EURUSD remains rangebound after pullback from four-week high

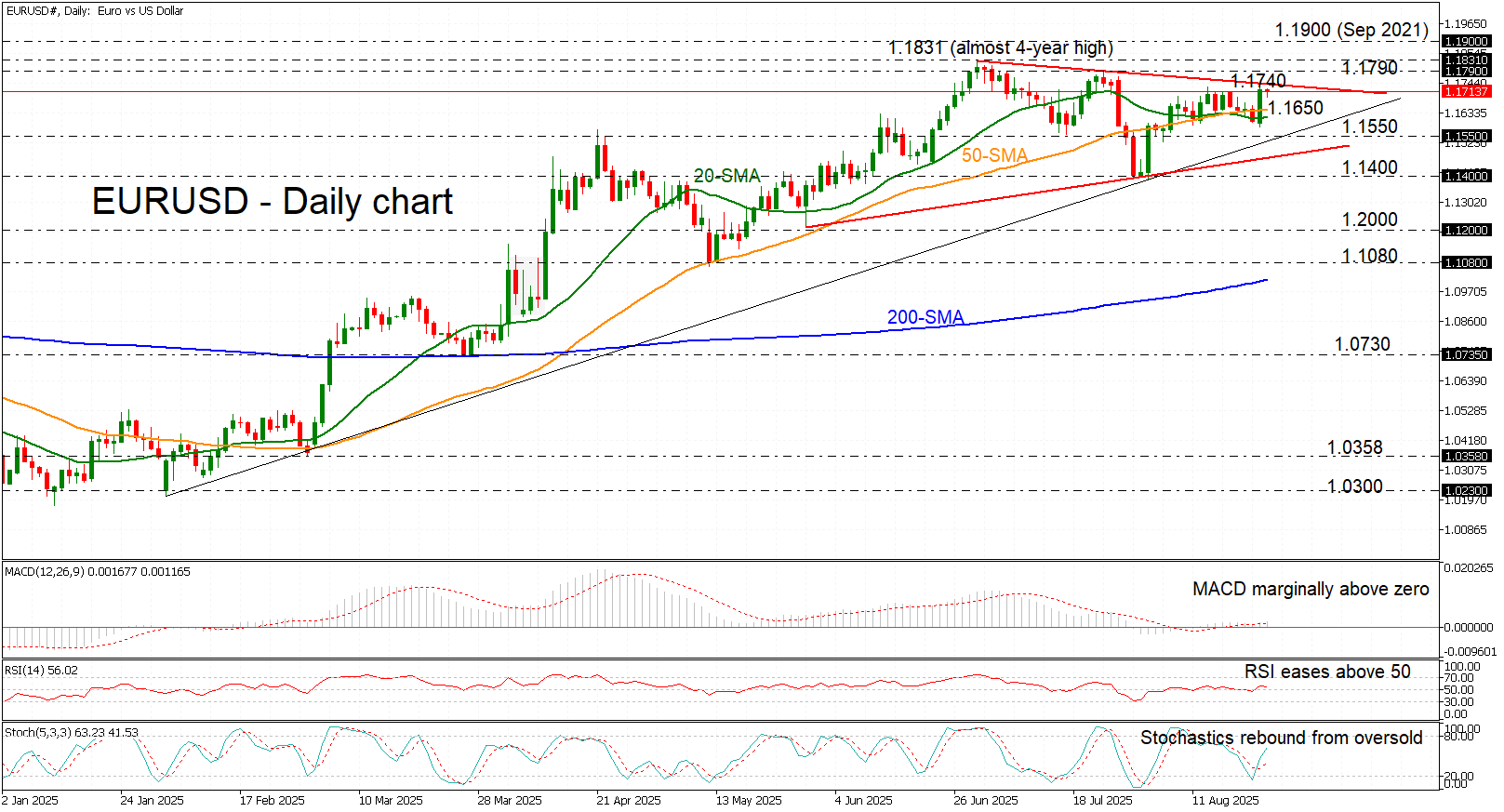

EURUSD is pulling back from Friday’s four-week high of 1.1740, after dovish remarks from Fed Chair Jerome Powell signalled the possibility of a rate cut next month, pressuring the dollar. The pair is currently consolidating within a pennant formation, with converging trendlines between the 1.1550 - 1.1790 range, suggesting a pause before a potential continuation of the broader uptrend.

The momentum indicators reflect a neutral bias. The MACD is trading marginally above zero and its red signal line, the RSI is flatlining above the neutral 50 level and the stochastics are rebounding from the oversold area, hovering in their midline.

To the upside, initial resistance is likely at Friday’s peak of 1.1740, followed by the July 24 high of 1.1790. A breakout above this zone would confirm a pennant breakout, with the next bullish target at the almost four-year high of 1.1831.

In the event of a deeper pullback, initial support lies around the 50- and 20-day simple moving averages (SMAs) near 1.1650. A break below this area and the medium-term uptrend line could expose 1.1550, with further downside risk toward 1.1400 – the level from which the pair rebounded earlier this month – which would signal a potential shift in sentiment.

All in all, EURUSD is on a modest pullback from 1.1740, but appears set to continue consolidating within its pennant formation. Downside risks remain limited as long as the pair holds above the 1.1650 support zone.

.jpg)