Encouraging weakness of US data

Encouraging weakness of US data

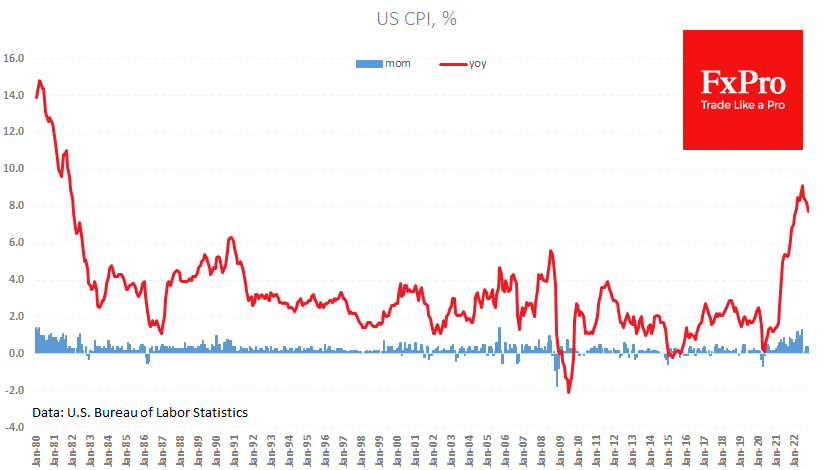

US consumer prices rose markedly weaker than expected, sparking excitement in financial markets. A rise in weekly jobless claims also added to the picture of a weakening economy, reviving speculation that the Fed will slow down tightening soon.

The consumer price index for October rose 0.4%, slowing the annual growth rate to 7.7% from 8.2% a month earlier and stronger than expected at 7.9%. The core index (without energy and food) added 0.3% last month, slowing from 6.6% to 6.3% against expectations of 6.5%.

The weak inflation data takes speculators' fears off the radar that the Fed will make another 75-point hike and that the key rate will exceed 5% in this monetary cycle.

Before this, for more than a year, we have only seen an apparent tightening of the tone time after time. However, the neat reversal of official commentary rhetoric has been given a firm footing in subdued inflation.

It won't be right to tune in to an imminent rate cut or a pause in rate hikes, but slowing the pace is big news for markets strangled by Central Bank policy. And they are now able to breathe more freely.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)