RBA's hawkish surprise temporarily boosted Aussie but failed to turn it around

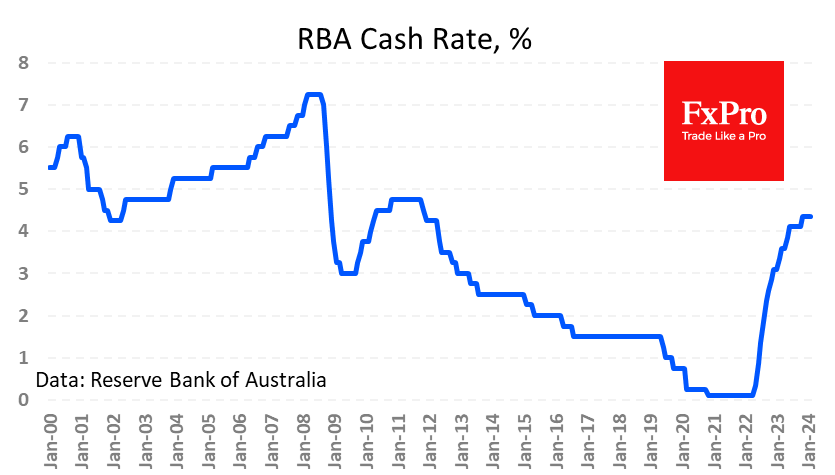

The Reserve Bank of Australia kept its cash rate unchanged at 4.35% for the third consecutive meeting. The markets widely expected the decision, but the tone of the accompanying commentary was more hawkish than the market had anticipated, adding to Aussie buying.

The RBA warned that it still hasn't ruled out a rate hike. This is a stricter course than we hear from the Fed and the ECB, who are openly saying that the next step is a cut but prefer to wait for a longer pause than market participants want to see.

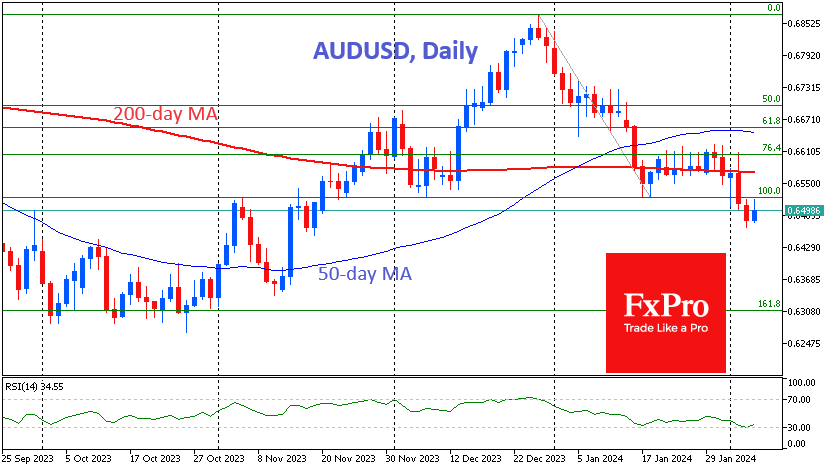

The difference between expectation and fact explains the initial speculative jump in AUDUSD of 0.5% to 0.6520. However, it will be difficult for the Aussie to sustain these gains.

Australia's benchmark rate is well below the Fed's 5.25-5.50% range, as well as the Bank of England's 5.25% and even the ECB's 4.5%. Meanwhile, inflation is higher than its listed peers at 4.1% y/y. This combination of factors limits the inflow of capital into the carry trade.

It is also important to note that current interest rates are relatively low for Australia. This is only a 10-year high, while rates in the US and Europe are at the high end of previous tightening cycles and at levels not seen for around 20 years.

The only potential driver in this environment could be the difference in expected policy easing. However, we can see that the Fed, the ECB and the Bank of England are in favour of delaying the expected start of easing. In this context, the initial rally in AUDUSD looks like a profit-taking bounce after an impressive decline since the end of last month.

The AUDUSD fell sharply below its 200-day moving average on the release of the NFP, further indicating bearish dominance. After a relatively long consolidation period, the ultimate downside target now appears to be the 0.6300 area, where the 161.8% level of the nearly three-week decline since the 28th and last October's lows meet.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)