The dollar got a second boost from the Fed

The dollar got a second boost from the Fed

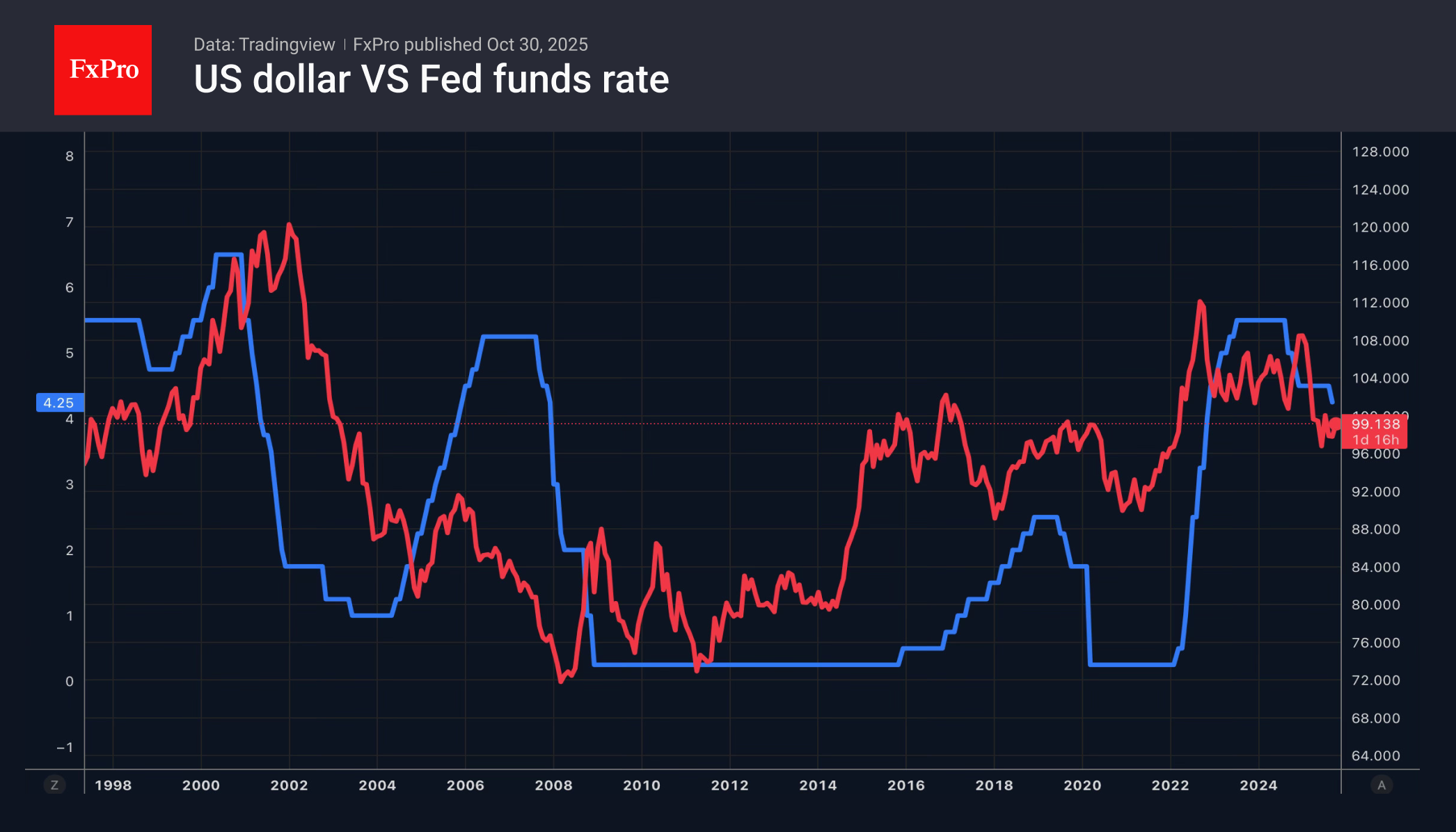

The second consecutive cut in the federal funds rate in 2025 has once again strengthened the US dollar. Since the September FOMC meeting, the USD index has risen by 3%. In both cases, the greenback benefited from a reassessment of market expectations regarding the path of monetary easing. Before Jerome Powell's speech, the futures market was pricing in a more than 90% probability of a 3rd cut in borrowing costs in December, but afterwards, the chances plummeted to 65%.

In September, the FOMC forecasts helped the US dollar. In October, it was helped by the split that emerged within the committee. Kansas City Fed President Jeffrey Schmid unexpectedly voted to keep rates unchanged. Pressure from the hawks is mounting. Jerome Powell is forced to acknowledge the persistence of inflationary risks. He also noted the labour market cooling, not falling off a cliff.

He compares monetary policy in the absence of data due to the shutdown to driving a car in fog. Whether he likes it or not, the driver has to slow down. Investors interpreted this rhetoric as a signal that the Fed's monetary policy easing cycle is nearing its end. This helped the bears on EURUSD.

However, the main currency pair is in no hurry to fall into the abyss. According to most Bloomberg experts, the European Central Bank will keep the deposit rate at 2% not only in October, but until 2027. The futures market gives a 50% probability of a rate cut by September 2026.

Meanwhile, the pound has fallen against the euro to its lowest level since 2023 and is on track for its longest monthly losing streak in nine years. This is due to the UK Treasury's intention to raise taxes and cut public spending to balance the budget. Chancellor Rachel Reeves will present a draft financial plan in November. As the date approaches, sterling is losing ground against major world currencies.

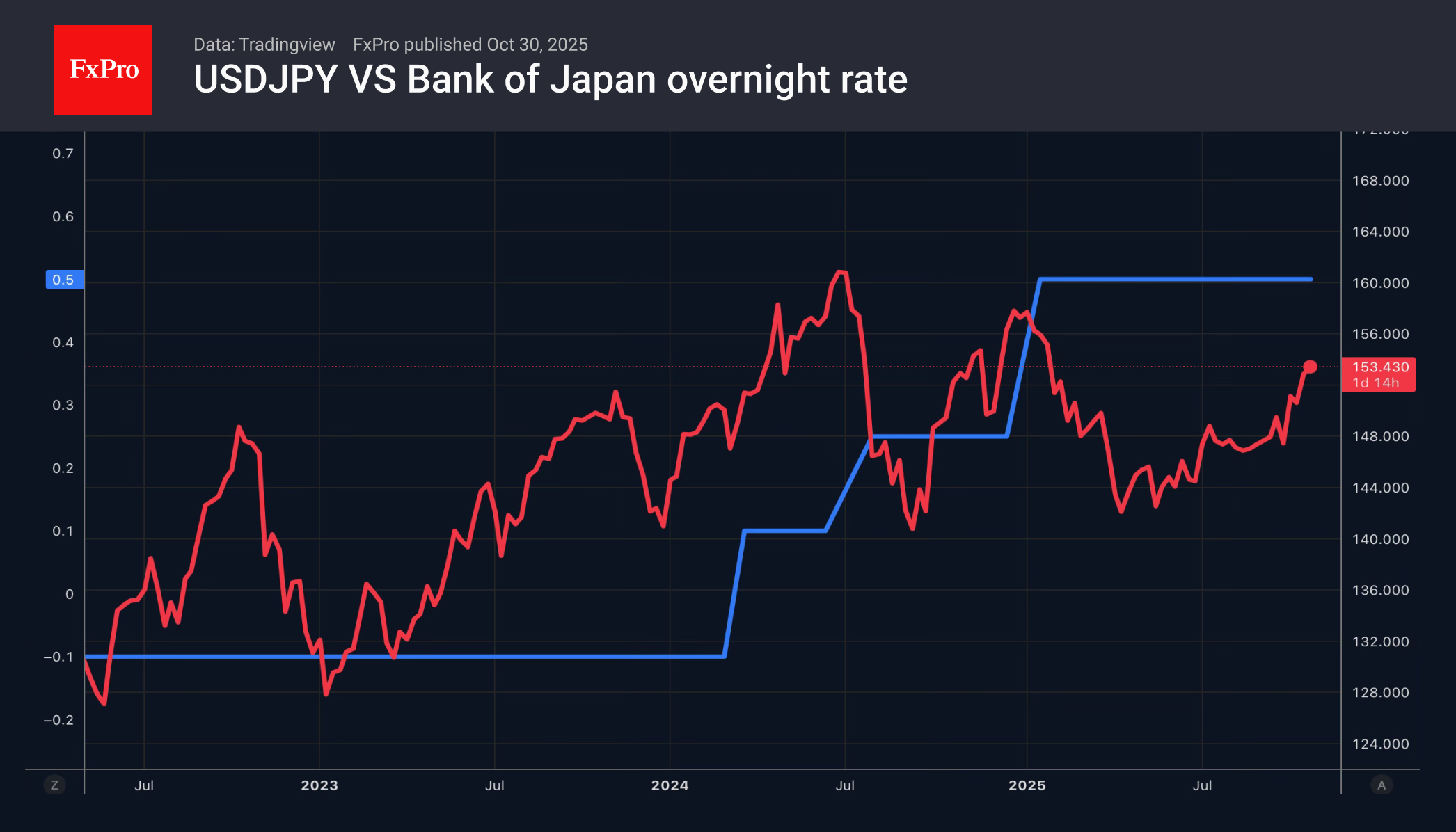

The yen has also resumed its decline. The Bank of Japan maintained its overnight rate at 0.5% at its October meeting and refrained from providing any indications about its future direction. Along with the Fed's hawkish rhetoric, this pushed the USDJPY higher.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)