Altcoins take the lead in Cryptocurrency momentum

Market picture

The Crypto market cap rose 3.6% for the week to $1.21 trillion, according to CoinMarketCap. The Cryptocurrency Fear and Greed Index lost 2 points for the week to 54 (neutral). Bitcoin’s price has been virtually unchanged, and Ethereum gained 4%. Growth was driven by XPR (+60%), Solana (+32%) and several other altcoins backed by Ripple's case against the SEC.

On a weekly timeframe, Bitcoin is trending up on the highs and lows but down on the close and open. The market is simply cooling off after rallying from the 200-week average. Failure to rally from current levels opens the door for a correction to the $27 area if risk-off sentiment intensifies later in the week. Alternatively, a move above 32 would confirm the bullish sentiment and open the way to $35K in the coming weeks.

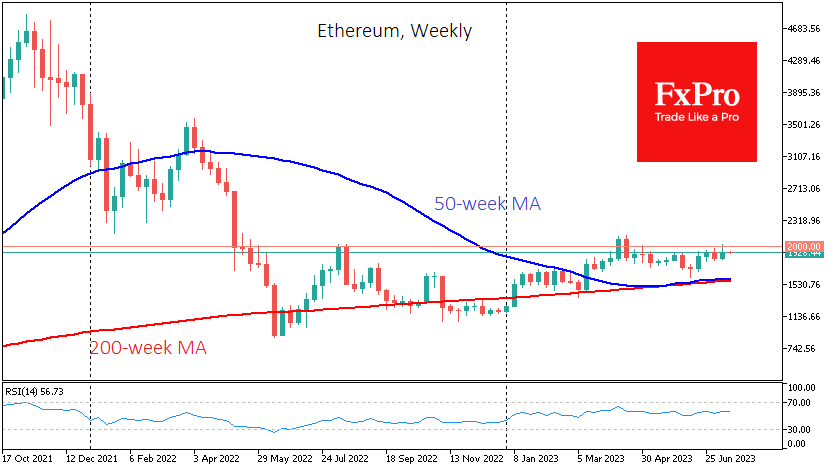

Ethereum gained 4% to $1930, encountering a sell-off above $2000 but maintaining positive momentum for the week. The performance of the largest altcoin sets the mood for a continuation of the bullish trend for the entire market. Still, we must wait for consolidation above $2000 for confirmation.

News background

Larry Fink, CEO of BlackRock, said he sees cryptocurrency opportunities. Many investors are waiting for spot bitcoin ETFs to emerge because of the minimal cost of investing. He said, "We are at the very beginning of the development of this trend in the crypto market".

Mike Novogratz, CEO of Galaxy Digital, said that a new wave of applications for spot bitcoin ETFs will help the first cryptocurrency grow significantly by the end of the year. According to him, bitcoin has become a viable investment alternative.

The US dollar's status as the world's reserve currency will be in jeopardy if Congress does not pass the Stablecoin Act, said Circle CEO Jeremy Allaire.

Major exchanges Binance and Coinbase said they plan to resume trading the XRP token for US users following Ripple's victory in a case against the US Securities and Exchange Commission (SEC).

Ripple Labs' general counsel commented on the court's ruling that the XRP token is no longer considered a security in the secondary market. He said, "Now the SEC will not be able to control cryptocurrencies fully".

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)