Signs of deepening correction in altcoins

Market picture

The crypto market capitalisation remained near the $2.5 trillion level with no unified dynamics among the top coins. Notably, sentiment returned to extreme greed territory despite a spike in volatility in the final trading hours of the US session.

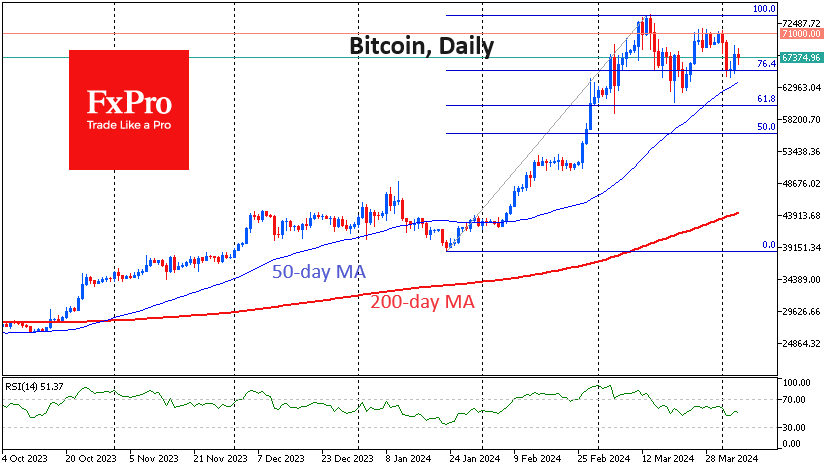

Bitcoin jumped to $69K on Thursday evening but failed to develop an offensive and rolled back to $67K by the start of active trading in Europe. A reversal to the downside has occurred from lower levels, but it will take local lows below $65K to validate the dominance of the downtrend.

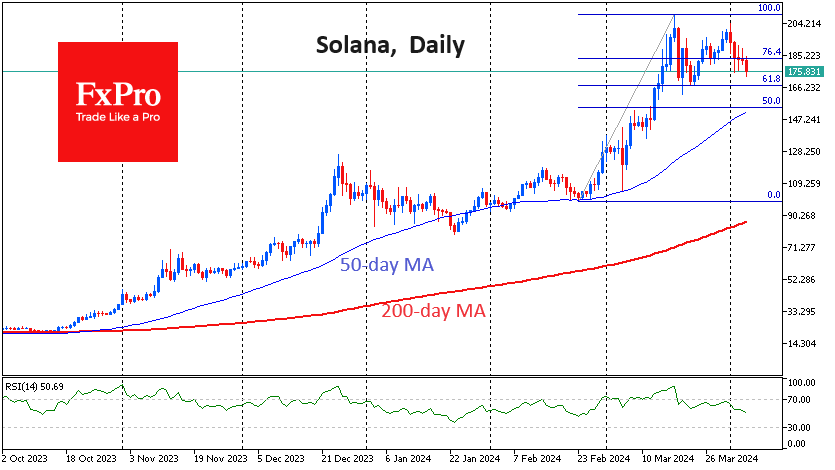

Solana has already made its move lower, deepening the correction, losing every day this month, and pulling back to $175. It is worth watching if the downside develops below $165. A buyback from that point would leave the coin within a correction after the upside momentum. A failure below will open a quick path to $151, where the 50-day MA passes.

Ethereum has already dipped below its 50-day MA, which calls into question the uptrend since last October. Without a new wave of buying in the next couple of days, the chances of further declines grow dramatically.

News background

On April 4, the Bitcoin Cash (BCH) network saw the second halving in its history. The reward per block decreased from 6.25 BCH to 3.125 BCH. The BCH price rose 10% overnight.

US banks are interested in buying bitcoins directly from miners due to a shortage of BTC supply on exchanges, mining company Hut 8 said. Hut 8 is the fourth largest corporate Bitcoin holder after MicroStrategy, Marathon Digital and Tesla, according to Bitcointreasuries.

Ripple said it plans to launch its USD-linked stablecoin by the end of 2024. It will be 100 per cent backed by USD deposits, short-term US Treasuries, and other cash equivalents. It will be launched on the XRP Ledger and Ethereum networks.

Google sued two Chinese nationals for distributing fraudulent apps. Since 2019, the attackers have uploaded 87 apps to Google Play that, under the guise of investing in cryptocurrencies, stole funds sent through them.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)