USD Strength Returns as Yen Slides, Metals Ease | 7th October 2025

Markets React to Dollar Rise

The US Dollar regained traction on Tuesday, climbing against major peers as renewed demand for safe-haven assets and firmer Treasury yields supported the greenback. Commodities and risk-linked currencies eased slightly, with silver retreating below $48.50 and the Japanese yen weakening to multi-month lows. Meanwhile, OPEC+’s modest production hike helped stabilize oil prices, while traders remained cautious amid ongoing uncertainty surrounding the US government shutdown.

Silver Price Forecast (XAG/USD)

Current Price and Context

Silver (XAG/USD) slipped below the $48.50 level after briefly touching a fresh 14-year high earlier this week. The renewed strength in the US Dollar and profit-taking from recent highs have led to modest downside pressure, though the broader uptrend remains intact.

Key Drivers

Geopolitical Risks: Ongoing US government shutdown uncertainty and Middle East tensions are supporting safe-haven demand.

US Economic Data: Delayed US data releases due to the shutdown are keeping volatility contained.

FOMC Outcome: Markets still expect a potential rate cut before year-end, underpinning long-term silver demand.

Trade Policy: Stable global trade tone limits additional upside momentum.

Monetary Policy: A softer Fed outlook remains broadly supportive for precious metals.

Technical Outlook

Trend: Silver remains in a strong bullish channel despite short-term pullback.

Resistance: $49.20, followed by $50.00 psychological barrier.

Support: $47.60, then $46.80.

Forecast: A rebound toward $49.00 is likely if buyers reemerge above $48.00.

Sentiment and Catalysts

Market Sentiment: Traders remain bullish, viewing dips as opportunities amid global policy uncertainty.

Catalysts: Fed commentary, inflation trends, and any new shutdown developments will guide near-term moves.

WTI Crude Oil Forecast (WTI/USD)

Current Price and Context

WTI crude oil found buyers near $61.50 after OPEC+ confirmed a modest production hike of 137,000 barrels per day for November. The move eased oversupply concerns and encouraged short-term buying interest, though demand-side worries remain.

Key Drivers

Geopolitical Risks: Middle East supply disruptions remain a lingering risk for oil prices.

US Economic Data: Softer US demand expectations limit upside momentum.

FOMC Outcome: Rate cut expectations could support energy demand outlook later this quarter.Trade Policy: No major changes in trade conditions, maintaining global oil flow stability.

Monetary Policy: A more accommodative global stance supports long-term energy demand.

Technical Outlook

Trend: Neutral to mildly bullish in the short term.

Resistance: $62.20, followed by $63.00.

Support: $60.80, then $59.90.

Forecast: WTI may consolidate between $61–63, awaiting fresh catalysts from OPEC or US data.

Sentiment and Catalysts

Market Sentiment: Slightly bullish amid supply restraint optimism.

Catalysts: OPEC+ compliance data, US inventory figures, and demand forecasts from the IEA.

Australian Dollar Forecast (AUD/USD)

Current Price and Context

The Australian Dollar steadied after earlier losses, holding near 0.6420 as the US Dollar regained ground. Traders are balancing weak Westpac Consumer Confidence data against steady global risk appetite and the ongoing US fiscal standoff.

Key Drivers

Geopolitical Risks: US shutdown uncertainty continues to cap AUD upside.

US Economic Data: Delays in major data releases have reduced volatility.

FOMC Outcome: Fed rate cut expectations may lend support to risk currencies like the AUD.

Trade Policy: Stable China–Australia trade ties aid sentiment.

Monetary Policy: RBA remains cautious amid weak domestic growth signals.

Technical Outlook

Trend: Sideways with mild downside bias.

Resistance: 0.6460, then 0.6500.

Support: 0.6380, followed by 0.6330.

Forecast: Consolidation likely; a break above 0.6460 could trigger recovery toward 0.6500.

Sentiment and Catalysts

Market Sentiment: Neutral to slightly bearish amid USD rebound.

Catalysts: Chinese economic releases, RBA statements, and global risk sentiment shifts.

Japanese Yen Forecast (USD/JPY)

Current Price and Context

The Japanese Yen weakened to its lowest level since early August, trading around 149.00 as markets bet on further fiscal easing measures in Japan. The USD’s modest recovery also pressured the Yen, highlighting the BoJ’s policy divergence from global peers.

Key Drivers

Geopolitical Risks: Limited safe-haven flows as risk sentiment improves.

US Economic Data: Delays in data keep USD gains modest.

FOMC Outcome: Rate-cut bets may cap further USD/JPY upside.

Trade Policy: Japan’s exports remain steady, providing limited currency support.

Monetary Policy: BoJ’s dovish stance and possible fiscal stimulus weigh on the Yen.

Technical Outlook

Trend: Bullish bias persists.

Resistance: 149.30, then 150.00.

Support: 148.30, then 147.70.

Forecast: Continued Yen weakness likely unless BoJ signals policy tightening.

Sentiment and Catalysts

Market Sentiment: Bearish for JPY as traders expect prolonged policy divergence.

Catalysts: BoJ commentary, Japanese inflation data, and shifts in US Treasury yields.

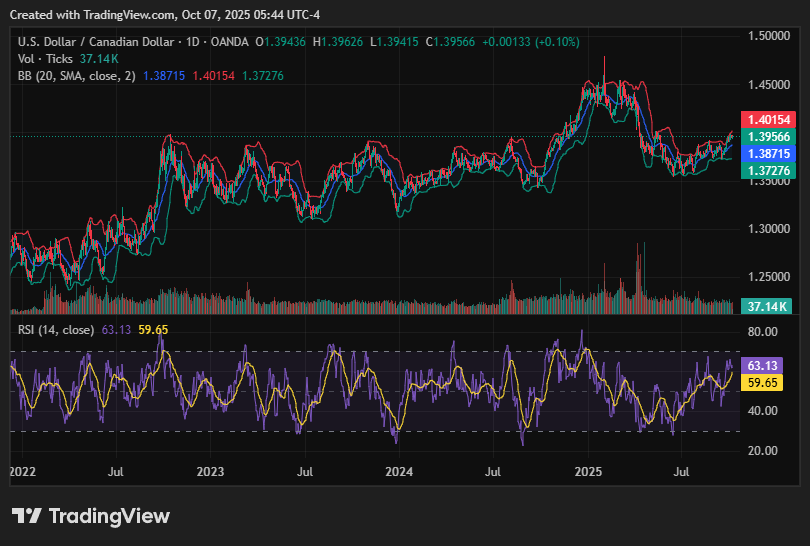

USD/CAD Forecast

Current Price and Context

USD/CAD climbed toward 1.3950 as the US Dollar extended its rebound, aided by softer crude prices and dovish expectations for the Bank of Canada. The pair maintains a firm tone amid cautious global sentiment.

Key Drivers

Geopolitical Risks: Energy market volatility keeps CAD direction uncertain.

US Economic Data: Shutdown-delayed releases hinder momentum clarity.

FOMC Outcome: Possible Fed rate cuts later this year could temper USD strength.

Trade Policy: Stable North American trade ties offer support for CAD resilience.

Monetary Policy: BoC’s dovish tone continues to pressure the Loonie.

Technical Outlook

Trend: Uptrend remains intact.

Resistance: 1.3975, then 1.4000.

Support: 1.3880, then 1.3820.

Forecast: Room for modest upside toward 1.4000 unless oil stabilizes above $63.

Sentiment and Catalysts

Market Sentiment: Bullish USD bias prevails amid global uncertainty.

Catalysts: Crude oil trends, BoC communications, and upcoming Fed statements.

Wrap-up

Market sentiment remains fluid as investors balance renewed dollar strength against shifting global policy expectations. With key US inflation data and central bank commentary ahead, volatility across commodities and currencies is likely to persist. Traders will continue to watch the interplay between fiscal risks, yield movements, and global demand signals for fresh market direction.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!