Three-year stagnation in US durable goods orders

Three-year stagnation in US durable goods orders

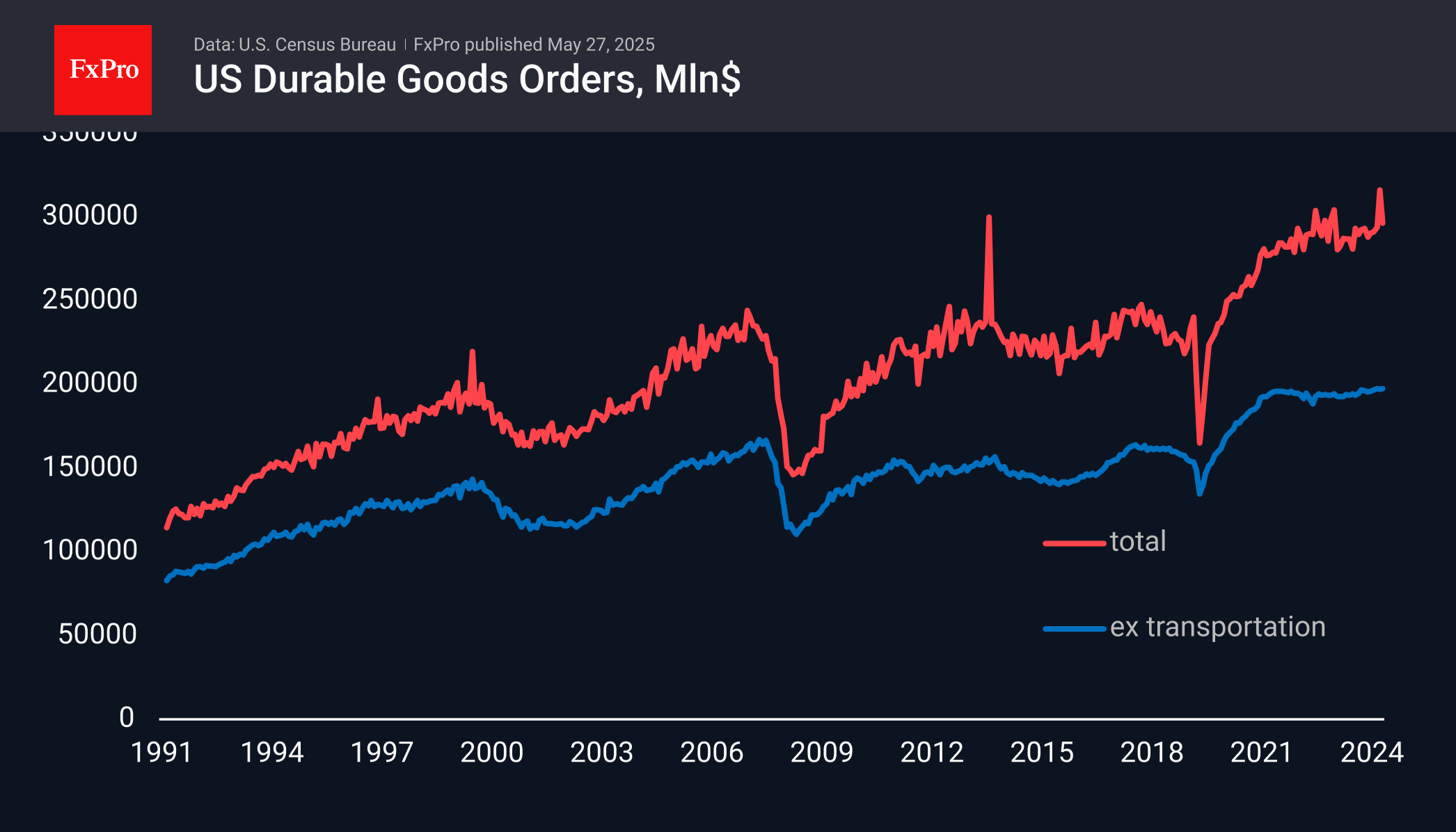

Preliminary estimates of durable goods orders in the US showed a less sharp than expected dip in April. The decline was 6.3% versus a 7.5% jump a month earlier and an expected 7.6% drop. The volatility is almost entirely due to the transport sector, and without that component, there was a 0.2% gain for the month after an equal decline earlier. This indicator has been near a plateau for the past three years, adding only 1% in money over that time against a 12% rise in the Core CPI and a 9% rise in Core PPI. Simply put, America has been cutting investment in durable goods for about as long as the Fed has been shrinking its balance sheet.

In the short term, the current report is relatively positive for demand for US assets, including the dollar, coming in above expectations. However, in the medium term, it is worth paying attention to the decline in orders expressed in real prices. This may indicate a growing threat of stagnation, if not contraction, of the US economy, bringing the Fed rate cut closer.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)