USDJPY clears 200-EMA ahead of Japan's election

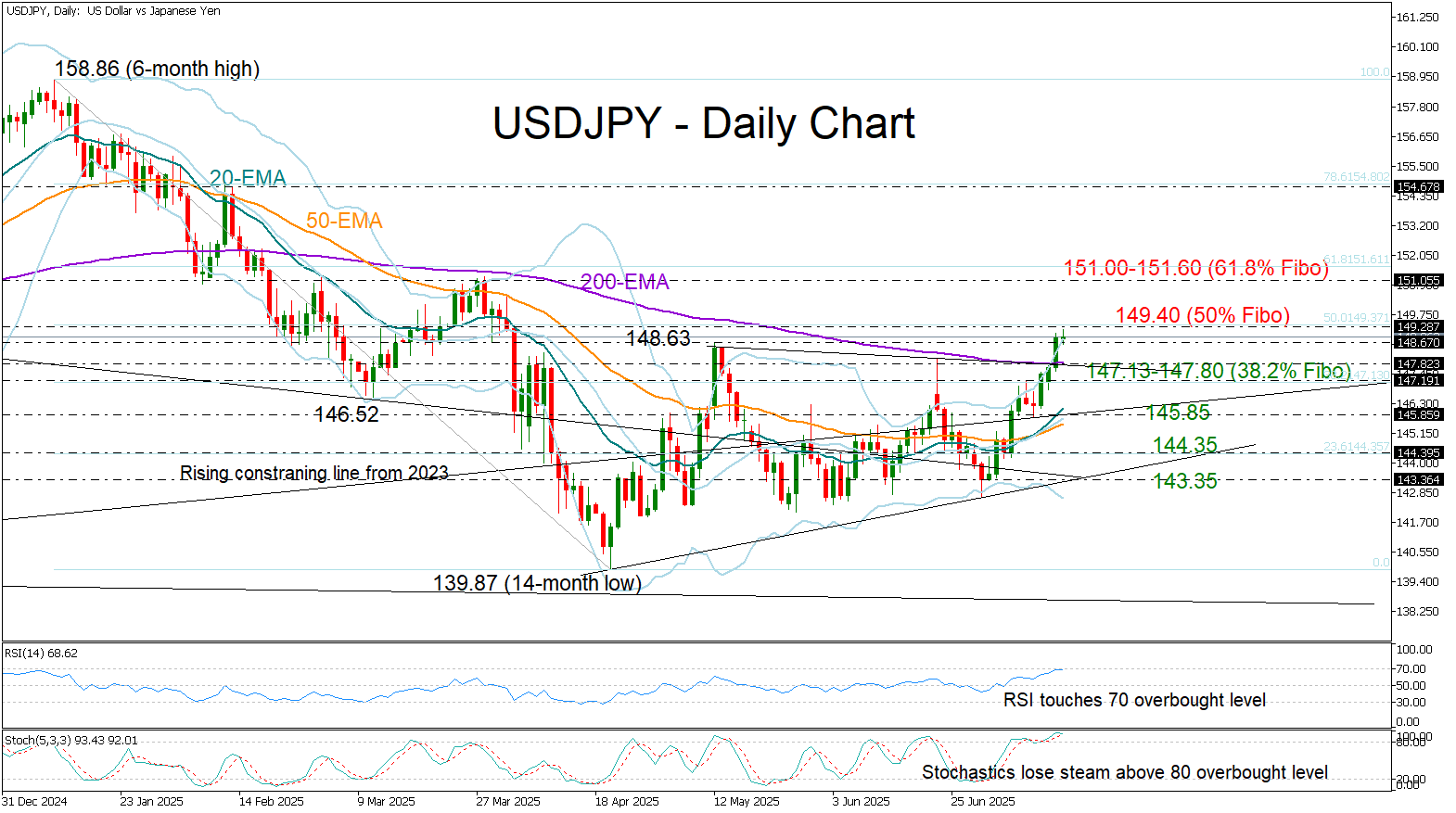

USD/JPY advanced above its 200-day exponential moving average (EMA) for the first time since February on Tuesday, while slightly extending its ascent to a new three-month high of 149.17 earlier today before losing momentum.

The bullish price action coincides with growing political uncertainty in Japan, as the ruling Liberal Democratic Party and its coalition partner face the risk of losing their majority in the upper house in Sunday’s election. However, a sustained move higher remains uncertain, given that the price has closed above the upper Bollinger Band and both the RSI and stochastic oscillator are signaling overbought conditions.

A decisive breakout above the 50% Fibonacci retracement of the January–April downleg could pave the way for an extension toward the 151.00 barrier and the 61.8% Fibonacci level at 151.60. A move beyond that point may open the door for a rally toward 154.70.

On the downside, if bullish pressure fades, the price could find immediate support between the 200-day EMA at 147.85 and the 38.2% Fibonacci level at 147.13. Further declines may stabilize near 145.85. However, only a drop below 143.35 would signal a bearish trend reversal.

Overall, USD/JPY appears cautious, as overbought conditions hint at a possible pullback or consolidation in the short term. The next bullish phase is likely to resume above 149.40.

.jpg)