US Dollar Has to Retreat

By RoboForex Analytical Department

The market major starts this new week of February with an attempted correction. EUR/USD is balancing near 1.0690. After the lows of the previous week, this is good news though right now the bounce does not look really confident.

Investors are beginning to have more and more doubts that the Federal Reserve System will put aside its tightening monetary policy and include the expectations of further interest rate increases in the quotes. While previously traders used to expect a pause after two subsequent increases by 25 base points this year, now there are no such guarantees.

It is a day off in the US today, which means volatility will be smoothed out.

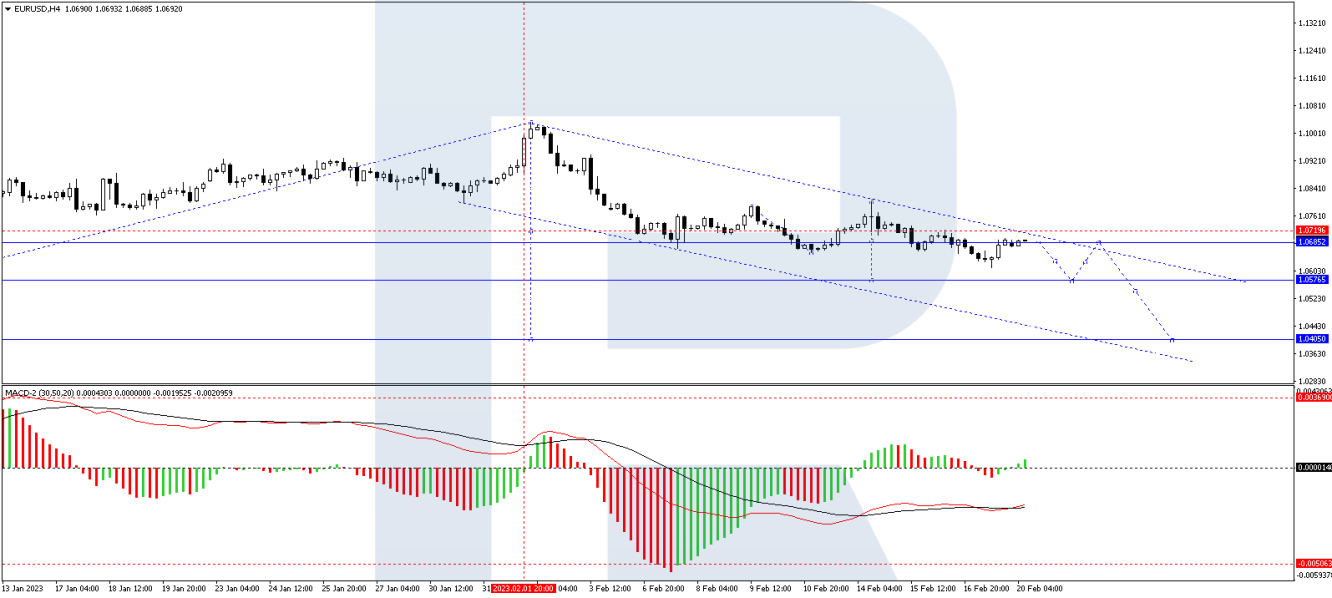

On the EUR/USD H4 chart, a consolidation range formed around 1.0720. The market extended it downwards to 1.0612. A link of correction to 1.0720 is not excluded (a test from below). Then a decline to 1.0577 should follow, from where the wave might extend to 1.0500. Technically, the scenario is confirmed by the MACD, whose signal line is under zero. Wait for the lows to be renewed.

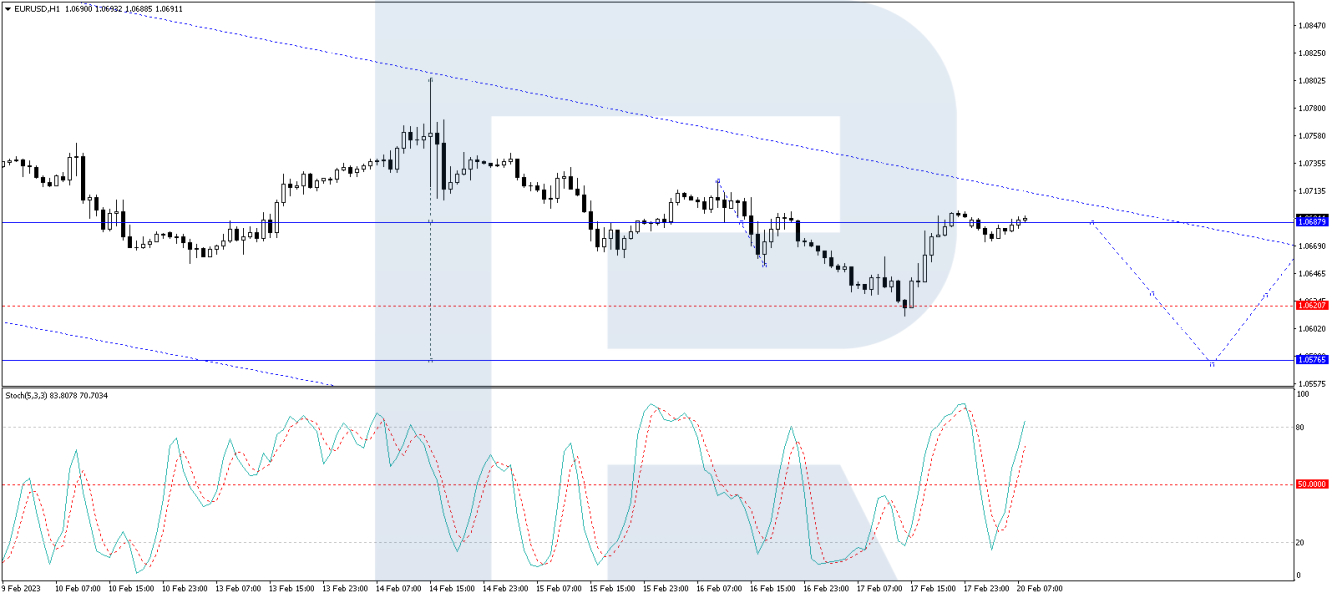

On H1, the currency pair has completed a wave of decline to 1.0612 and a correction to 1.0690. A consolidation range is expected to form around this level. With an escape downwards, a new wave of decline to 1.0577 should start. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is above 50, and a decline to 20 is to follow.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.