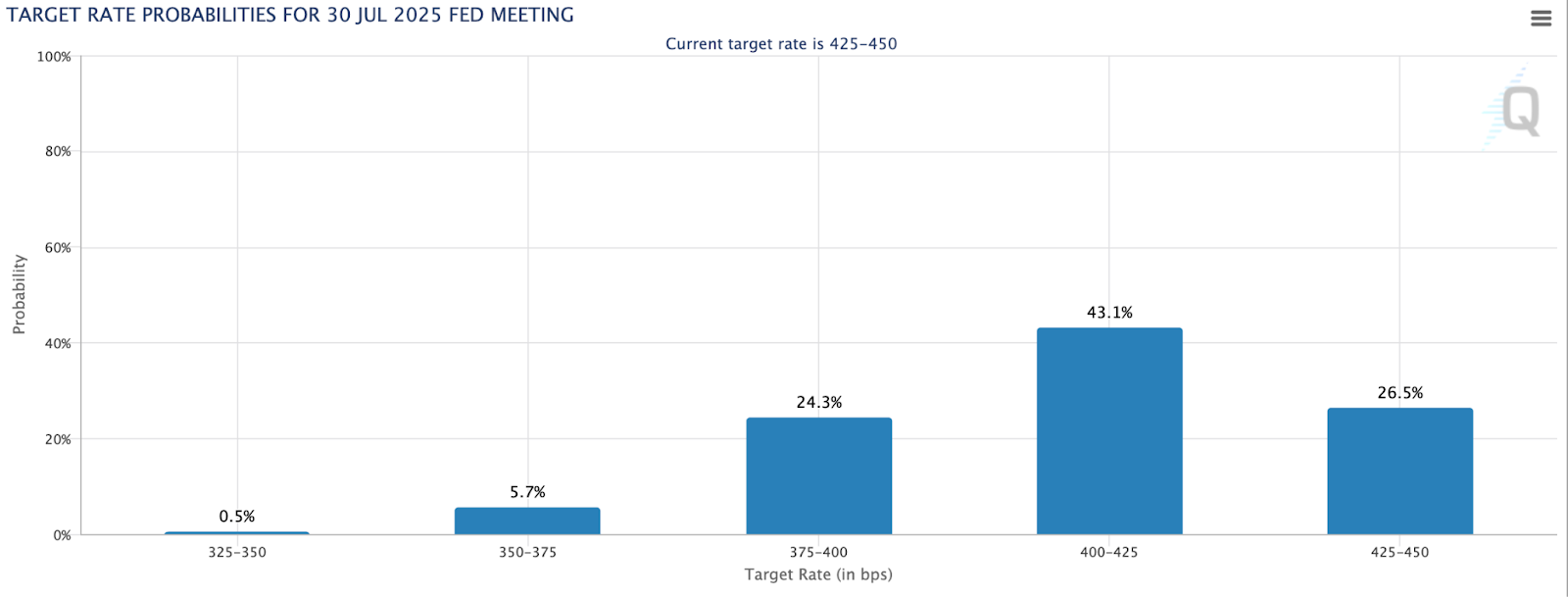

Political and “trade war” narratives remain intact, and interest rate expectations start to tighten. According to the Fedwatch tool from CME, traders expect the interest rate in the US to decline only in July 2025.

Fedwatchtool. Source: cmegroup.com

That creates a context for the stronger US dollar, which is also boosted by the “flight to safety” narrative, as investors cut off risk amid political and geopolitical uncertainty.

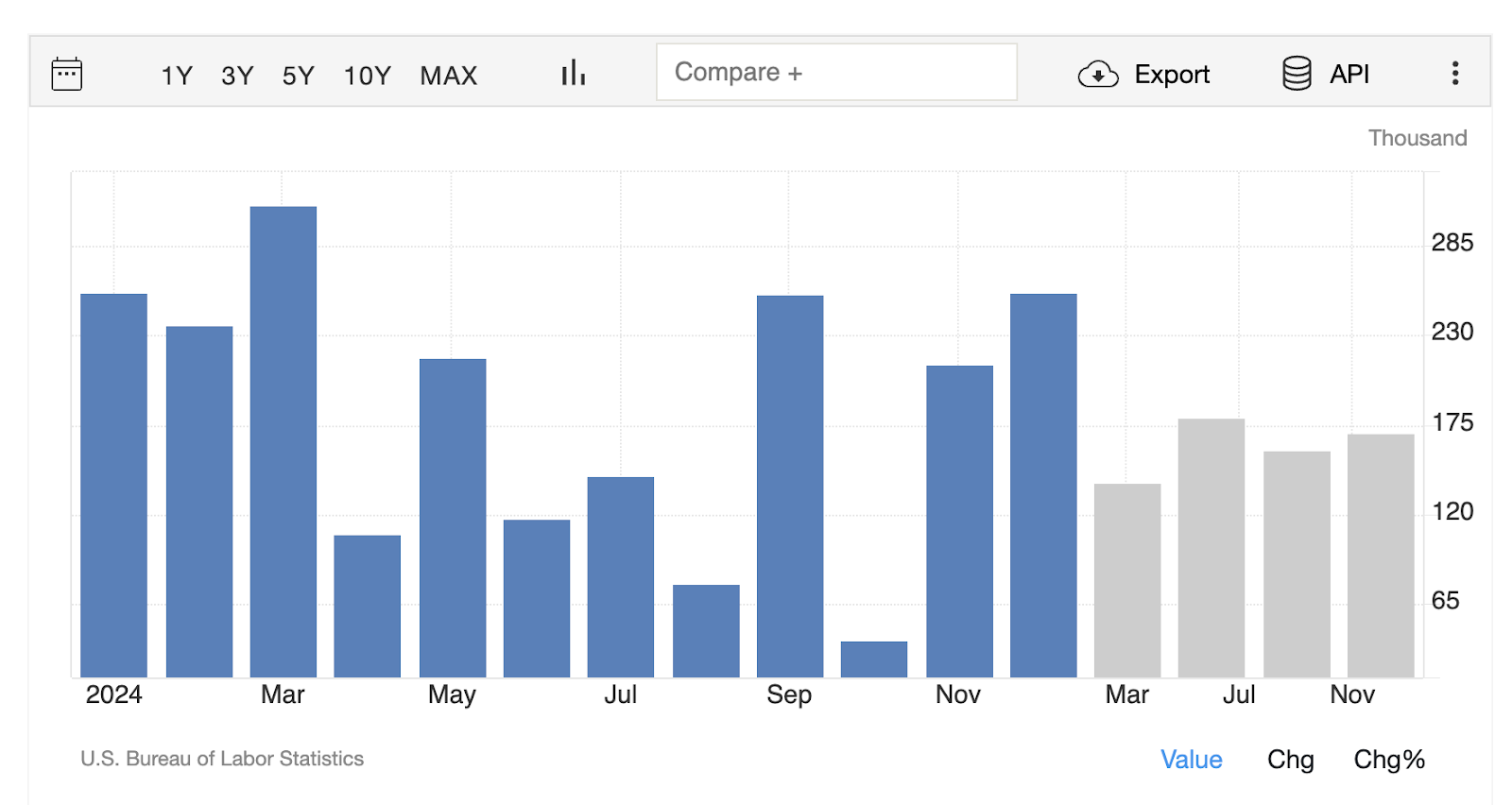

Employment in focus

This week, investors sit on the sidelines awaiting employment data to come in. Current expectations discount a little decline compared to the previous month, but any stronger than expected data may lead to another round of strengthening for the US dollar. Currently, there is no clear direction of the market, as most currency pairs are locked in consolidation areas, except for Gold, which has reached yet another all-time-high.

US employment forecast. Source: Tradingeconomics.com

Gold in focus

Gold had reached the all-time-high, prolonging the unstoppable intermediate-term price swing, which already lasted for more than a month. Is it a strong buy?

From a technical point of view, it potentially might be close to the intermediate-term high, given a remarkable strength and overall bullish sentiment. We never know exactly where the peak will be established, but opening a long trade in such a location would carry increased risk for a trader.

The usual behavior of a strong trending market is not to correct lower, but rather to lock in a consolidation and take a break from the bullish pressure.

XAUUSD, daily chart. Source: Exness.com

Silver is driven higher, but in a problematic zone

Silver produces similar dynamics, as Gold (as silver has a proven statistical correlation with gold), but it might contain hidden weakness. The price crossing the static resistance level of $32 puts silver in a problematic zone, where it can either develop a continuation of upswing (white scenario), or fall down from the peak, as displayed in the orange scenario.

Should Gold stop growing, silver might trigger a profit-taking rally (with a sharp decline), breaking its winning streak.