Verbal interventions do not help yen

Verbal interventions do not help yen

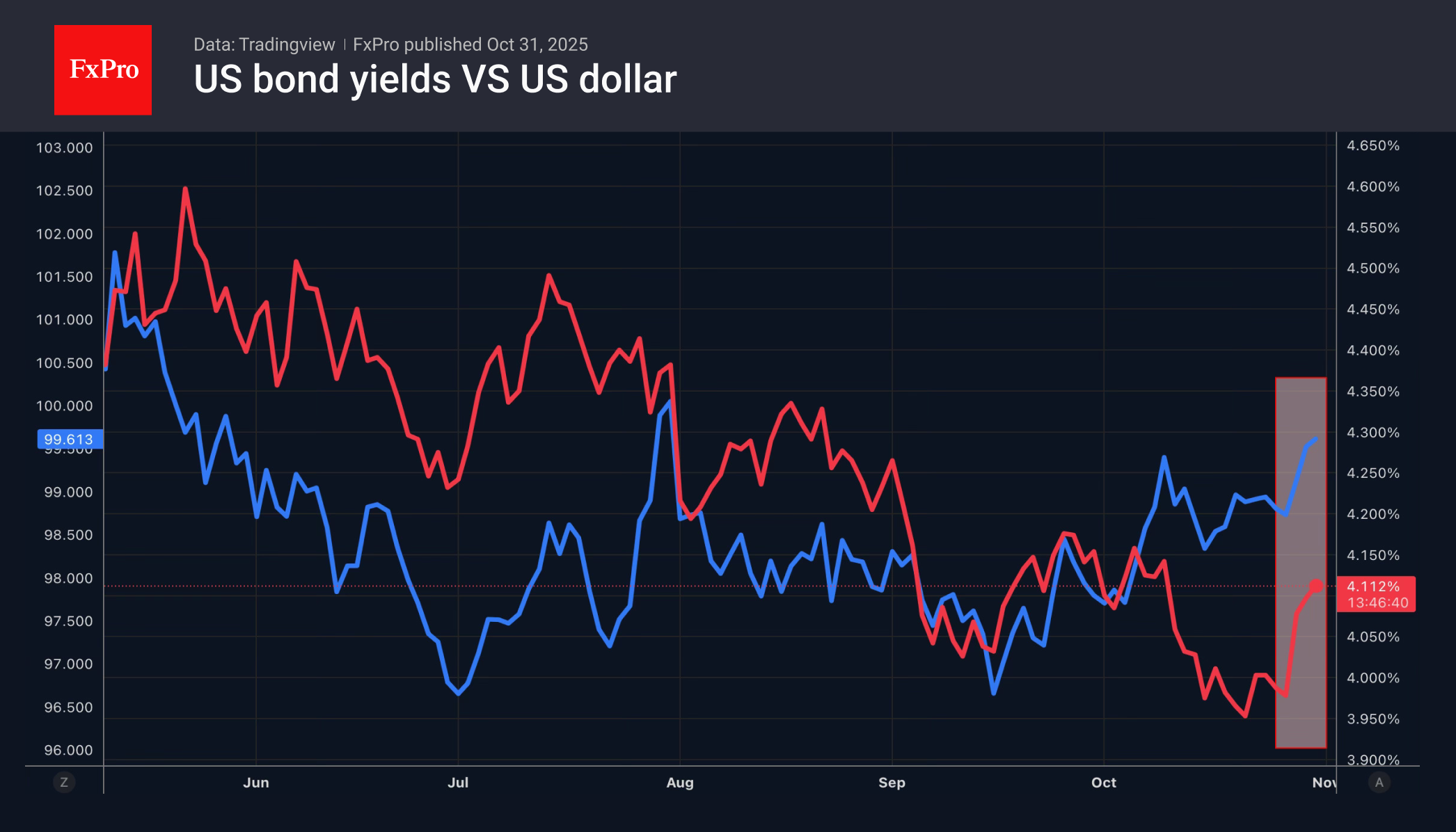

The Bank of Japan's passivity and the ECB's reluctance to spring surprises weakened the yen and the euro, adding fuel to the USD index rally. The market continues to reassess its views on the fate of the federal funds rate and is buying the US dollar. At the same time, growing uncertainty is boosting demand for the greenback as a safe-haven currency. The trade deal between the US and Beijing is being compared to a truce with hidden risks of escalation. The Supreme Court's cancellation of tariffs in November could even trigger chaos in the financial markets.

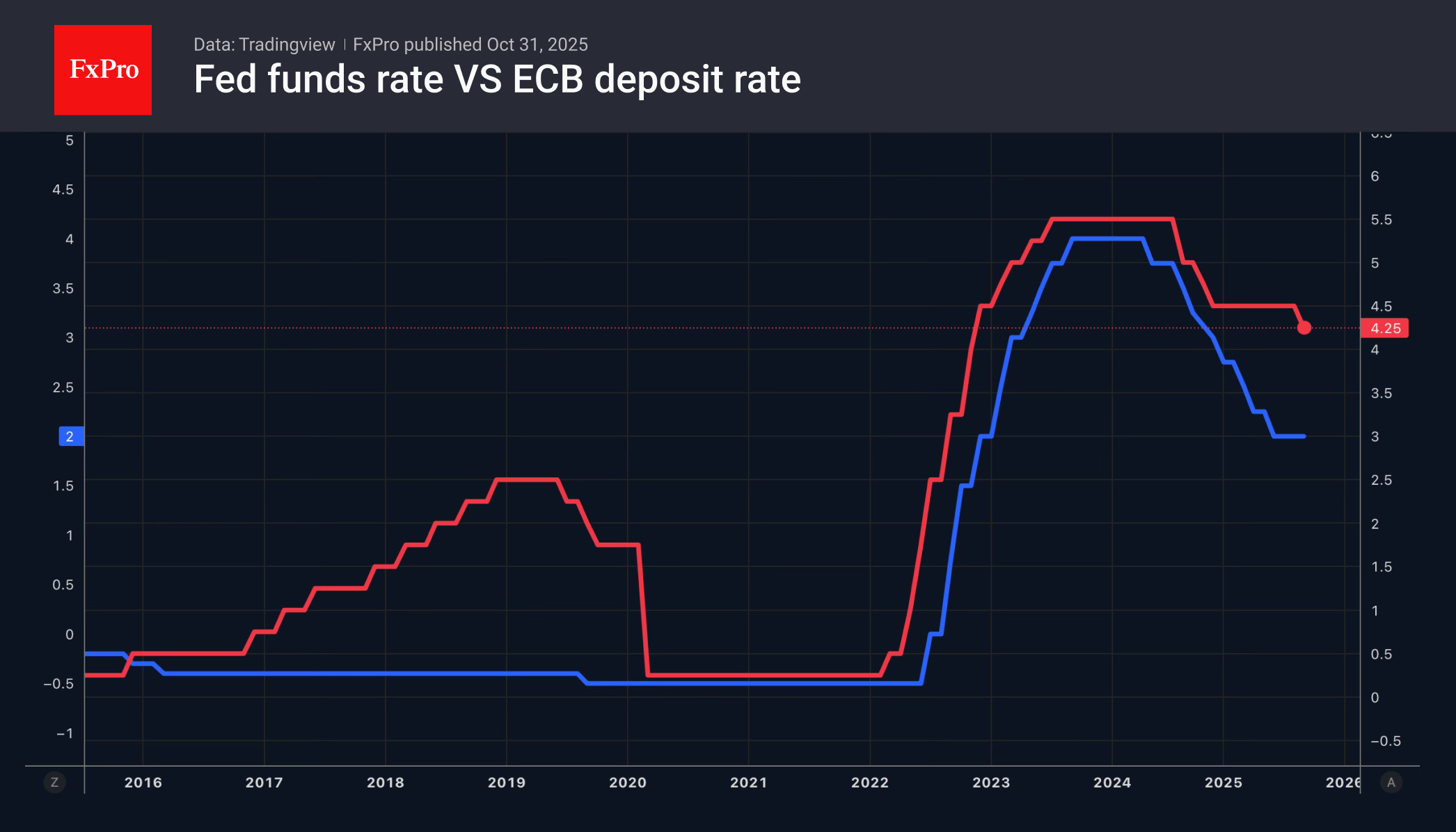

The ECB has no reason to complain about the eurozone economy. In the third quarter, it accelerated from 0.5% to 0.9% year-over-year, thanks to the gradual adjustment of exports to US tariffs, a strong labour market, solid household balance sheets, and a prolonged cycle of rate cuts.

However, risks remain. The Governing Council's doves warn of a slowdown in GDP and inflation under the influence of high US tariffs and a strong euro. The futures market gives a 40% probability of a deposit rate cut by mid-2026. This puts pressure on EURUSD. The euro could stumble at any moment and fall off the cliff near the 1.1550 mark.

On the contrary, the chances of a Fed rate cut in December fell from more than 90% at the start of the week to 67%. At the same time, Treasury bond yields are rising, which is supporting the US dollar.

USDJPY managed to restore its upward trend due to the Bank of Japan's reluctance to signal an increase in the overnight rate in the future. Kazuo Ueda cited uncertainty in the US economy and the need for new wage data, saying he was not afraid of a situation where sluggishness could trigger a surge in inflation.

The yen was not helped by the acceleration of consumer prices in Tokyo from 2.5% to 2.8% and verbal interventions. According to Finance Minister Satsuki Katayama, the government is closely monitoring speculative movements on Forex and is ready to intervene. However, such statements only temporarily cooled the bulls' enthusiasm for USDJPY. Moreover, hedge funds are positioned for the US dollar to rise towards 160 yen.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)