Dollar and equities rip higher after stellar US jobs data

Dollar shines after impressive jobs data

Another blockbuster employment report highlighted the resilience of the US economy on Friday, pouring cold water on bets of imminent Fed rate cuts. The American economy added 353k jobs in January, nearly double what economists had projected, while last month’s figures were also revised higher.

In another sign of strength, wage growth accelerated to hit 4.5% in yearly terms, fueling concerns that the war against inflation is not quite over. Markets interpreted the stunning jobs numbers as another sign the Fed won’t begin the rate cutting process in March, reinforcing the latest messages from Chairman Powell.

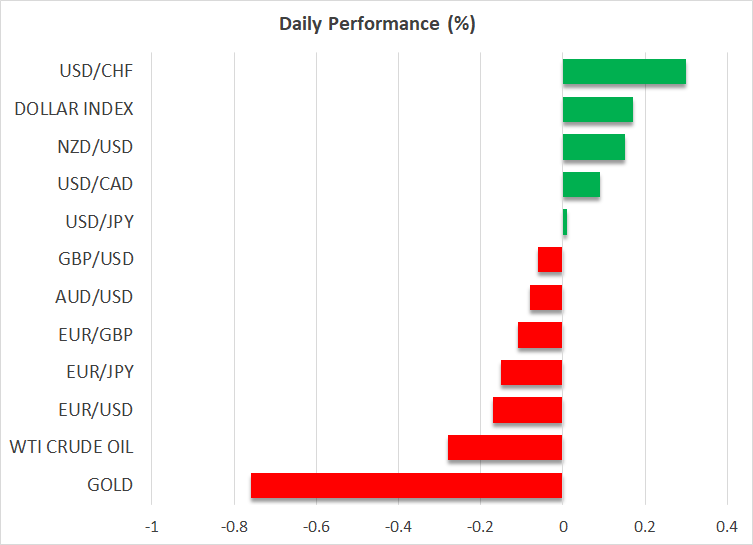

The probability of a rate cut in March fell to 15% in the aftermath. For the entire year, less than five rate cuts are now baked into the cake, down from nearly six before this dataset. With traders pricing in a ‘higher for slightly longer’ path for interest rates, the US dollar powered higher, riding the wave of rising yields.

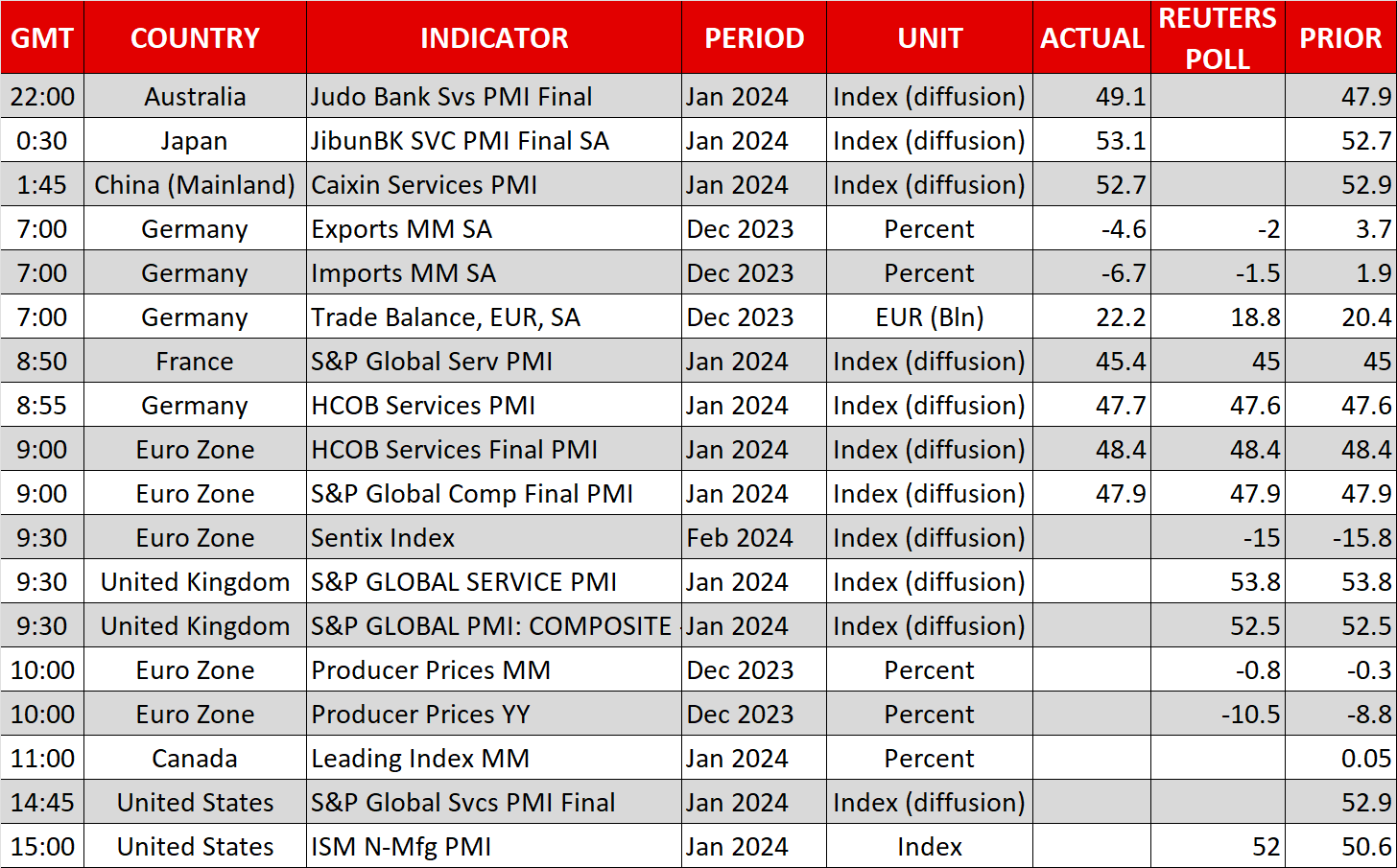

Losing the most against the dollar was the Japanese yen, which fell almost 1.5% on Friday as the rift between US and Japanese yields grew wider. The next event for the dollar will be the release of the ISM services survey for January later today. More encouraging signals on the US economy from this leading indicator could completely shut the door for a March rate cut, adding fuel to the dollar’s rally.

Stocks hit fresh records

Shares on Wall Street closed at new record highs last week, as signs of a robust labor market and reassuring earnings from the tech sector helped the market brush aside the threat of delayed rate cuts.

The S&P 500 erased an early decline following the nonfarm payrolls numbers, and instead climbed to hit new unchartered heights with some help from stellar earnings by Amazon (+7.9%) and Meta Platforms (+20.3%).

Equity markets are currently enjoying the best of all worlds. The US economy and consumer spending remain resilient, the Fed will ride to the rescue by cutting rates if growth falters, and in the meantime, investments in artificial intelligence are juicing up earnings. No wonder then that stock markets just won’t stop rallying, despite valuations being so stretched.

Even some warnings from Donald Trump that he could impose tariffs exceeding 60% on Chinese goods if he is elected in November did not dent the cheerful tone in the markets. Investors might view such threats as inflated political rhetoric considering that even during the 2017 trade war, Trump did not go overboard with tariffs, minimizing the pain on US consumers.

Oil drops, ISM data and RBA next

Crude oil prices came crashing down last week, unable to capitalize on solid economic data, the cheerful tone in equities, or the latest attacks by the United States against Iran-backed targets in Iraq and Syria.

Oil’s inability to rally in the face of seemingly positive developments underscores the larger concerns among investors, such as OPEC+ supply cuts not being extended beyond March as the cartel moves to defend its market share from soaring US production. Coupled with risk of demand weakness from China as its property sector continues to deleverage, oil buyers might remain cautious for some time.

Looking ahead, the ISM services survey will be the main event today before the spotlight shifts to the Reserve Bank of Australia, which will announce its decision early on Tuesday. Incoming data has been on the weaker side lately with inflation slowing sharply and the labor market losing jobs, so there’s a risk the RBA abandons its tightening bias, leaving the aussie vulnerable to another selloff.

.jpg)