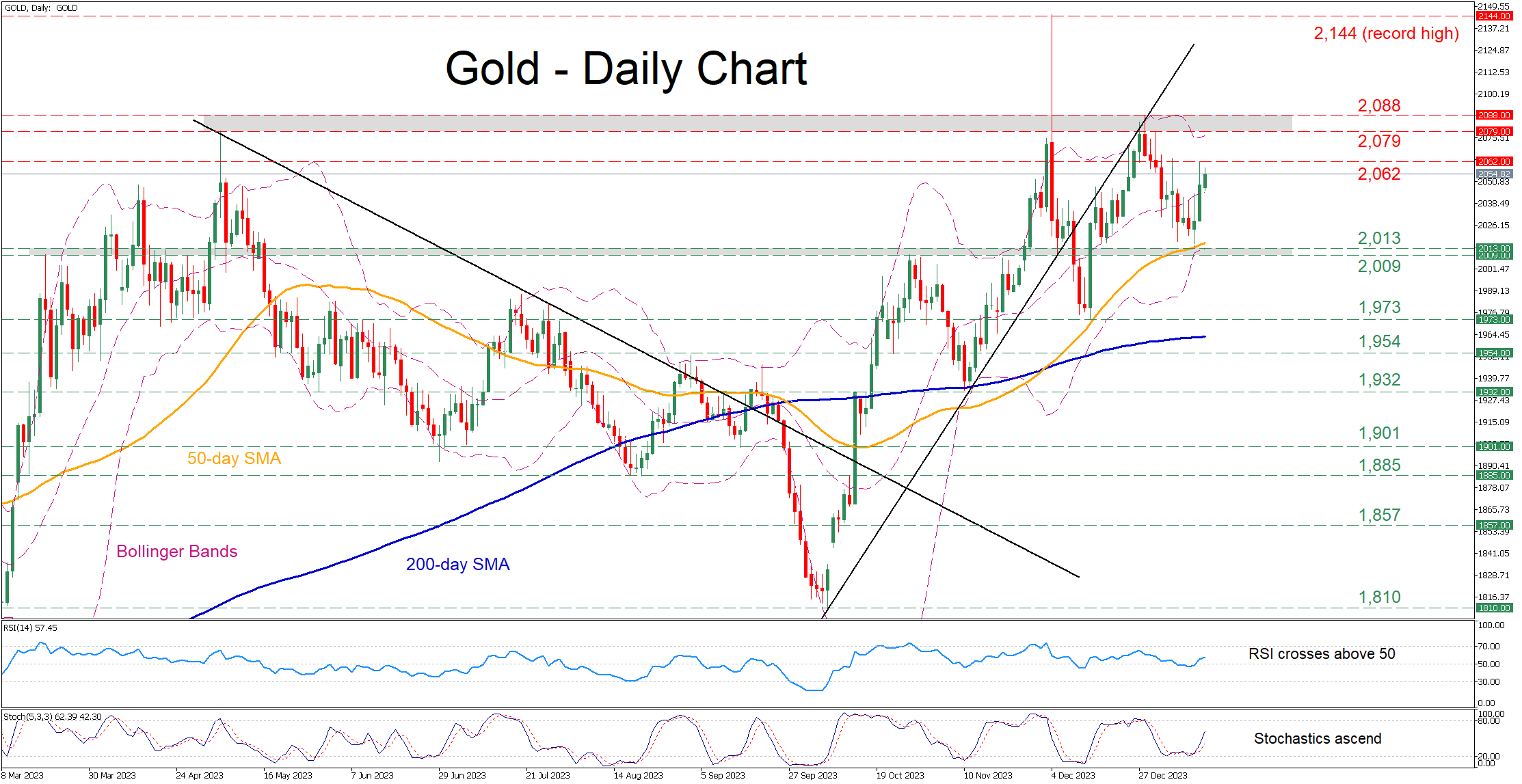

Gold edges higher after hitting 50-day SMA

Gold had been undergoing a downside correction after attempting to break above an upward sloping trendline drawn from its October lows. However, the price bounced off its 50-day simple moving average (SMA) and recouped some losses, with the short-term oscillators suggesting improving positive bias.

Should the bulls attempt to push the price even higher, the recent resistance of 2,062 could be the first barrier in their way. A violation of that zone could open the door for the crucial 2,079-2,088 range. Failing to halt there, the price may challenge the record high of 2,144.

On the flipside, bearish actions could send the price lower towards the 2,009-2,013 range defined by the October resistance territory and January low. If that barricade fails, the bears may attack the December bottom of 1,973. Even lower, the October support of 1,954 may provide downside protection.

In brief, gold has regained traction following its rebound from the 50-day SMA. Nevertheless, a fresh higher high is needed for the latest advance to become more convincing.

.jpg)