AUD/USD surges within critical levels

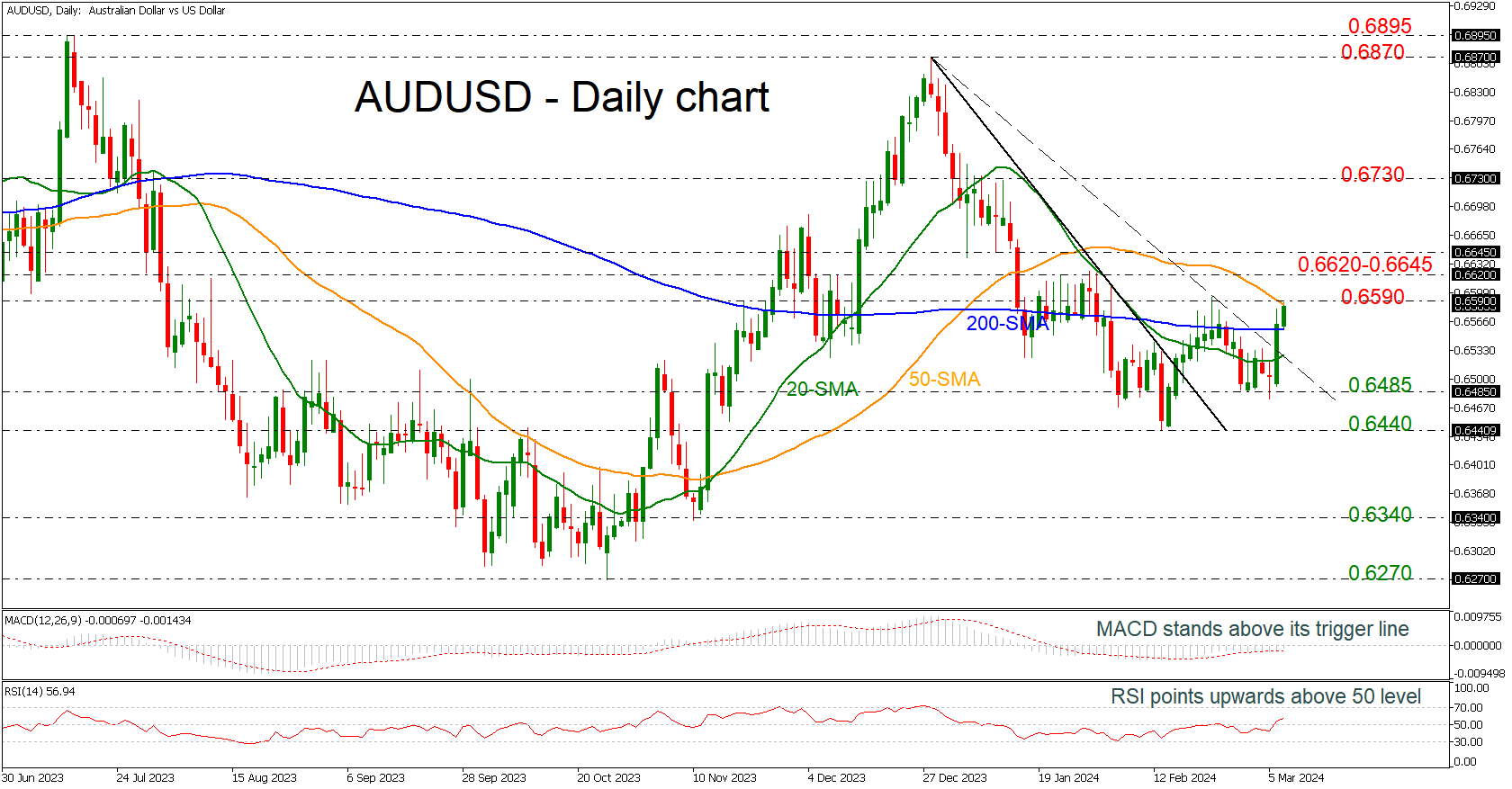

AUD/USD has been experiencing a new up leg over the last couple of days, surpassing above the short-term downtrend line and the flat 200-day simple moving average (SMA), meeting the 50-day SMA near the 0.6590 critical resistance.

Technically, the MACD oscillator is standing above its trigger line in the bearish region, while the RSI is pointing upwards above the neutral threshold of 50.

If the market manages to overcome the key region of 0.6590 then it may open the way for more bullish actions towards the 0.6620-0.6645 area ahead of the 0.6790 barricade, taken from the highs on January 9.

On the flip side, a decline beneath the 200- and the 20-day SMAs may increase speculation of a neutral phase, hitting the 0.6485 and 0.6440 support lines. Even lower, the market may switch to a strongly negative one, diving towards the 0.6340 bar.

All in all, AUD/USD is looking neutral in the near-term timeframe, but the break above the downtrend line may add some optimism for traders for some increases.

.jpg)