EBC Markets Briefing | Yen lower Washington urges peace

The yen dipped on Monday ahead of a key meeting between Trump and Zelenskiy, while investors also looked ahead to the Fed's Jackson Hole symposium for more policy clues.

Japan's economy expanded 0.3% in Q2 from the previous first three months, outpacing forecasts despite tariff headwinds. The increase was mainly attributed to resilience in exports.

Three-quarters of Japanese firms have a favourable view of the latest trade deal after Tokyo managed to draw some concessions from Trump, a Reuters survey showed on Thursday.

Household spending rose in June at a slower rate than market participants had expected as higher prices particularly for food items discouraged purchases and added pressure to broader consumption trends.

The BOJ cautioned about a slowdown in overseas economies, as well as a decline in domestic corporate profits. Economic revitalisation minister Ryosei Akazawa is pushing for bigger QT.

While core inflation has exceeded target for well over three years, potentially giving the bank leeway to raise interest rates amid lacklustre consumption and geopolitical tensions.

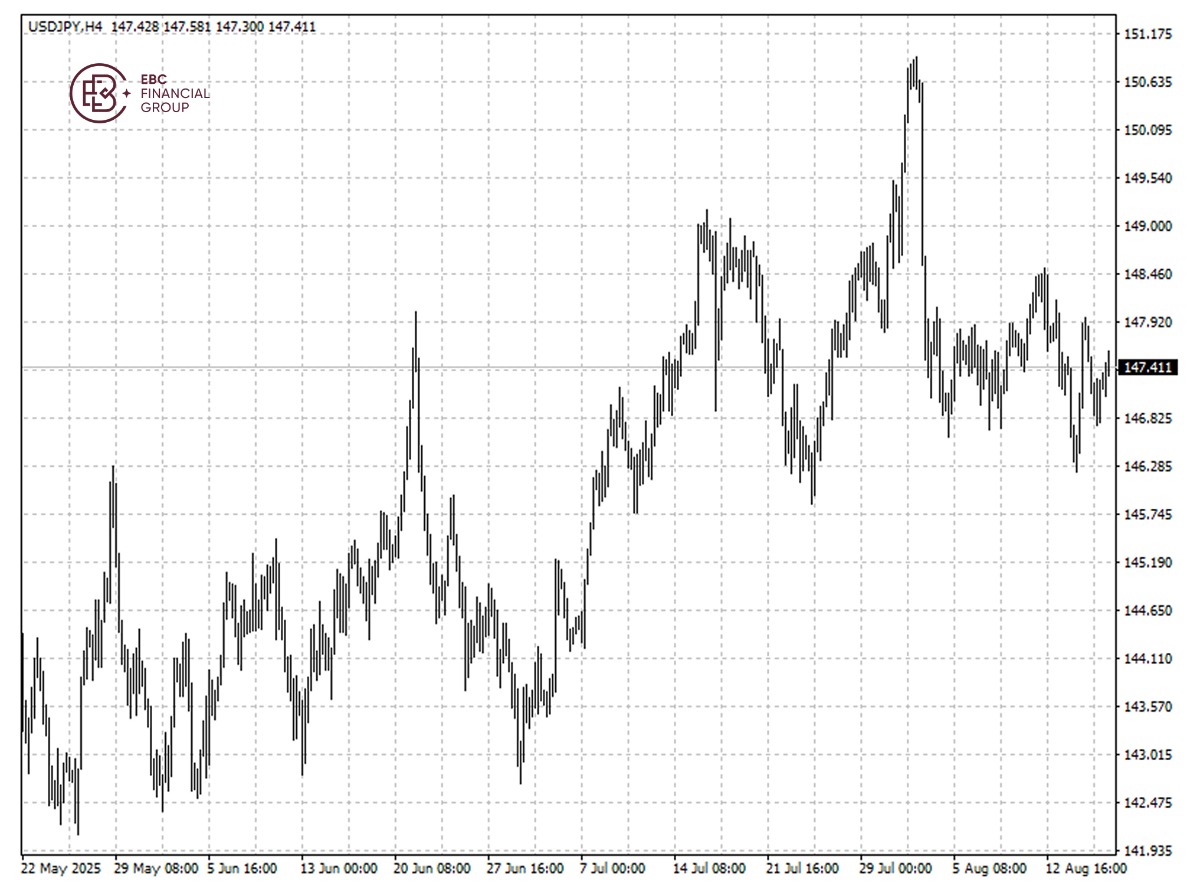

A symmetric triangle seems in the making for the yen which has risen significantly this month. The currency will likely inch lower soon before a decisive breakout.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.