EBC Markets Briefing | Sterling weakens on rising debt pressure

Sterling fell to a two-week low on Monday, pressured by domestic headwind. Currency moves in the early Asia session were more subdued following last week's monetary decisions.

The BOE voted to keep interest rates on hold on Thursday, as it weighs up sticky inflation with an uncertain growth outlook. Deutsche Bank expects to see a slightly longer pause when it comes to the next rate move.

The latest monthly growth data showed there was zero growth in July, compared with the previous month. The manufacturing sector, in particular, experienced its sharpest monthly fall in a year.

Britain's borrowing has shot past the official forecasts that underpin tax and spending plans, compounding the already big challenge facing finance minister Rachel Reeves in her proposed budget.

PwC UK economist said the government faced a combination of higher debt costs, hot inflation, opposition to spending cuts and the risk of an OBR downgrade to its growth forecasts.

Employers have expressed concern that they might again bear the brunt of tax hikes in November, having been hit with higher social security bills in Reeves' first budget last year.

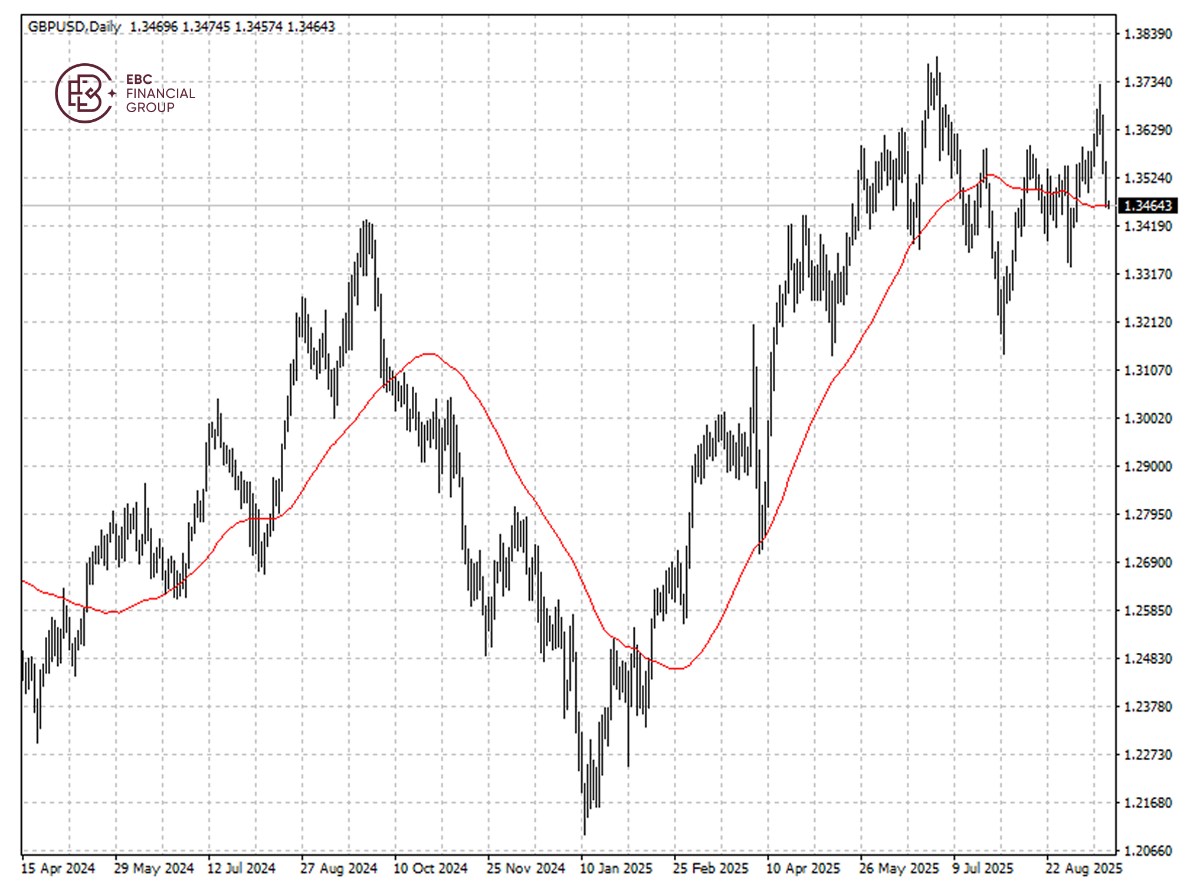

The pound is around the 50 SMA which may provide support. If the dip ends there, it will likely rally towards the 1.3560 area.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.