Crypto market rests after recovery

Crypto market rests after recovery

Market Picture

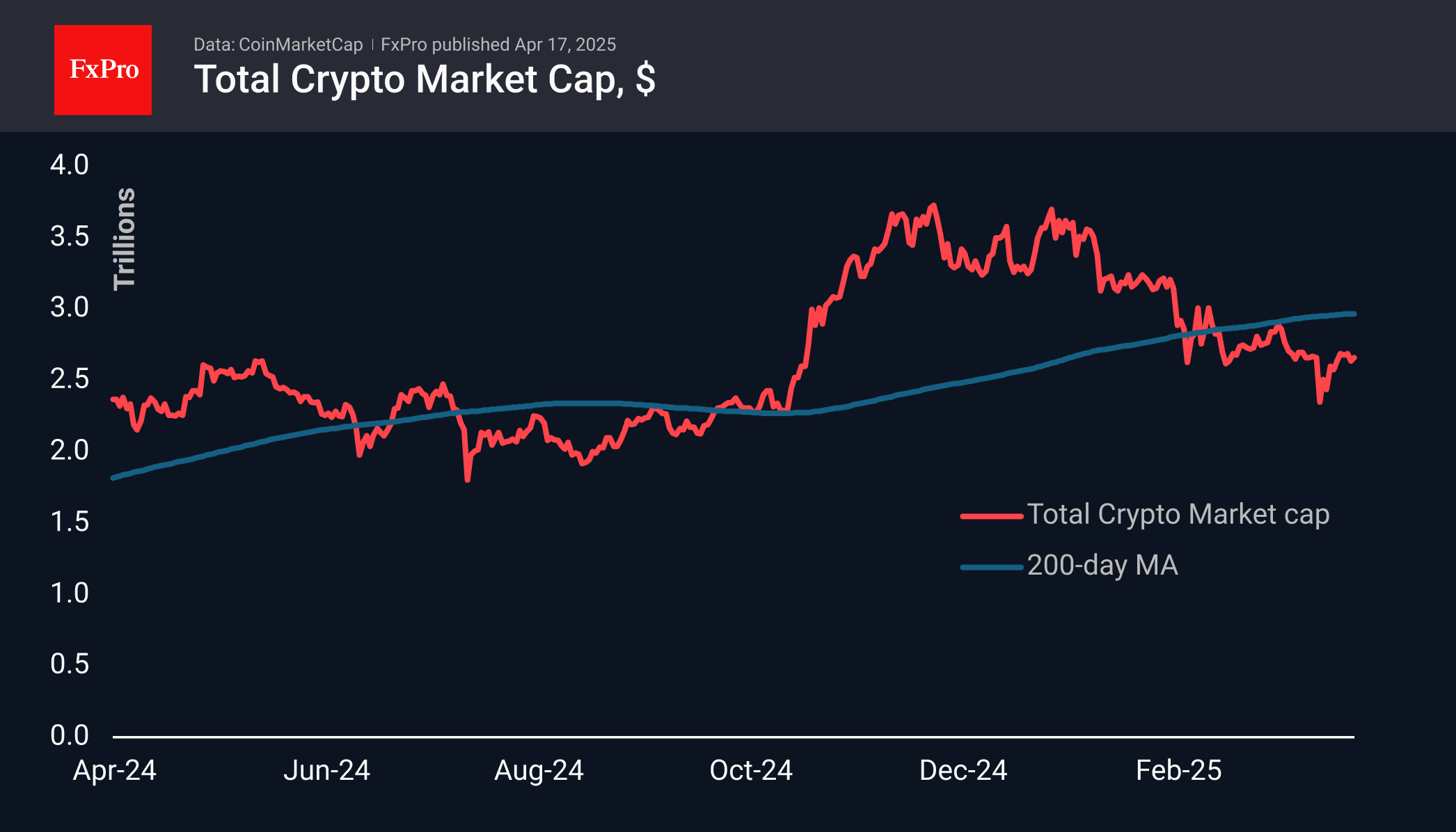

Over the past seven days, the cryptocurrency market went from falling to $2.5 trillion to rising to $2.71 trillion but later corrected to the $2.65 trillion area. The recovery momentum lost strength near the previous consolidation zone. The market has so far failed to overcome the descending resistance line formed from the peak on the US Presidential Inauguration Day.

The sentiment index is gradually moving out of the ‘extreme fear’ zone and consolidating in the ‘fear’ area. This is a good signal that the correction may be over, but there are still not enough catalysts for a full-fledged rally.

Bitcoin continues to trade within a relatively narrow range of $83K–$86K, hovering around the 50-day moving average but still struggling to break above the 200-day. On the daily chart, the RSI is showing a bullish divergence, with a higher low on the indicator despite a lower local price low.

News Background

Gold continues to update records amid the escalation of the trade war, while bitcoin is not yet demonstrating the behaviour of a ‘protective asset,’ QCP Capital noted. A similar trend is also observed for the US dollar and US government bonds.

Standard Chartered predicts that by 2028, the capitalisation of stablecoins will increase more than eightfold, up to $2 trillion. The growth driver will be the expected adoption of the GENIUS Act in the US, which will create a regulatory framework for the stablecoin sector.

The state of Oklahoma (USA) rejected a bill to create a strategic bitcoin reserve (SBR). The document did not receive approval in the Senate's profile committee, and the decision was made with a minimum margin of six votes against five.

According to Reuters, local authorities in China are using private companies to sell confiscated cryptocurrencies to supplement the budget. Bitbo estimates the number of bitcoins in the possession of Chinese officials at 194,000 BTC (~$16.3bn).

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)